Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 06, 2025

Global employment falls as developed world job losses reach highest since July 2020

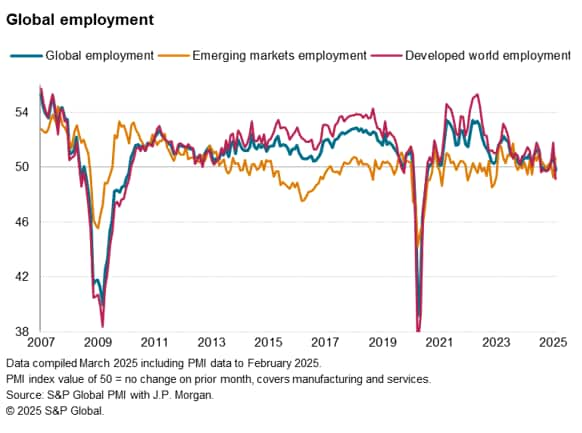

A combination of slower current demand growth and diminished optimism about the year ahead caused companies worldwide to trim their headcounts for the first time in three months in February, according to S&P Global Market Intelligence's PMI surveys. Job losses were concentrated in the developed world, where payrolls were cut to the greatest extent since the pandemic downturn in 2020.

Global demand growth slows and confidence wanes

The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, fell from 51.8 in January to 51.5 in February, its lowest since December 2023. Historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.2%, down sharply from an estimated 3.0% rate in the fourth quarter of last year.

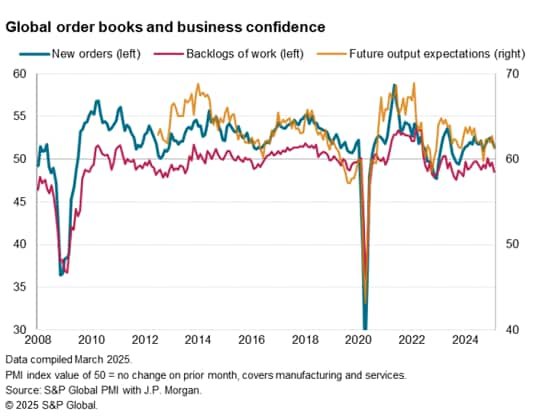

February also saw global new business grow at the slowest rate since last September, rising only very modestly to register the second-smallest increase in demand for goods and services seen for just over a year. Backlogs of work - a key indicator of workloads (and hence future output requirements) - meanwhile rose globally to the smallest extent recorded since December 2023.

Rounding off a trio of weaker forward-looking indicators was a fall in the survey's future output expectations gauge - which contrasts with other indicators in capturing business sentiment about the next 12 months rather than tracking actual changes in various metrics compared to the prior month.

The global PMI's future output expectations index in fact fell to its lowest since last September (which saw a weak spot in sentiment ahead of the US presidential election), dropping further below the survey's long-run average in February.

Notably, besides last September, weaker global sentiment has not been seen since 2022.

Global business optimism slides on heightened uncertainty

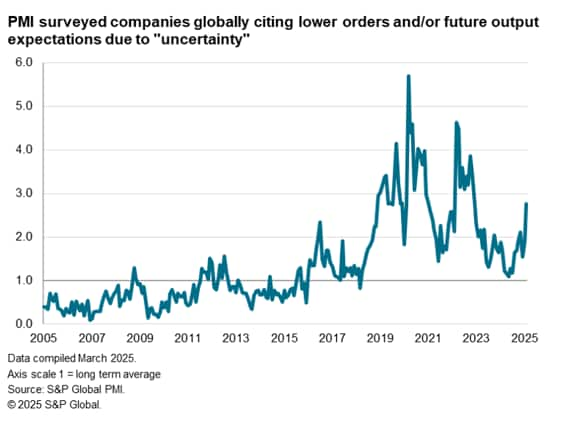

Resilient manufacturing sentiment in February - helped in part by the postponement of US tariff implementation - contrasted with a marked weakening of confidence in the global services economy. The latter saw businesses grow concerned over geopolitical and economic stability and the potential for financial conditions to loosen less than previously anticipated, in part linked to the possibility of higher inflation and higher interest rates.

The degree to which "uncertainty" is reportedly dampening demand and business optimism is now at its highest since December 2022, and is at a level not seen by the PMIs in the 15-year data history prior to the pandemic.

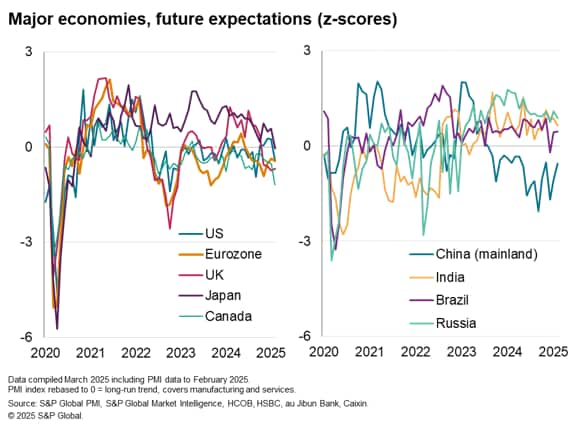

Among the major developed economies, the highest degree of sentiment relative to long-run trends was again recorded in Japan, where the weak yen has buoyed exports (both for goods and incoming tourism), but even here sentiment has fallen below its long-run trend. Sentiment also fell in the US - to its second-lowest since 2023 amid falls in both manufacturing and services - and in Canada to its lowest since May 2020. Eurozone sentiment dipped only slightly, and UK confidence improved marginally, though in both cases levels of sentiment are subdued by historical standards.

The highest level of confidence among the major emerging markets (relative to long-run averages) was seen in Russia followed by India, albeit moderating slightly in both cases. While sentiment remained particularly low in mainland China (below its long-run average), it nonetheless rose to the second-highest for ten months amid improved perceived prospects in both manufacturing and services.

Global employment falls as developed world job losses reach highest since July 2020

The combination of weakening current output and order book growth, alongside slumping sentiment, caused global employment to fall marginally for the first time in three months in February. Losses were focused on manufacturing, though service sector payrolls failed to grow in February for the first time in six months.

While emerging market employment rose at the fastest rate for seven months, developed world jobs were cut at a pace not seen since July 2020. Besides the early pandemic months, the PMI Employment Index for the developed world has not been this low for 15 years (since February 2010), reflecting accelerating job shedding in both manufacturing and services.

Job trends worsen across all major developed markets, contrasting with record high job creation in India so far this year

Employment trends worsened across the major developed economies in February, albeit with Japan's rate of job creation merely cooling.

After buoyant business optimism drove job creation sharply higher in the US at the start of the year, February saw pay-back as jobs were cut on average for the first time in three months. Job cuts also deepened in Canada, to the highest since the early days of the pandemic, and spiked higher again in the UK amid higher payroll tax. Only modest job losses were meanwhile seen in the eurozone.

The hiring picture was brighter in the major emerging markets. Job creation in India remained close to January's all-time high, and accelerated in both Brazil and Russia. While job losses continued to be recorded in mainland China, the decline was only marginal and the smallest recorded since last September.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-falls-as-developed-world-job-losses-reach-highest-since-july-2020-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-falls-as-developed-world-job-losses-reach-highest-since-july-2020-Mar25.html&text=Global+employment+falls+as+developed+world+job+losses+reach+highest+since+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-falls-as-developed-world-job-losses-reach-highest-since-july-2020-Mar25.html","enabled":true},{"name":"email","url":"?subject=Global employment falls as developed world job losses reach highest since July 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-falls-as-developed-world-job-losses-reach-highest-since-july-2020-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+employment+falls+as+developed+world+job+losses+reach+highest+since+July+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-falls-as-developed-world-job-losses-reach-highest-since-july-2020-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}