Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2025

US business growth hits lowest since late-2023, confidence slumps and prices move higher

The early flash PMI data for April point to a marked slowing of business activity growth at the start of the second quarter, accompanied by a slump in optimism about the outlook. At the same time, price pressures intensified, creating a headache for a central bank which is coming under increasing pressure to shore up a weakening economy just as inflation looks set to rise.

US growth drops to 16-month low

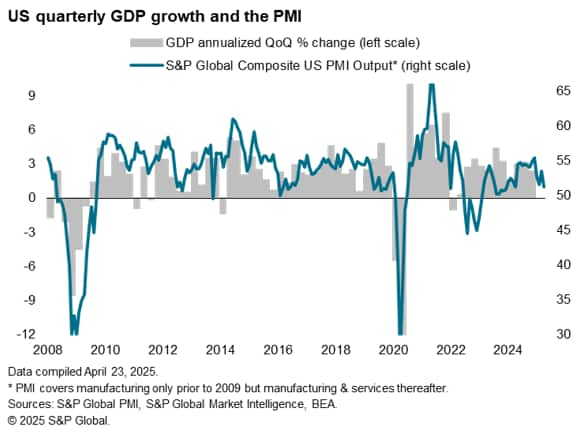

The headline S&P Global US PMI Composite Output Index fell from 53.5 in March to 51.2 in April, according to the preliminary 'flash' reading (based on approximately 85% of usual survey responses). The fall in the index signals a deceleration of activity growth to a 16-month low from the three-month high seen in March.

The survey data indicate that the US economy is growing at a modest annualized rate of just 1.0%.

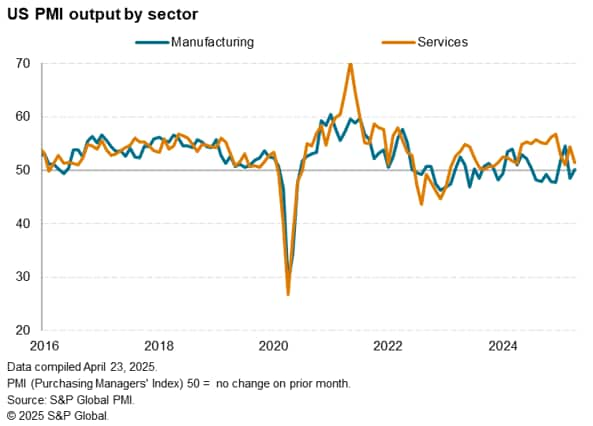

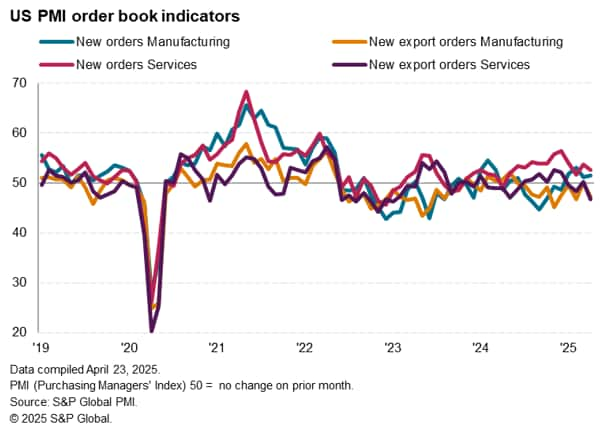

Manufacturing is broadly stagnating as any beneficial effects of tariffs are offset by heightened economic uncertainty, supply chain concerns and falling exports, while the services economy is slowing amid weakened demand growth, notably in terms of exports such as travel and tourism.

Growth of service sector business activity has slowed sharply to only a modest pace, registering the second-weakest expansion recorded over the past year. Exports of services are falling on a scale not seen since January 2023.

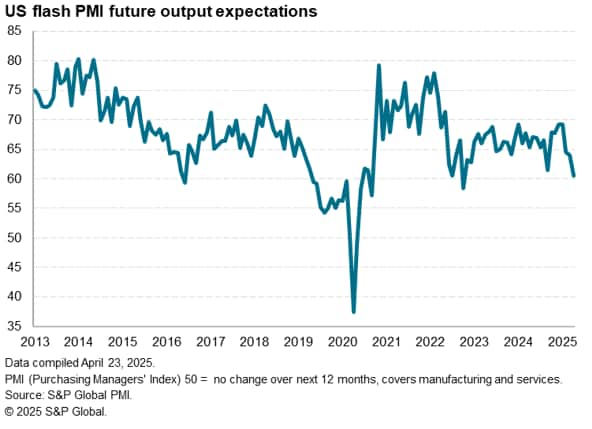

Future sentiment slumps

Sentiment among companies about their output over the coming year meanwhile fell for a third successive month in April, dropping sharply to register the least optimistic outlook since July 2022. The latest reading was the second-lowest since September 2020, surpassed only by October 2022.

Sentiment about the future was relatively more resilient in manufacturing than services, as factories often reported hopes of positive impacts from government policies such as recent trade protectionism measures. Factory confidence nonetheless fell to its lowest since last August amid concerns over higher costs, supply constraints, weaker economic growth, and falling demand from export customers.

Service sector optimism also cooled, sliding further from December's one-and-a-half year high to its lowest since October 2022. April saw a growing number of companies cite concerns over government policies and the resulting economic uncertainty.

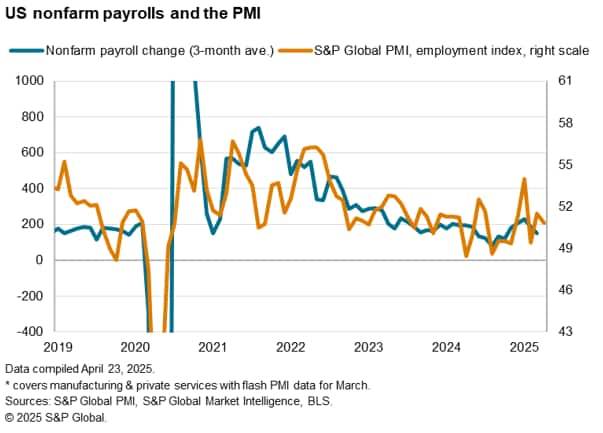

Employment

Employment rose slightly in April, up for the fourth time in the past five months, albeit registering a much-reduced rate of hiring compared to the 31-month high seen at the start of the year. Although a modest net increase in payroll numbers was recorded across the service sector in April, manufacturing jobs were cut for the first time since last October.

Hiring was often restricted by concerns over the economic outlook and demand environments both at home and in export markets, with rising cost concerns and labor availability also cited as restricting factors.

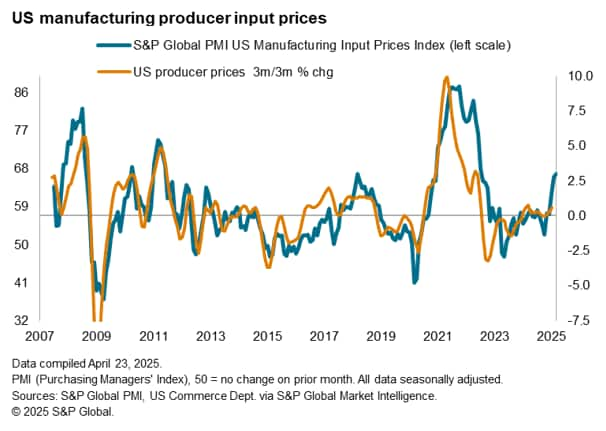

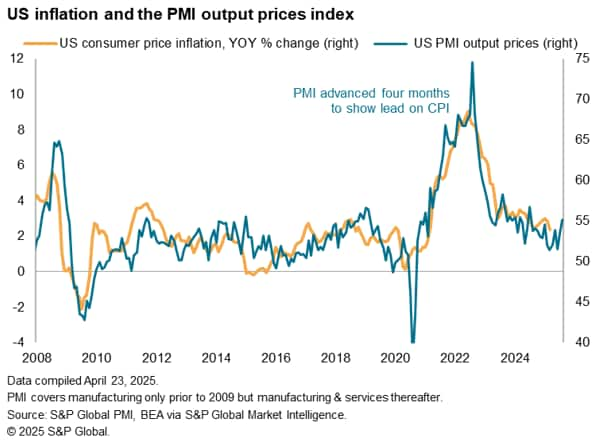

Prices rise at fastest rate for over a year

Average prices charged for goods and services rose at the sharpest rate for 13 months in April, increasing especially steeply in manufacturing (where the rate of inflation hit a 29-month high) but also picking up further pace in services (where the rate of inflation struck a seven-month high).

Higher charges were attributed to rising costs, linked widely in turn to tariffs, rising import prices and increased labor costs. Input costs in the manufacturing sector rose at a pace not seen since August 2022, as suppliers pushed through price hikes linked to tariffs, supply concerns and a weakened exchange rate.

Policy tensions

The concern is that these higher prices will inevitably feed through to higher consumer inflation, potentially limiting the scope for the Federal Reserve to reduce interest rates at a time when a slowing economy looks in need of a boost.

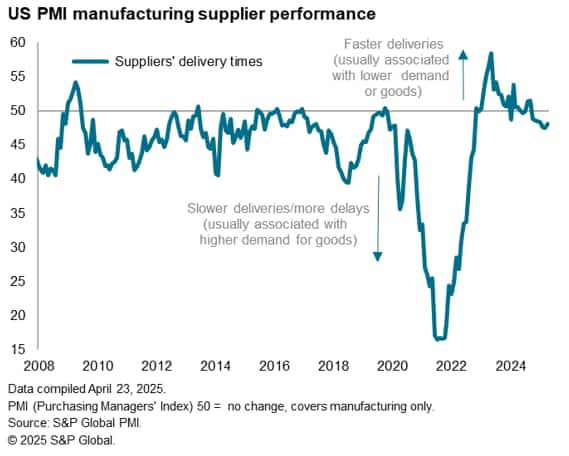

Supply chain factors

If one is looking for some good news, it is that supply chain delays remain relatively muted. As measured by the PMI's suppliers' delivery times index, supply delays have risen over the past seven months, though the lengthening of lead times in April was muted by comparison to that seen during the pandemic and the prior spell of tariff intensification seen in 2018.

While April saw an increased number of manufacturers report delays in the supply of goods or shortages due to tariffs, notably in terms of imports, weak demand and good supply from domestic customers helped alleviate any import shortages.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-business-growth-hits-lowest-since-late2023-confidence-slumps-and-prices-move-higher-apr25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-business-growth-hits-lowest-since-late2023-confidence-slumps-and-prices-move-higher-apr25.html&text=US+business+growth+hits+lowest+since+late-2023%2c+confidence+slumps+and+prices+move+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-business-growth-hits-lowest-since-late2023-confidence-slumps-and-prices-move-higher-apr25.html","enabled":true},{"name":"email","url":"?subject=US business growth hits lowest since late-2023, confidence slumps and prices move higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-business-growth-hits-lowest-since-late2023-confidence-slumps-and-prices-move-higher-apr25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+business+growth+hits+lowest+since+late-2023%2c+confidence+slumps+and+prices+move+higher+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-business-growth-hits-lowest-since-late2023-confidence-slumps-and-prices-move-higher-apr25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}