Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 16, 2025

US sector PMI data support recent gains in financial and technology sector stocks

The August S&P Global US PMI data continued to signal fundamental macro support for recent gains on the S&P 500 index, despite deepening concerns over valuations as the broad index hit fresh record high. However, detailed sector PMI revealed that the financial services and technology were the top performing sectors in August, underscoring the support to the economy from recent upticks in equity prices.

That said, while optimism over future market gains, spurred by potentially lower US interest rates and better trade relations, partly underpinned the gains on US equity indices, the US PMI continued to reflect a likely temporary boost from front-running of potential tariff hikes. The potential for these activities to fade in the coming months, reinforced by reduced optimism, hint at the potential for greater market volatility ahead.

S&P 500 index and the US PMI

Ahead of the September US Federal Open Market Committee (FOMC) meeting. US equity prices have soared, prompting concerns of over-valued equity prices. Valuations were cited as the biggest concern among US money managers in August, according to the latest S&P Global Investment Manager Index (IMI). That said, August S&P Global US Composite PMI data continued to show support for recent gains in the S&P 500 index, which reached fresh record highs going into September.

At 54.6 in August, down from 55.1 in July, the S&P Global US PMI Composite Output Index indicated solid growth in the US, with the latest reading being the second-highest seen so far this year. The strong performance was driven by a surge in manufacturing output in August, though partially offset by slightly slower services activity growth.

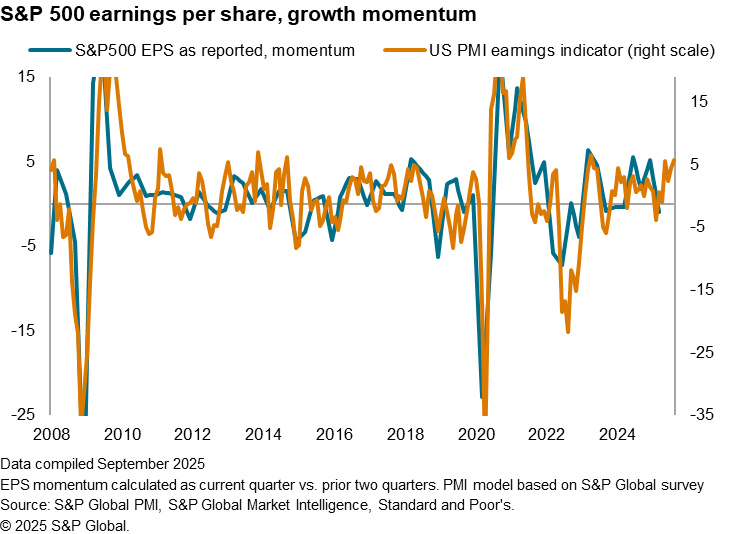

The recent performance of the PMI data are consistent with improved corporate profit momentum.

However, as cautioned in previous notes, the latest improvements in manufacturing performance continued to be partially linked to the temporary front-running of potential tariff hikes, especially as August data were collected during a period straddling the implementation of widespread US import tariffs on many economies. Uncertainty about future tariff increases in the coming months has also lingered.

As such, the likelihood for payback in the months ahead hint at the risk for softer US PMI readings, and also therefore point to potentially lessened support for equity market gains should the trajectory continue. This is of course barring improvements in economic growth with the lowering of US interest rates, a development that had boosted equity market sentiment of late. However, even with widely recognized prospects of further rate cuts this year, US business optimism lowered further in August according to PMI data, serving as a warning for the growth outlook.

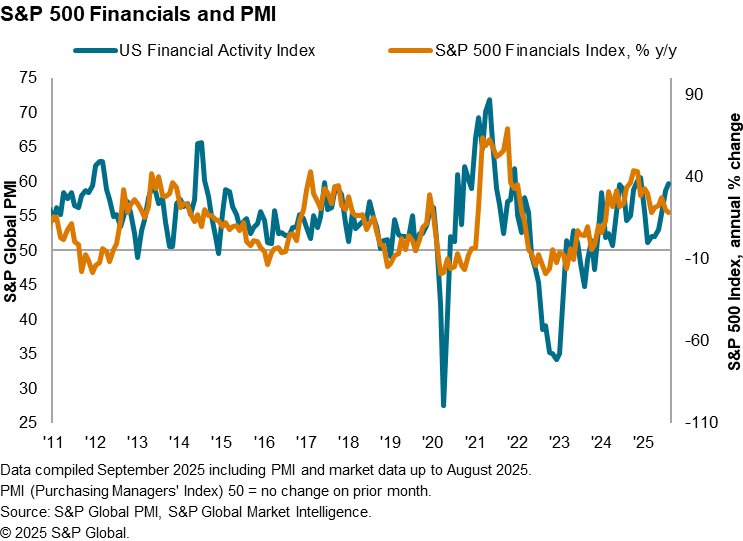

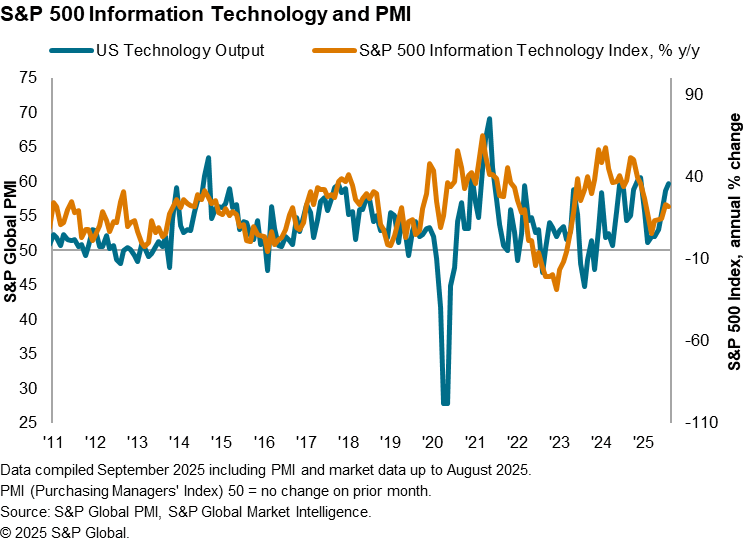

Buoyant financial and technology sectors

Diving into sector performance, detailed US Sector PMI revealed that the financials and technology sectors were the two top performing sectors in August. The trend holds true on a global scale as well. As detailed in the sector PMI article, we see financial services activity being buoyed by factors including rising demand for financial products linked to improving financial conditions amid the lowering of borrowing costs in many economies as well as rising asset prices. Although not the top performing sector on a year-to-date basis, the S&P 500 Financials Index certainly saw substantial year-on-year gains with recent improvements in the US financial sector PMI supporting the gains.

Meanwhile, the S&P 500 IT sector is among the best performing on a year-to-date basis and with the year-on-year gains having been an upward trajectory so far in 2025. The technology boom, driven in part by AI demand, certainly fueled positive equity market sentiment, with actual improvements in US technology output also confirmed by the PMI data.

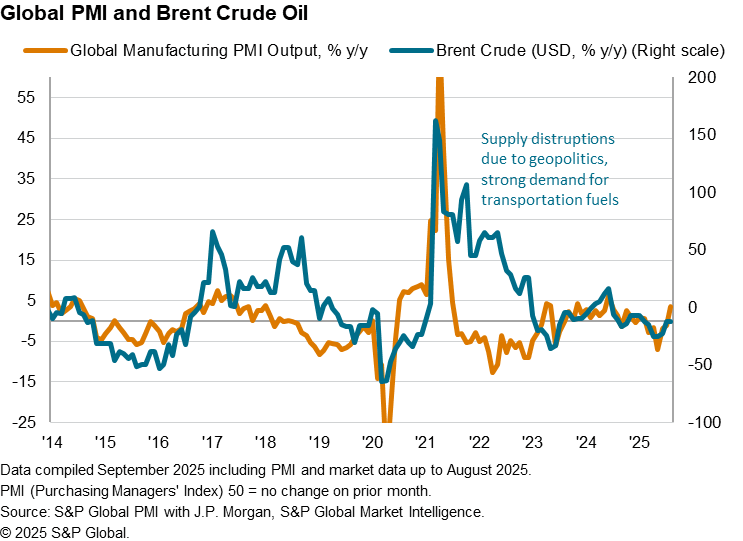

Brent crude oil price and global manufacturing production

Turning slightly away to look at crude oil prices amid concerns over the impact of geopolitics and demand slowdown, the latest comparison between the global manufacturing output index and brent crude oil price change showed that they are largely trending in line with each other, suggesting that crude oil prices are trading in line with fundamentals. Once again, the risks are to the downside in the coming months with business sentiment subdued, not just among manufacturers, but also on a global scale. Additionally, uncertainty over further Fed cuts also linger with US PMI data hinting at potential for more price rises that could hinder the US Federal Reserve from further loosening monetary policy settings.

Uncertain outlook

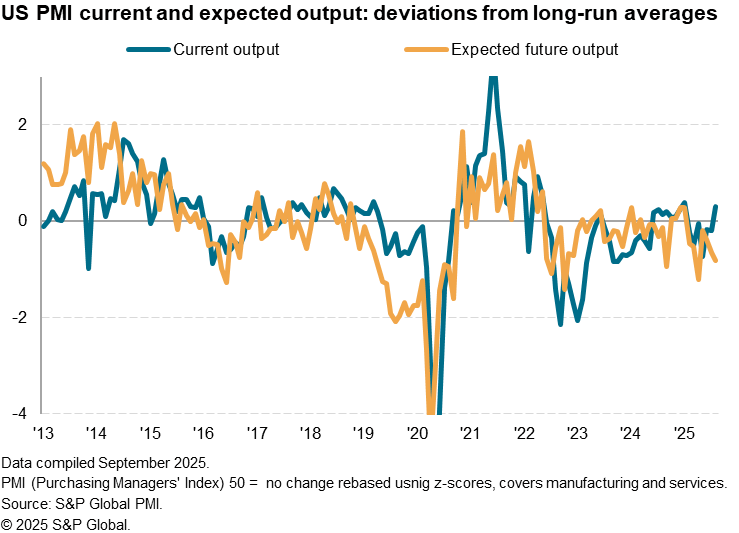

Where the economy goes from here remains highly uncertain, as underscored by a widening spread between current output (which is rising at an above trend rate) and expectations of future output (which is falling further below trend levels). Such a divergence is unusual outside of extreme events such as the pandemic, though the last time any such sustained spread was observed was during the first round of US tariffs in Trump's first presidency. At that time, lower interest rates from the Fed and then massive fiscal stimulus during the pandemic helped restore output and confidence. For the current situation, we await news on the FMOC's rates path and in particular the market reaction to the rate decision.

More PMI data will help to understand the business reaction to recent events with the release of flash PMI data on 23rd September.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-data-support-recent-gains-in-financial-and-technology-sector-stocks-sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-data-support-recent-gains-in-financial-and-technology-sector-stocks-sep25.html&text=US+sector+PMI+data+support+recent+gains+in+financial+and+technology+sector+stocks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-data-support-recent-gains-in-financial-and-technology-sector-stocks-sep25.html","enabled":true},{"name":"email","url":"?subject=US sector PMI data support recent gains in financial and technology sector stocks | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-data-support-recent-gains-in-financial-and-technology-sector-stocks-sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+sector+PMI+data+support+recent+gains+in+financial+and+technology+sector+stocks+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-data-support-recent-gains-in-financial-and-technology-sector-stocks-sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}