Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2025

Flash eurozone PMI heralds gloomier outlook as confidence slumps

The flash PMI® survey data showed the eurozone economy struggling to expand in April, with business confidence also sinking to its lowest for nearly two and a half years.

The main area of weakness was the services economy, as manufacturing output rose modestly in part due to the front-running of tariffs. However, with future expectations sliding lower in both sectors, the survey signals a broad-based downside risk to growth in the coming months.

Cost pressures meanwhile waned, with manufacturers in fact seeing a fall in input prices, allowing scope for further interest rate cuts from the European Central Bank.

Eurozone business activity barely rises

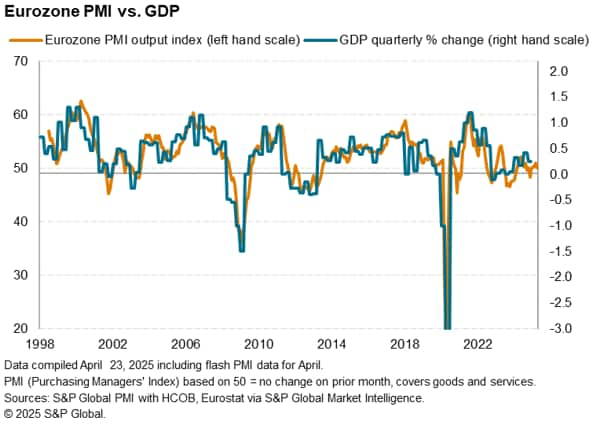

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, posted 50.1 in April, only fractionally above the 50.0 no-change mark and therefore signalling largely stagnant business activity. The latest reading was down from 50.9 in March and the lowest in four months.

A simple statistical model indicates that the current PMI reading is consistent with eurozone GDP growing at a mere 0.1% quarterly rate in April, which would be slightly below the average pace seen in the first quarter.

Manufacturing output growth offsets services downturn

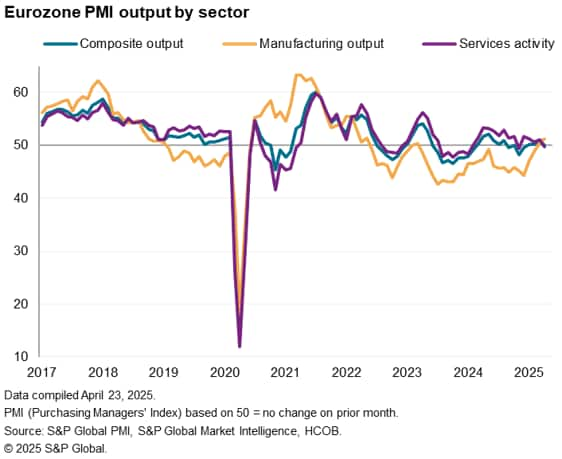

The disappointing news was mainly centered in the service sector, where business activity decreased marginally in April to end a four-month run of modest growth. This is only the second time in the past 15 months that services activity has fallen, though a broad cooling trend in growth for the sector has been evident over the past year.

More encouragingly, manufacturing production rose for a second consecutive month. Although the pace of expansion remained only modest, the latest rise was the most marked since May 2022 to represent a marked contrast to the steep declines seen throughout much of the past two years.

Gloomy outlook

The upturn in manufacturing output is at face value a positive surprise, given April's survey is the first since President Trump's "Liberation Day" tariff announcements. These now include a flat 10% tariff on eurozone exports to the US with a higher 25% on autos. However, this flat rate is only temporarily down from a proposed 20% rate, which Trump paused for 90 days.

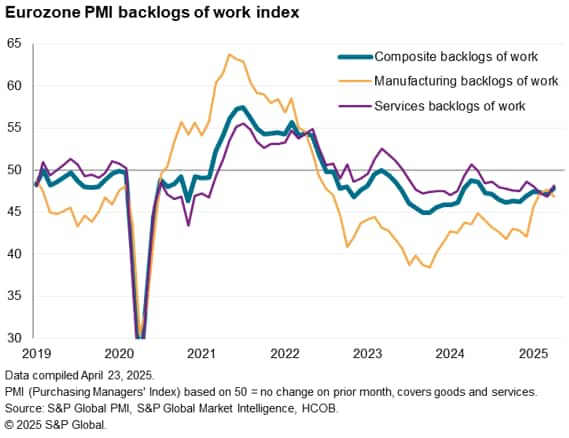

Some of the recent upturn in production is therefore reflective of eurozone producers front-running these tariffs, according to anecdotal evidence from manufacturers, amid reports of stock building and unplanned orders from customers. However, even with these unplanned orders, total volumes of new orders continued to fall at manufacturers in April, causing backlogs of work to decline at the fastest rate for three months. The latter points to a depleted pipeline of outstanding work at eurozone manufacturers, and was accompanied by a similar continued fall in backlogs of work at service providers.

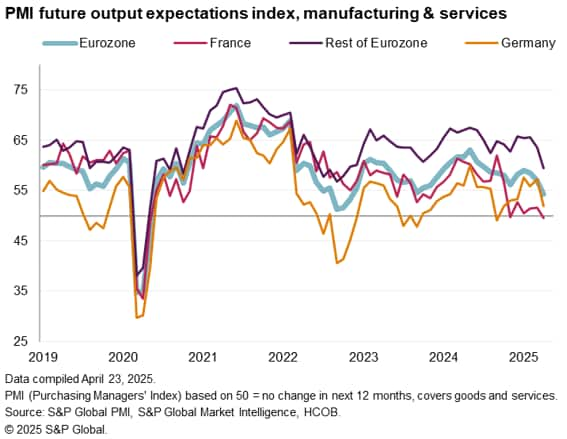

The worsening order book situation, coupled with growing concerns over global trade and US protectionism, fed through to a considerable deterioration of business confidence. Expectations of output over the next 12 months fell in April to the lowest since November 2022, dropping in both manufacturing and services. The latter is in fact now seeing confidence at its lowest for five years and, prior to the pandemic, confidence across the services economy has not been this low since the region's debt crisis in 2012.

In manufacturing, lower levels of sentiment had been recorded during the first wave of US tariff protectionism in 2018 and 2019, though it is likely that the historical low level of confidence seen in April is suggestive of the current upturn in factory output being short-lived.

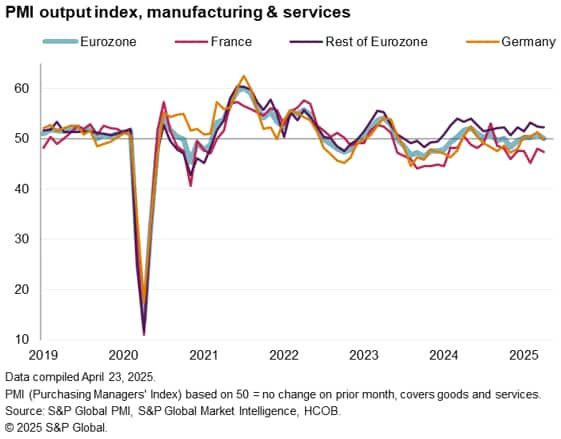

Eurozone 'periphery' provides main support to growth

Within the eurozone, Germany saw business activity decrease for the first time in four months during April after growth had hit a ten-month high in March. Although manufacturing output expanded for a second successive month, services output fell for the first time since November 2024, contracting at the sharpest rate since February of last year. Future expectations also fell in Germany, down to their lowest since last October, deteriorating in both manufacturing and services. Notably, the latter saw the worst reading for over one and a half years. Some support to German manufacturing sentiment came from hopes of increased fiscal spending, notably on defense.

Meanwhile, France remained in contraction and saw the pace of decline in business activity quicken over the month thanks to a faster service sector decline, where future expectations also sank to their lowest since the pandemic lockdowns of early 2020. Manufacturing output edged back into growth in France for the first time since May 2022, with future expectations also up to an 11-month high, providing a ray of optimism for the eurozone's second-largest member where confidence overall remains subdued by domestic and global political uncertainty.

The rest of the eurozone hence provided the main support to growth, albeit with the pace of expansion easing slightly from that seen in March and future expectations hitting their lowest since November 2022.

ECB policy to be loosened further

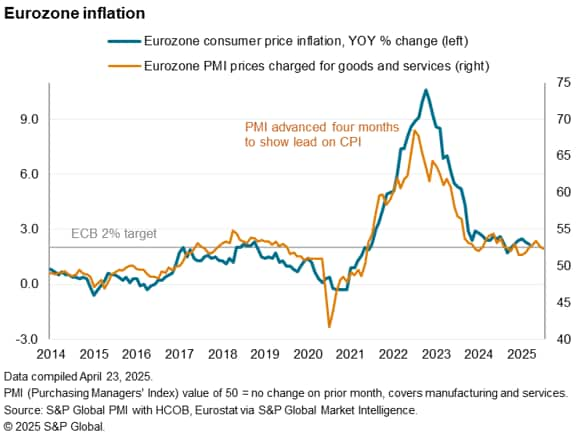

The flash eurozone PMI's main selling price index, which tracks changes in prices charged for both goods and services, meanwhile dropped further in April and is running at a level broadly consistent with inflation running close to the ECB's target. Of particular encouragement to inflation hawks was a further cooling of service sector selling price inflation, which reached its second-lowest for nearly four years.

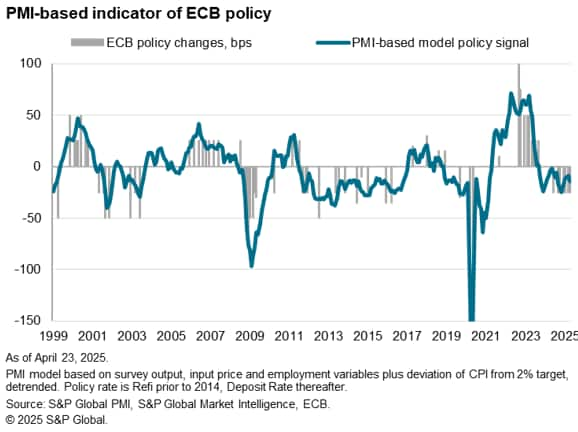

A composite indicator, based on key PMI gauges and the extent to which inflation is deviating from the ECB's 2% target, consequently remained firmly in rate-cutting territory in April, reflecting the overall weakness of output growth, the benign inflation picture, and a sustained but stalled labour market seen in the latest surveys (overall employment fell marginally in April, according to the flash PMI).

The latest PMI data follows the recent April interest rate cut from the ECB, which was the seventh 25 basis point reduction in the past year to take the Deposit Rate to 2.25% from a peak of 4.00%. The latest cut was seen as responding to a weakening growth and inflation outlook, the latter predicated on the stronger euro, lower energy prices, and cheaper imports as trade (notably from mainland China) is diverted from the US to Europe. In this environment, the markets are pricing at least another two 25 basis point rate cuts in 2025.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-heralds-gloomier-outlook-as-confidence-slumps-April2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-heralds-gloomier-outlook-as-confidence-slumps-April2025.html&text=Flash+eurozone+PMI+heralds+gloomier+outlook+as+confidence+slumps+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-heralds-gloomier-outlook-as-confidence-slumps-April2025.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI heralds gloomier outlook as confidence slumps | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-heralds-gloomier-outlook-as-confidence-slumps-April2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+heralds+gloomier+outlook+as+confidence+slumps+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-heralds-gloomier-outlook-as-confidence-slumps-April2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}