Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 28, 2025

Week Ahead Economic Preview: Week of 1 December 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide PMI survey data for manufacturing and services are released by S&P Global in the coming week, accompanied by additional US numbers from the ISM.

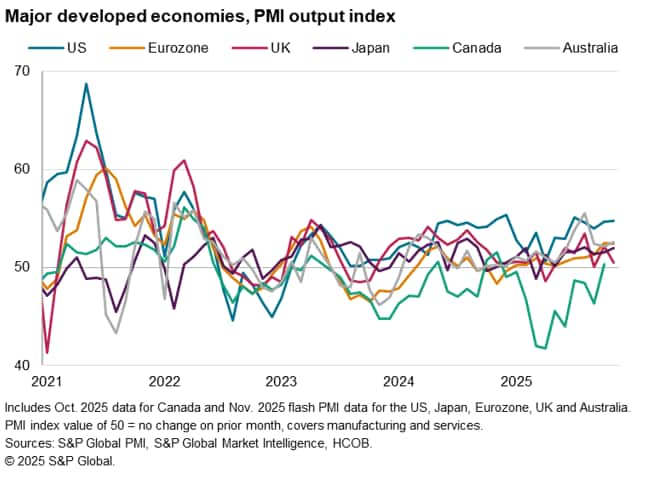

The November PMI survey data follow provisional flash PMI releases which pointed to an ongoing US outperformance among the major developed economies in terms of both manufacturing and service sector growth. However, eurozone business growth was sustained at one of the strongest rates seen over the past two and a half years, and Japan's growth rate remained one of the highest recorded in the past year. The good news was tempered, however, by growth coming close to stalling in the UK amid uncertainty ahead of the Autumn Budget.

PMI data for mainland China as well as other manufacturing-oriented Asian economies, notably including Taiwan, South Korea and Vietnam, will also be keenly awaited to assess the impact of US tariff policy, both on national performances as well as shifting broader global trade patterns.

The US November PMI data from S&P Global and the ISM take particular prominence given the ongoing disruptions to official data releases caused by the government shutdown. However, some official data are due to be released, including job openings (JOLTS) data, albeit only relating to August, and import and export prices for September. However, ADP employment data for November and University of Michigan consumer confidence data are also released to help guide views on the US labour market and household sentiment in relation to spending and affordability.

In Europe, eurozone inflation is signalled to have remained comfortably close to the ECB's 2% target, with the flash PMI data having indicated benign price pressures overall, despite lingering signs of sticky services inflation. The eurozone also sees a third estimate of third quarter GDP updated alongside fresh retail sales data. In the UK, the PMIs are accompanied by Halifax house price data.

A rate cut from the Reserve Bank of India is meanwhile widely anticipated at its December meeting. After a series of cuts in the first half of the year the RBI has held rates steady, but there's a widespread expectation that lower inflation will allow policymakers to sanction another 25 basis point reduction to take the policy rate down to 5.25%. Although India continues to report a strong economic performance, there's a wish to stimulate more domestic spending to meet a higher growth potential.

Key diary events

Monday 1 Dec

Worldwide Manufacturing PMIs, incl. global PMI*

(Nov)

Americas

- US ISM Manufacturing PMI (Nov)

EMEA

UAE Market Holiday

- Türkiye GDP (Q3)

- UK Mortgage Lending and Approval (Oct)

APAC

- Japan Capital Spending (Q3)

- South Korea Balance of Trade (Nov)

- Indonesia Balance of Trade (Oct)

- Indonesia Inflation (Nov)

- Hong Kong SAR Retail Sales (Oct)

Tuesday 2 Dec

Americas

- Brazil Industrial Production (Oct)

- Mexico Business Confidence (Nov)

EMEA

UAE Market Holiday

- South Africa GDP (Q3)

- Eurozone Inflation (Nov, flash)

- Italy PPI (Oct)

APAC

- South Korea Inflation (Nov)

- Australia Building Permits (Oct, prelim)

- Japan Consumer Confidence (Nov)

Wednesday 3 Dec

Worldwide Services, Composite PMIs, inc. global PMI* (Nov)

Americas

- US ADP Employment Change (Nov)

- US Import and Export Prices (Sep)

- US ISM Services PMI (Nov)

EMEA

- Türkiye Inflation (Nov)

- Switzerland Inflation (Nov)

- Eurozone PPI (Oct)

APAC

- South Korea GDP (Q3, final)

- Australia GDP (Q3)

Thursday 4 Dec

Americas

- Brazil GDP (Q3)

- Canada Balance of Trade (Oct)

- US Initial Jobless Claim

- Canada Balance of Trade (Sep)

- US Balance of Trade (Oct)

- Brazil Balance of Trade (Nov)

EMEA

- Switzerland Unemployment (Nov)

- Eurozone HCOB Construction PMI* (Nov)

- UK S&P Global Construction PMI* (Nov)

- Eurozone Retail Sales (Oct)

- Türkiye Balance of Trade (Nov, prelim)

APAC

- Australia Balance of Trade (Oct)

- Thailand Inflation (Nov)

Friday 5 Dec

Americas

- Brazil PPI (Oct)

- Mexico Consumer Confidence (Nov)

- Canada Unemployment Rate (Nov)

- US UoM Sentiment (Dec, prelim)

- US Factory Orders (Oct)

EMEA

- Germany Factory Orders (Oct)

- UK Halifax House Price Index* (Nov)

- France Industrial Production (Oct)

- France Balance of Trade (Oct)

- Spain Industrial Production (Oct)

- Italy Retail Sales (Oct)

- Eurozone GDP (Q3, 3rd est.)

APAC

Thailand Market Holiday

- Japan Household Spending (Oct)

- Philippines Inflation (Nov)

- India RBI Interest Rate Decision

- Singapore Retail Sales (Oct)

- Taiwan Inflation (Nov)

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-december-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-december-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+1+December+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-december-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 1 December 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-december-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+1+December+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-december-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}