Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 07, 2025

Week Ahead Economic Preview: Week of 10 March 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US inflation and global business sentiment under spotlight

US inflation data will be a key highlight of the week's data flow, alongside GDP updates in Japan and the UK, eurozone industrial production numbers, and an interest rate decision in Canada.

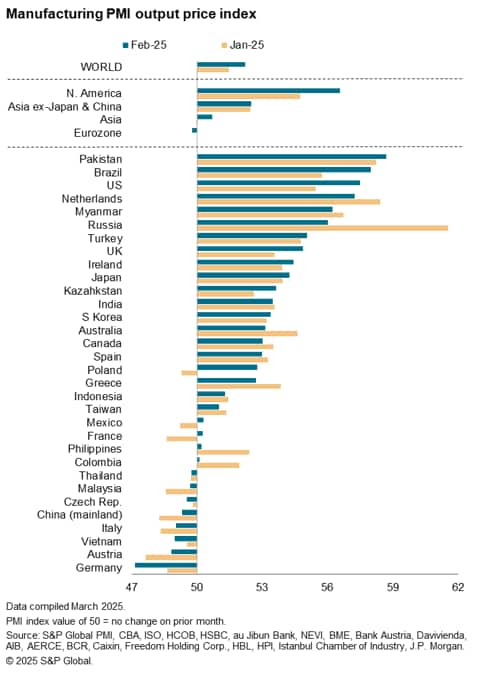

Tariff developments and geopolitics will inevitably dominate the news flow over the coming week, but some key data will also be eagerly assessed for the impact of recent US policy changes. In particular, CPI data are updated for the US. The consensus is for monthly core inflation to slow from 0.4% to 0.3% and the headline rate to moderate from 0.5% to 0.3%, but there are concerns that tariffs are already driving costs higher, as indicated by surveys such as those conducted by the ISM and S&P Global Market Intelligence. Both showed purchasing managers in US manufacturing reporting sharply higher input costs, often directly linking price rises to tariffs and supply chain worries. The S&P Global February surveys notably showed US factory gate price inflation hitting a two-year high, exceeding that of all other economies bar only Pakistan and Brazil (see chart). Updated official producer price data will accompany the US CPI release and hence also be closely scrutinised for tariff impact.

The Bank of Canada is meanwhile expected to cut interest rates to bolster an economy that is already seeing damage from US tariff announcements.

Some important sentiment data will also be worth watching. For the US, data on consumer inflation expectations and the University of Michigan consumer sentiment index will provide insights into how tariff concerns and federal budget cutting policies are affecting households. Meanwhile the S&P Global Business Outlook Survey - a forward-looking sentiment poll derived from the worldwide PMI panels - will offer clues as to how the changing geopolitical and economic landscape is impacting businesses globally, notably in relation to investment and hiring intentions. Also look out for the updated Investment Manager Index (IMI) survey, the February edition of which showed a marked rise in risk aversion among US equity investors.

Elsewhere, UK monthly GDP will be released and are expected to show the economic growth trends remaining subdued, with recruitment industry survey data also offering new insights into UK labour market trends.

US industrial prices under spotlight

Only Pakistan and Brazil reported higher manufacturing price growth that the US in February, the latter reporting the steepest increase for two years.

Key diary events

Monday 10 Mar

Japan Current Account (Jan)

China (Mainland) National People's Congress (5-13 Mar)

Germany Trade and Industrial Production (Jan)

Norway Inflation (Feb)

Sweden GDP (Jan)

Turkey Industrial Production (Jan)

Switzerland Consumer Confidence (Feb)

United Kingdom KPMG/REC Report on Jobs* (Feb)

Mexico Consumer Confidence (Feb)

United States Consumer Inflation Expectations (Feb)

Tuesday 11 Mar

Australia Westpac Consumer Confidence (Mar)

Japan Household Spending (Jan)

Japan GDP (Q4, final)

Australia NAB Business Confidence (Feb)

Malaysia Unemployment (Jan)

Brazil Industrial Production (Jan)

United States JOLTs Job Openings (Jan)

S&P Global Investment Manager Index* (Mar)

Wednesday 12 Mar

Malaysia Industrial Production (Jan)

India Industrial Production (Jan)

India Inflation (Feb)

Brazil Inflation (Feb)

United States CPI (Feb)

Canada BoC Interest Rate Decision

OPEC Monthly Report

S&P Global Business Outlook Surveys* (Feb)

Global GEP Supply Chain Volatility Index* (Feb)

Thursday 13 Mar

South Korea Unemployment Rate (Feb)

Eurozone Industrial Production (Jan)

Mexico Industrial Production (Jan)

United States PPI (Feb)

Friday 14 Mar

India Market Holiday

China (Mainland) M2, New Yuan Loans, Loan Growth (Feb)

India Trade (Feb)

Germany Inflation (Feb, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Jan)

United Kingdom Trade (Jan)

France Inflation (Feb, final)

Spain Inflation (Feb, final)

Italy Industrial Production (Jan)

Brazil Retail Sales (Jan)

United States UoM Sentiment (Mar, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US CPI, PPI, JOLTs job openings, UoM sentiment; BoC meeting; Brazil inflation

The key economic data release in the new week will be US CPI inflation data. According to S&P Global US PMI prices data, which precedes the trend for CPI, inflationary pressures remained muted in February, but with a red flag for goods prices. While the latest PMI Output Prices Index showed that charges rose at a softer pace compared to the start of the year aided by slower services price growth, goods selling prices rose at the fastest pace in two years. Also watch out for US JOLTs data to assess the latest hiring trend, as well as PPI data and consumer inflation expectations amid rising tariff concerns, plus consumer sentiment numbers.

Meanwhile the Bank of Canada convenes for their February monetary policy meeting with rate cut expectations having intensified since the implementation of tariffs. February's S&P Global Canada PMI also showed that Canada's private sector output declined at the fastest pace in over a year.

EMEA: UK monthly GDP and recruitment survey; Eurozone industrial production; Germany inflation, trade and industrial production; France inflation

The UK publishes January GDP data providing an official update of the growth trend at the start of 2025. January's PMI data revealed that the economy remained in a near-stalled state. Meanwhile the latest REC/KPMG recruitment survey will provide an update on the UK job market, with recent data having shown a marked deterioration.

Other key releases in the week include final inflation releases in Germany and France, while industrial production numbers will also be due for the eurozone and Germany.

APAC: Japan GDP; India inflation, industrial production

Japan's final Q4 GDP will be released on Tuesday while key releases from APAC also include India inflation and industrial production figures in the week.

Investment Manager and Supply Chain Volatility Indices

The March S&P Global Investment Manager Index will be released on Tuesday for insights into investor sentiment following the implementation of additional US tariffs in early March. Amidst the changes in policies, insights into what is expected to drive markets, sector preference and investors' views on US economic growth and the interest rate path will also be keenly awaited with the March release. February's survey had seen a marked shift toward risk aversion.

Meanwhile the GEP Global Supply Chain Volatility Index will be scrutinised for changes in supply conditions after global production growth accelerated in February.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-march-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-march-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+10+March+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-march-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 10 March 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-march-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+10+March+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-march-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}