Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 02, 2025

UK manufacturers report steepest job and export losses of all economies surveyed by PMI data

At 45.4 in April, the seasonally adjusted S&P Global UK Manufacturing Purchasing Managers' Index™ remained well below the 50.0 no change level for a seventh straight month. Although up slightly from March's 17-month low of 44.9, the PMI signals a persistent and strong downturn of the UK's goods-producing sector.

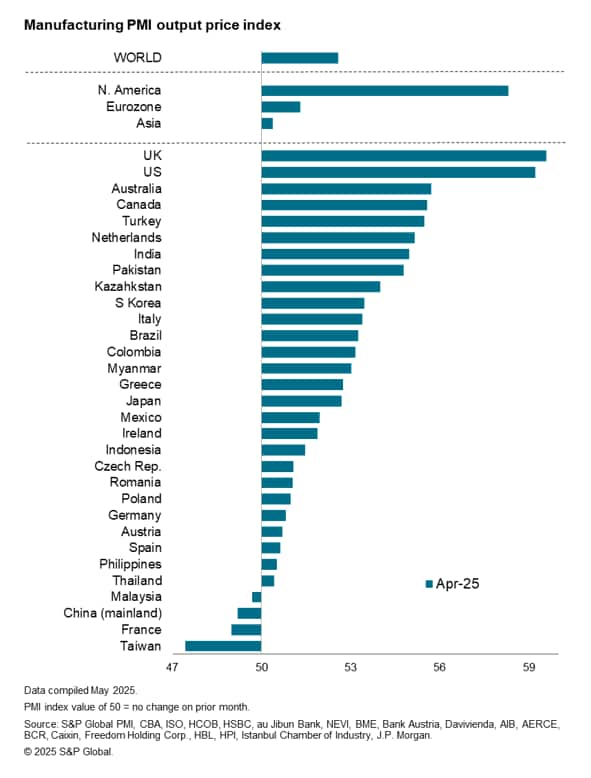

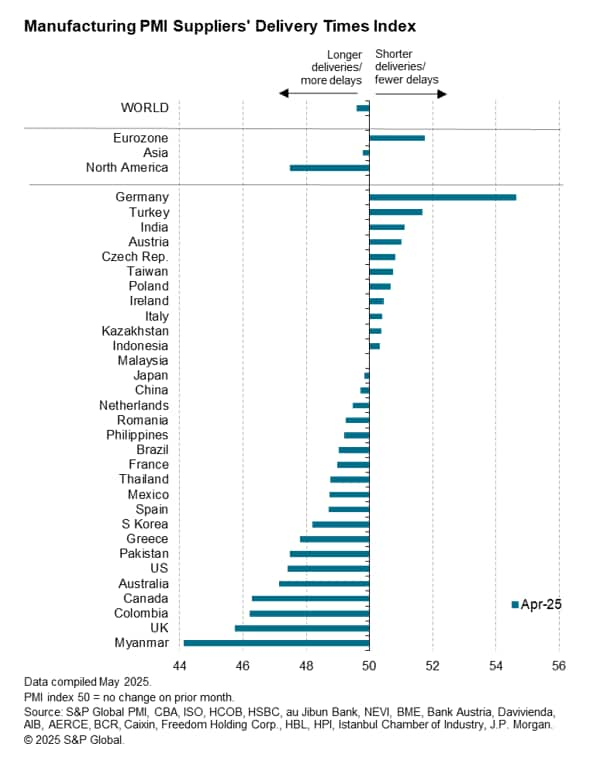

However, the performance of the UK becomes even more concerning when compared internationally. Of all 31 economies surveyed by S&P Global, the UK is seeing the steepest rate of job losses and the fastest rate of export order losses. At the same time, UK factories are reporting the highest goods price inflation of all economies surveyed globally, and a supply chain that is suffering from delays to a greater extent than all other economies bar only war-torn Myanmar.

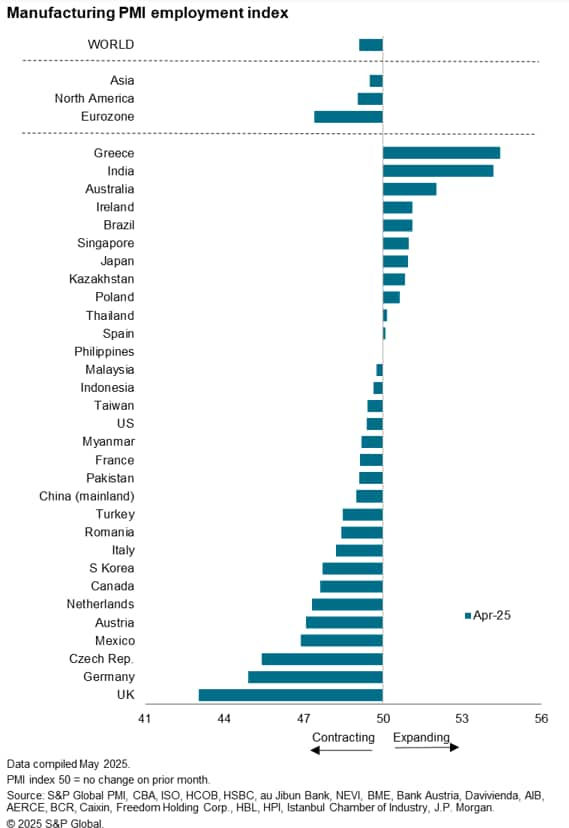

UK sees sharpest factory job cuts of all economies surveyed…

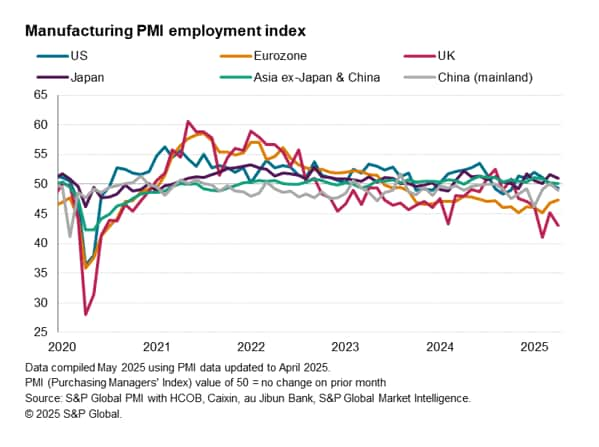

Of the 31 economies for which PMI data are so far available for April (publication of data for Russia and Vietnam are delayed due to public holidays), the UK reported the steepest decline in manufacturing employment, by some margin. The reduction in UK factory headcounts was less steep than the recent drop seen in February, but was the second-sharpest recorded since the initial wave of COVID-19 shutdowns in early 2020.

The drop in UK employment was attributed in part to weaker sales growth and economic uncertainty, but most notably to recent increases in both employer National Insurance contributions (a tax on employees) and the regulated minimum wage.

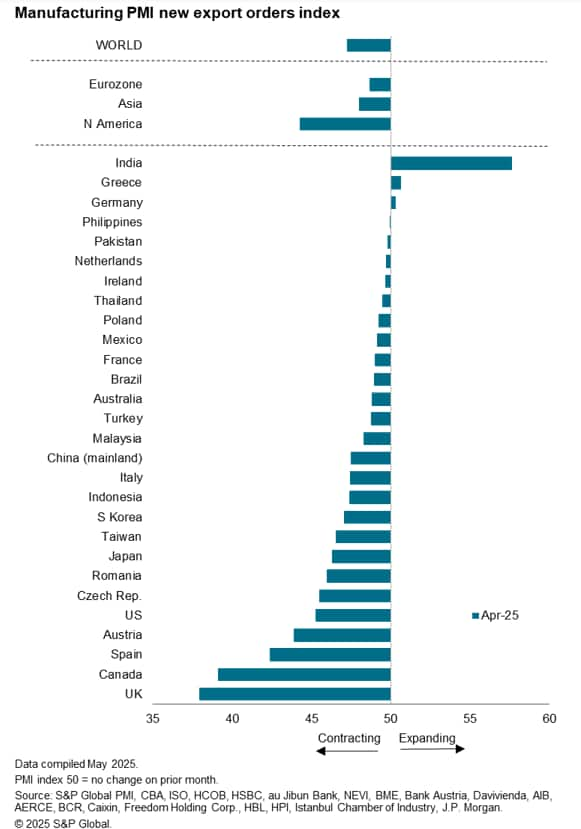

… alongside the steepest loss of exports…

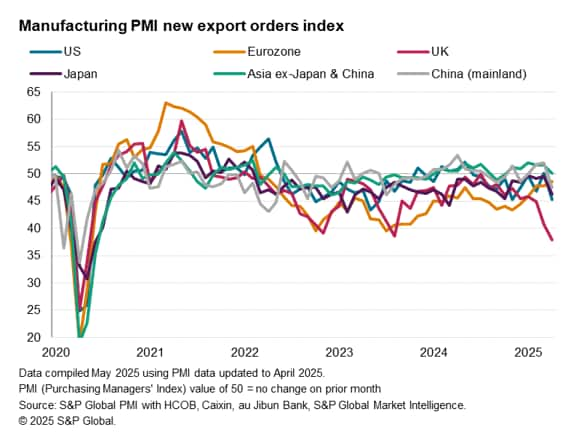

Concerns over sales reflected a decline in new export orders reported by UK manufacturers which was not only the steepest recorded since May 2020, but was also greater than recorded by any other economy tracked by the S&P Global PMI surveys.

Falling UK exports were blamed on increased tariff announcements in recent weeks as well as slower economic growth in key export markets and poor competitiveness, in part linked to high prices.

While exports from North America, including the US, and the eurozone also fell, the latter notably saw the rate of contraction ease to the weakest recorded for three years.

…and the highest selling price inflation

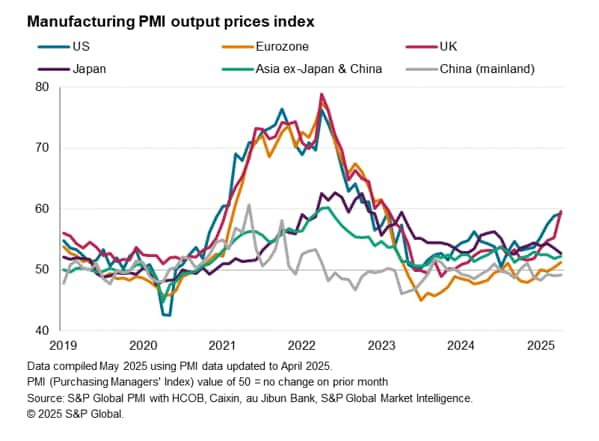

Faced with rising raw material prices and increases to staffing costs associated with the tax and wage changes implemented at the start of April, UK factories reported the steepest rise in selling prices for over two years (since February 2023). The rate of inflation exceeded that of all other economies surveyed in April, including even the US, where tariffs had reportedly caused prices to spike higher.

In contrast, eurozone output prices rose only modestly, and charges fell in mainland China which resulted in only a slight increase across Asia on average.

UK supply delays exceeded only by those seen in Myanmar

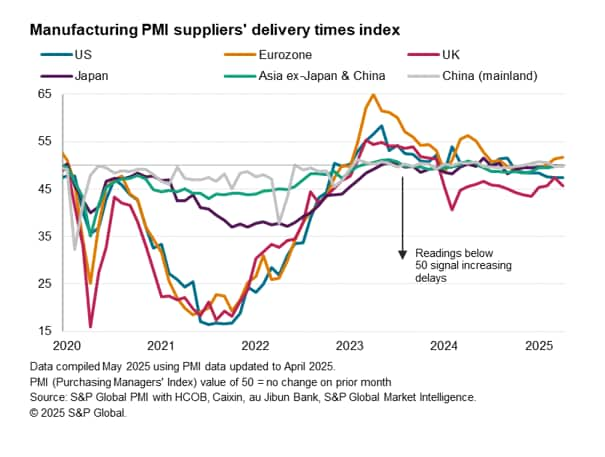

One further area of concern for the UK is the extent to which supply chains are deteriorating. April's PMI showed suppliers' delivery times lengthening for a sixteenth straight month, with only war-torn Myanmar reporting a more severe decline in supplier performance during the month. By contrast, supplier delivery times improved in the eurozone, but also worsened in North America and deteriorated slightly on average in Asia.

Tariff and tax impact

The UK's underperformance in terms of employment and its highest-ranking rise in selling prices is clearly linked by respondent companies to the government's policy changes announced in the Autumn Budget, which came in effect just ahead of the collection of April's survey data, as well as the deteriorating trade picture.

Why the UK's export performance has worsened so much relative to peers in the EU is uncertain, but there are indications from surveyed companies in some countries, such as Germany, that producers have been shipping to avoid US tariffs, for which a 90 day pause has been announced on additional EU tariffs. With the UK not currently subject to these higher tariffs, there has potentially been less perceived need for UK exporters to front-run shipments ahead of the extra levies.

As for supply chains, the UK's worsening performance relative to the EU is likely to be linked at least in part to the ease of shipping goods around the Single Market.

With deteriorating supply typically a major source of inflationary pressures, the worsening supplier delivery times situation in the UK will also be fueling the above-average price growth witnessed in April.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-steepest-job-and-export-losses-of-all-economies-surveyed-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-steepest-job-and-export-losses-of-all-economies-surveyed-may25.html&text=UK+manufacturers+report+steepest+job+and+export+losses+of+all+economies+surveyed+by+PMI+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-steepest-job-and-export-losses-of-all-economies-surveyed-may25.html","enabled":true},{"name":"email","url":"?subject=UK manufacturers report steepest job and export losses of all economies surveyed by PMI data | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-steepest-job-and-export-losses-of-all-economies-surveyed-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturers+report+steepest+job+and+export+losses+of+all+economies+surveyed+by+PMI+data+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-steepest-job-and-export-losses-of-all-economies-surveyed-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}