Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2025

UK flash PMI signals lacklustre June as employment falls amid weak confidence, but inflation pressures also moderate sharply

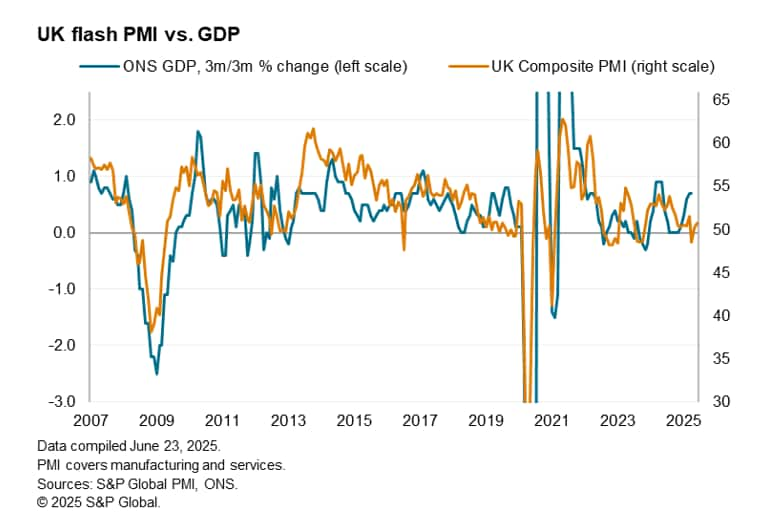

The UK economy remained in a sluggish state at the end of the second quarter, according to the early PMI survey data. Although business conditions have continued to improve since April's downturn, quelling recession fears, growth of business activity remains disappointingly lacklustre, indicative of second quarter GDP rising at only a 0.1% quarterly pace.

Business confidence also remains in the doldrums compared to this time last year, losing ground again in June. On top of concerns over the impact of recent government policies and worries over global trade protectionism, June's data collection coincided with increased tensions in the Middle East. Employment has hence continued to be cut as firms grapple with the combination of higher staffing costs, linked to last autumn's Budget, lower demand and subdued confidence.

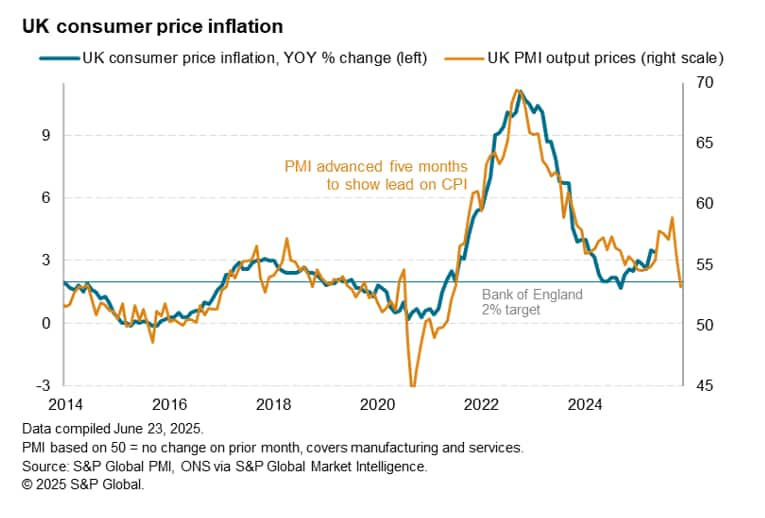

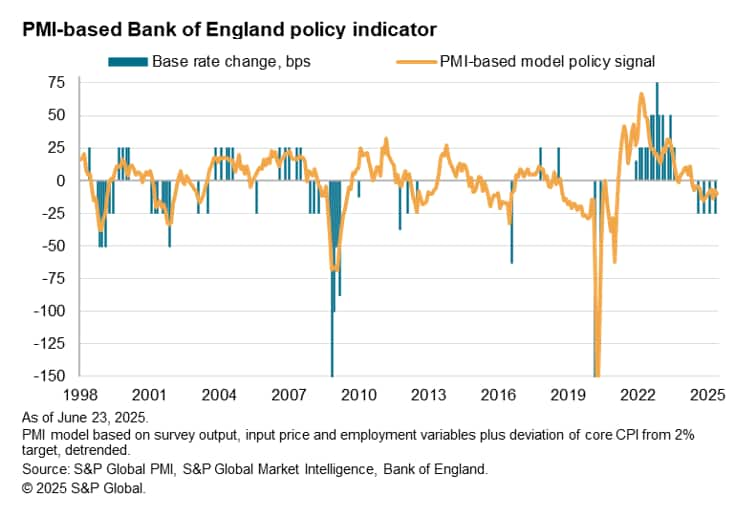

These conditions have, however, led to a marked cooling of inflationary pressures, notably in the services economy, which have been a major concern of the Bank of England. As such, the picture of near-stalled growth, falling employment and lower inflation opens the door for the Bank of England to cut rates again at its next policy meeting in August.

Sluggish expansion at end of second quarter

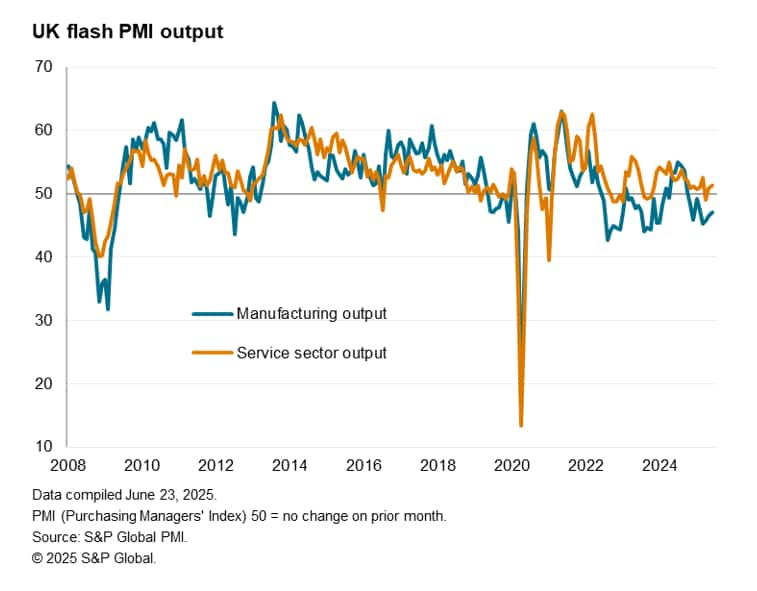

Growth of UK business activity continued to pick up a little pace in June from the decline seen back in April, though the rate of expansion remained only very modest to round off a disappointing second quarter. At 50.7, up from 50.3 in May, the flash PMI's headline composite output index was only slightly above the 50.0 no change mark. At this level, the PMI is broadly consistent with GDP growing at a mere 0.1% quarterly rate.

Although growth in the service sector edged higher for a second month to register an expansion just shy of that seen on average in the first quarter, the gain was still only slight, and partly offset by a further drop in manufacturing output. The goods-producing sector reported a downturn in output for an eighth straight month, the rate of decline moderating to the slowest since February yet remaining strong by historical standards.

Low confidence

Key to the ongoing subdued expansion was an environment of subdued demand and gloomy confidence.

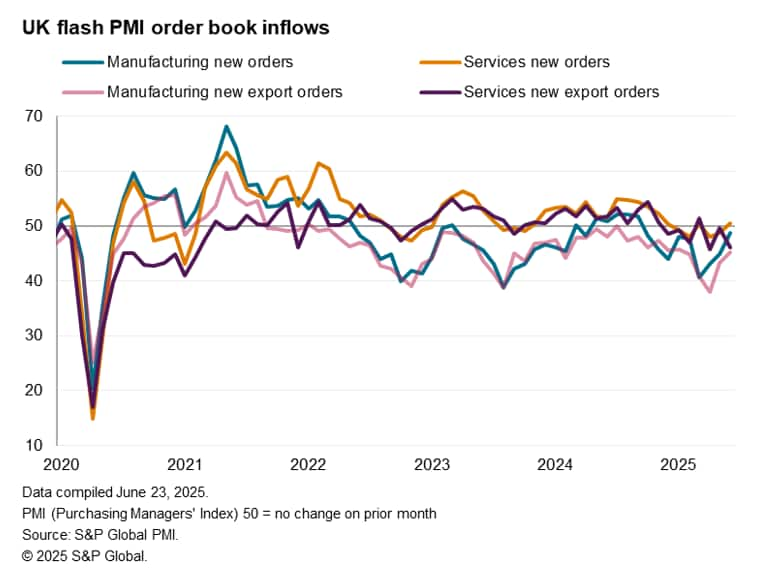

Measured overall, new orders placed for goods and services rose for the first time since last November, but the rise was only marginal to merely indicate a halting in the recent downturn in demand rather than any marked improvement. Export orders continued to fall especially sharply, dropping in the service sector at one of the steepest rates seen since the pandemic, offsetting some cooling in the rate of export decline in the manufacturing sector.

Having rebounded in May from a worryingly depressed level in April, business sentiment about the year ahead meanwhile lost some ground again in June, thereby remaining well below the survey's long-run average.

Sentiment continued to be dampened by domestic and overseas factors. A discontent with recent UK government policies was widely reported as having stymied confidence, compounded by worries over broader global issues such as US trade policy and geopolitics, with June's data collection coinciding with increased tensions in the Middle East.

Ongoing job losses

The historically subdued degree of confidence hints at sentiment acting as a drag on growth via lower business spending, including on investment and staffing. Employment in fact continued to fall at a steep rate in June. While not as severe as reported earlier in the year (and less marked than May's estimated payroll decline signalled by HMRC data), companies reported widespread job cuts designed to reduce costs amid weak demand.

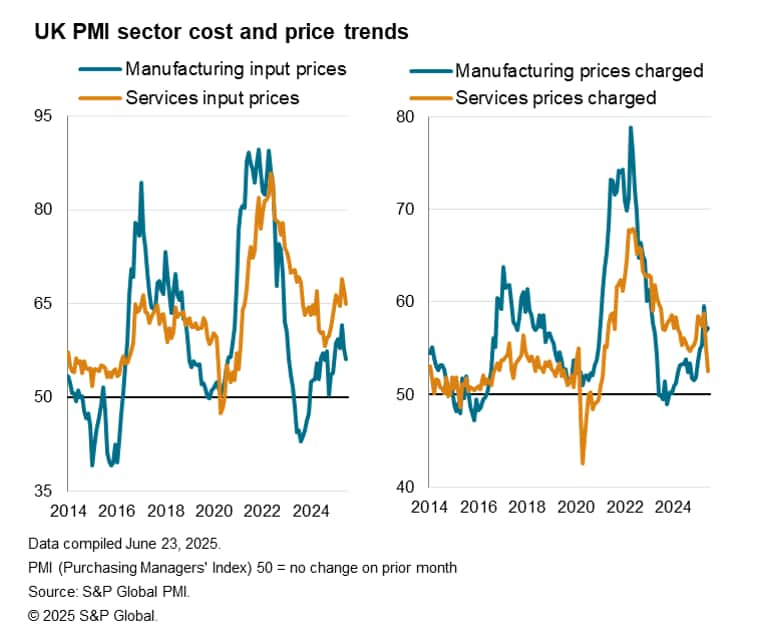

Input costs continued to rise at a steep rate in June, a pace above the average seen over the past two years and higher than a year ago, which many firms blamed on the recent rise in National Insurance contributions and Minimum Wage. Some upward pressure on costs was also linked to higher oil prices.

Cooler inflation

However, while still widespread, these higher cost pressures have in fact moderated further compared to the peak seen back in April, feeding through to lower selling price inflation. Selling prices rose at a much reduced rate in particular in the service sector, where the rate of inflation dropped sharply to its lowest since February 2021. Lower cost pressures, notably via a peaking of the National Insurance impact, were accompanied by increasingly intense discounting amid stiff competition and weak demand.

With average prices charged for manufactured goods also rising at a reduced rate in June, the survey's combined gauge of inflation for goods and services rose at the weakest rate since January 2021. This gauge is now broadly indicative of consumer price inflation returning to the central bank's target of 2%, according to historical comparisons.

More rate cuts expected

The flash PMI data for June come on the heels of the Bank of England choosing to leave interest rates unchanged at its June 19th meeting, albeit with three of the nine Monetary Policy Committee members voting for a quarter point cut. This easing bias is supported by the recent PMI data, which had sat in territory broadly supportive of looser policy in May. With the June PMI showing still sluggish economic growth combined with weaker price pressures and a further sharp drop in employment, the latest data increasingly support the view that the Bank of England will cut rates again at its next meeting in August.

Since August 2024, the Bank of England has reduced its Bank Rate four times, with the recent May meeting seeing the rate fall to 4.25%. We anticipate two more cuts in 2025 at the August and November policy meetings.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-lacklustre-june-as-employment-falls-amid-weak-confidence-jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-lacklustre-june-as-employment-falls-amid-weak-confidence-jun25.html&text=UK+flash+PMI+signals+lacklustre+June+as+employment+falls+amid+weak+confidence%2c+but+inflation+pressures+also+moderate+sharply+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-lacklustre-june-as-employment-falls-amid-weak-confidence-jun25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals lacklustre June as employment falls amid weak confidence, but inflation pressures also moderate sharply | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-lacklustre-june-as-employment-falls-amid-weak-confidence-jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+lacklustre+June+as+employment+falls+amid+weak+confidence%2c+but+inflation+pressures+also+moderate+sharply+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-lacklustre-june-as-employment-falls-amid-weak-confidence-jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}