Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2023

UK Flash PMI surveys signal growth slowdown in June as rate hikes take their toll

June's flash PMI survey data rounded off a solid quarter of growth for the UK economy, though the pace of expansion slowed amid signs of a growing toll from the rising cost of living and higher interest rates. Most notably, consumer spending on services, a core growth driver earlier in the year, is now showing signs of faltering.

One notable area of resilience in the economy is the labour market, with jobs growth accelerating in June as companies in the service sector continue to fill vacancies. While falling backlogs of work suggest this hiring trend could fade in the coming months as the economy weakens, for now it is generating higher wage growth, in turn feeding through to still-elevated inflation pressures in the service sector. As such, the survey's price gauges point to consumer price inflation remaining well above the Bank of England's target into 2024, which will add to the case for further interest rate hikes.

Thus, while the June survey reveals the economy to be cooling as a result of higher interest rates, the stubbornly elevated price growth in the service sector suggests the Bank of England will consider its fight against inflation as still a work in progress, which will inevitably mean the slowdown gathers pace in the coming months and adds to the likelihood of the economy tipping into recession later in the year.

Economic growth slows

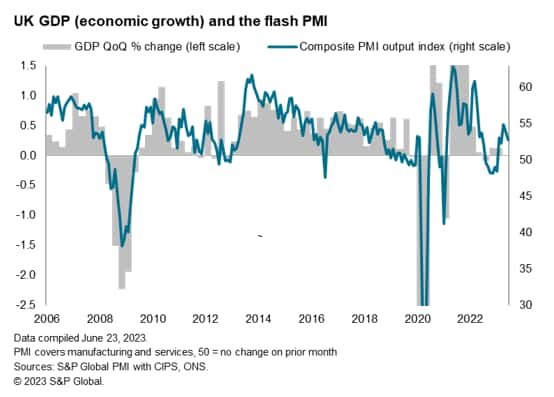

UK business activity grew for a fifth consecutive month in June, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS. However, the survey's headline output gauge, the composite PMI, fell from 54.0 in May to 52.8, indicating the weakest expansion since March. The reading was also well below the consensus expectation of 53.6.

The latest reading is consistent with GDP rising at a quarterly rate of 0.25% in June, pointing to growth of just over 0.3% for the second quarter as a whole.

While the latest data point to an improved economic performance compared to the 0.1% expansion seen in the opening quarter of the year, the detail of the survey adds to concerns about the near-term outlook.

Service sector drives growth, but shows signs of cooling

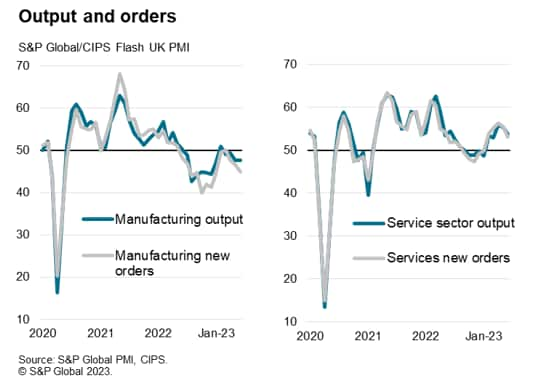

Worryingly, the upturn continues to be driven entirely by the service sector, where output rose for a fifth straight month while manufacturing output contracted for the eleventh time in the past 12 months. Although the rate of decline of manufacturing output held steady compared to May, an accelerating loss of new orders into the factory sector - including a steep drop in exports -suggest that production growth could falter further in the months ahead.

The dependence on the service sector is a particular concern as this is a part of the economy which is especially susceptible to demand being affected by higher interest rates. Some impact of higher borrowing costs was evident in June, with service sector growth slowing to the weakest for three months. Inflows of new business into the service sector slowed especially markedly, down to the lowest seen over the past five months.

Measured overall, new orders growth for goods and services sank to its lowest since January, dropping well below the rates seen in the spring.

Within the service sector, financial services was an outlier in reporting strong output and new business growth. Consumer-facing services, such as hotels, restaurants, travel and leisure, have meanwhile seen strong growth earlier in the year show signs of faltering. Business activity and new orders fell particularly sharply for hotels and restaurants in June. Demand for business services meanwhile remained largely stalled.

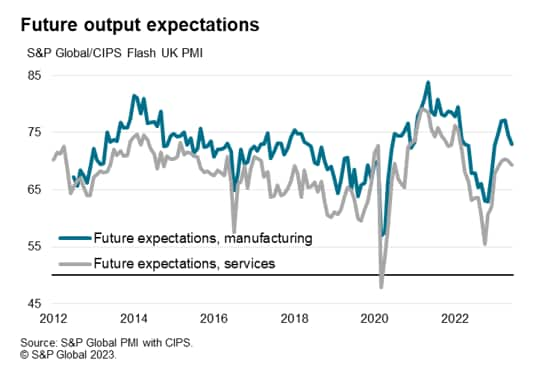

Concerns over the possibility of weaker growth in both sectors in the coming months was fueled further by business expectations deteriorating across the board in June. Companies - notably service providers - commonly cited higher interest rates, the rising cost of living and weaker customer spending as the principal drivers of weaker business activity growth in the year ahead.

Job market resilience

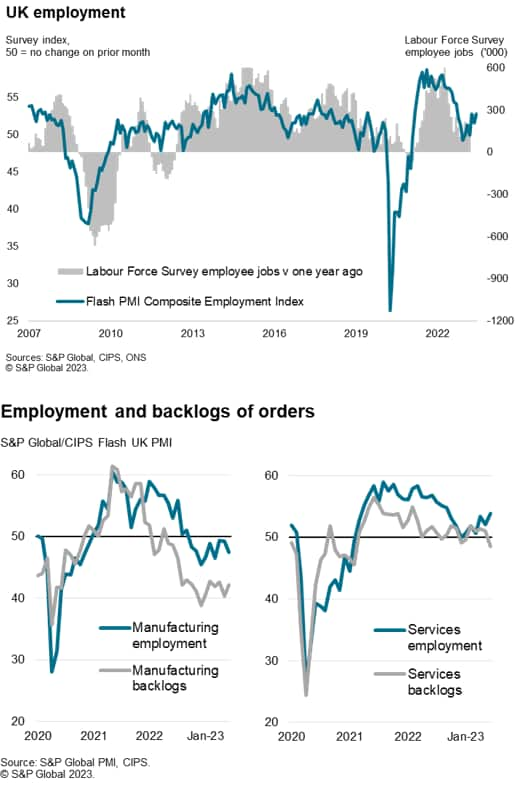

One aspect of the survey which continued to show encouraging resilience was employment. efforts to fill vacancies pushed jobs growth to its highest since last September, though the gain was entirely fueled by the service sector. Manufacturing jobs fell at an increased rate as producers reported lower demand and an unwanted build-up of unsold stock.

There are concerns that service sector jobs growth could also weaken, as backlogs of work fell in the sector for the first time in five months, dropping at the fastest rate since the COVID-19 lockdowns in early 2021. Declining backlogs of work are typically followed by falling employment as firms adjust capacity down to meet smaller workflows.

Inflation remains elevated for services

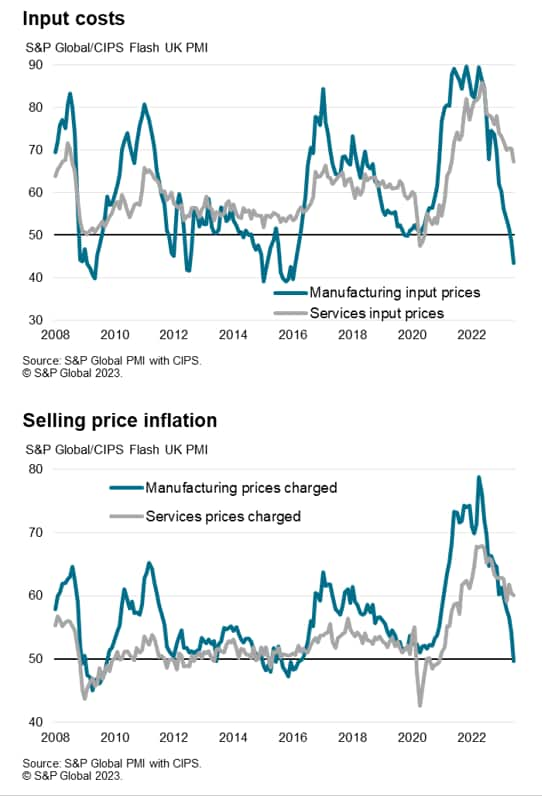

Such a cooling of the service sector jobs market would of course be music to the Bank of England's ears. Rising wages and salaries, linked to the tight job market, was again widely cited as a key factor driving service sector costs sharply higher in June. Although input cost inflation eased to a two-year low in the service sector, it remained elevated by historical standards, and well above anything recorded in the 12 years preceding the price surge of 2021. Hotels and restaurants once again reported by far the steepest price growth.

These higher costs were often passed on to customers resulting in another month of steeply rising charges for services, the rate of increase of which eased only marginally compared to May.

In contrast, manufacturing input costs fell sharply, dropping at a pace not seen since early 2016, as purchasing managers reported slumping demand combined with a further marked improvement in supply availability. These lower factory costs in turn fed through to a decline in manufacturers' average selling prices for the first time since April 2016.

However, given the greater size of the service sector relative to manufacturing, the upturn in costs and selling prices in the former ensured overall price pressures in the economy remained stubbornly high.

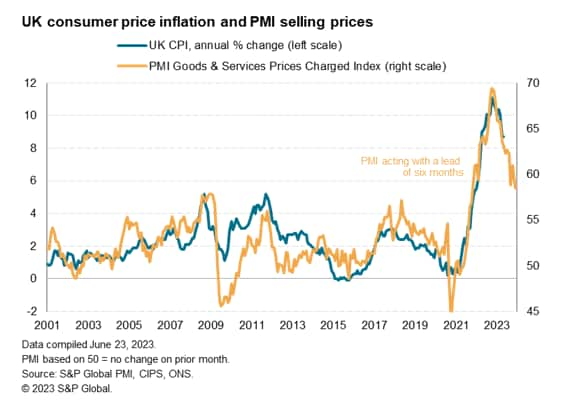

Although the survey's selling price gauge is consistent with consumer price inflation (CPI) moderating from the current 8.7% rate in the coming months, the survey data continue to point to inflation in the region of 6%, and therefore well above the Bank of England's 2% target, into the start of 2024.

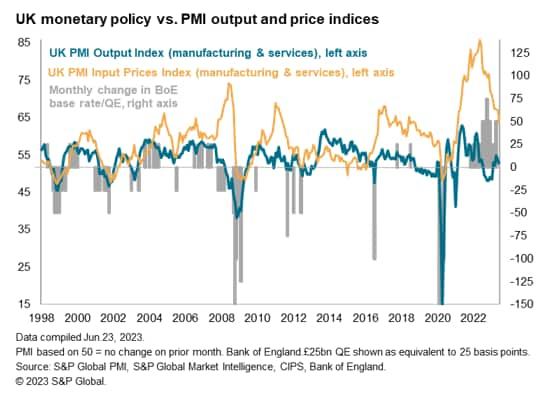

Recession risks mount amid likelihood of more rate hikes

The PMI data therefore reveal a growing impact of higher interest rates on the economy, notably via reduced growth of business activity and demand. The survey's inflation gauges are also showing signs of falling as the economy slows. Price gauges - notably in the service sector - nevertheless remain elevated by historical standards and suggest that, while falling, inflation is coming down only slowly with signs of the Bank's 2% target not yet in sight. Further rate hikes may therefore be called for in the coming months by a majority of MPC members, who have become increasingly determined to take aggressive action with a larger than anticipated 50 basis point rate hike in June, taking the policy rate to 5.0%. However, such rate hikes will clearly add to the likelihood of a recession later in the year, which is looking increasingly inevitable as collateral damage in the belated fight against inflation.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-surveys-signal-growth-slowdown-in-june-as-rate-hikes-take-their-toll-jun23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-surveys-signal-growth-slowdown-in-june-as-rate-hikes-take-their-toll-jun23.html&text=UK+Flash+PMI+surveys+signal+growth+slowdown+in+June+as+rate+hikes+take+their+toll+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-surveys-signal-growth-slowdown-in-june-as-rate-hikes-take-their-toll-jun23.html","enabled":true},{"name":"email","url":"?subject=UK Flash PMI surveys signal growth slowdown in June as rate hikes take their toll | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-surveys-signal-growth-slowdown-in-june-as-rate-hikes-take-their-toll-jun23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Flash+PMI+surveys+signal+growth+slowdown+in+June+as+rate+hikes+take+their+toll+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-surveys-signal-growth-slowdown-in-june-as-rate-hikes-take-their-toll-jun23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}