Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2025

UK flash PMI signals higher growth and optimism post-Budget, but inflation also lifts higher

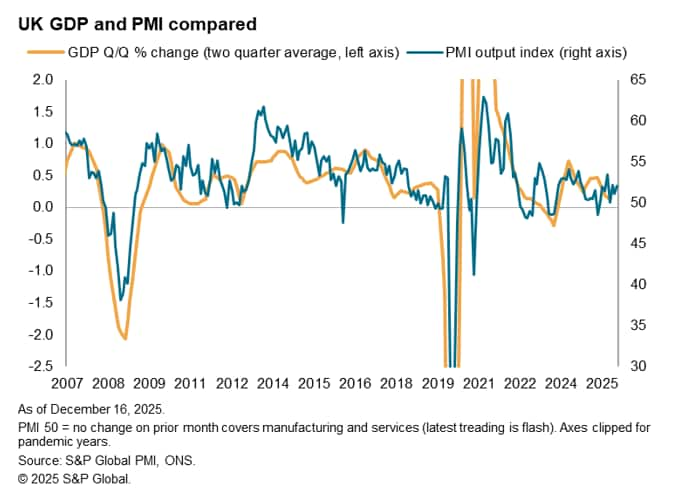

December's flash PMI surveys brought welcome news on faster economic growth at the end of the year, with businesses buoyed in part by the post-Budget lifting of uncertainty. The PMI is consistent with GDP growth accelerating to 0.2% in December, albeit with a more modest 0.1% gain signalled for the fourth quarter as a whole.

It's a big relief that business confidence has not slumped in a repeat of last year's post-Budget gloom. Instead, companies have ended the year on a slightly more optimistic note amid signs of improving demand now that some of the uncertainty created by the Budget has cleared. New orders are in fact growing at the fastest rate for over a year.

However, the overall pace of output and demand growth remains lacklustre, and the overall expansion is still very dependent on technology and financial services activity, with many other parts of the economy struggling to grow or in decline.

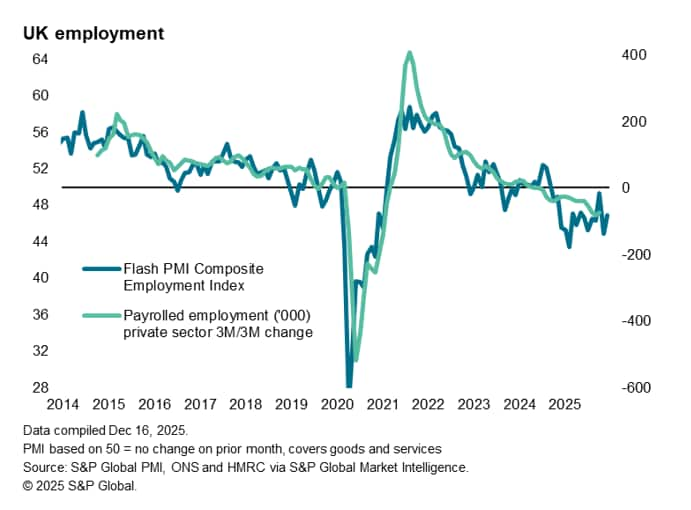

Job losses are also worryingly widespread, and it remains to be seen whether the uptick in orders during December will persuade more companies to start hiring again, especially as rising staff costs continue to be reported as one of the key concerns of businesses. These higher cost pressures were in turn cited as the key cause of a renewed upturn in selling price inflation across both goods and services.

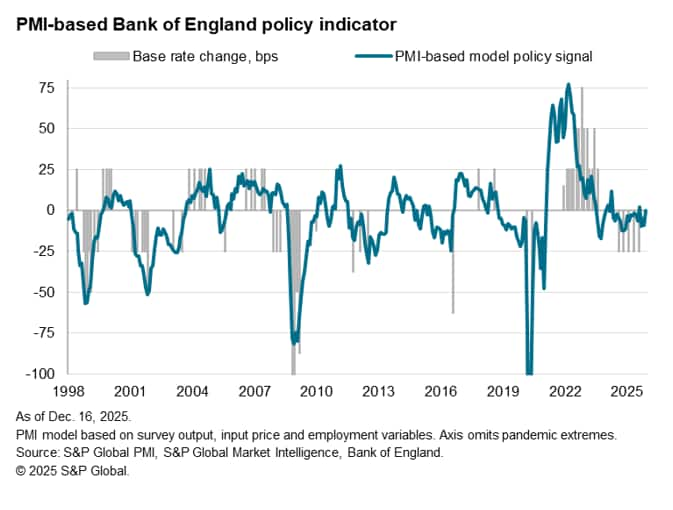

The sluggish growth and worrying jobs data from the flash PMI data therefore suggest that the odds remain in favour of a further cut to interest rates at the December MPC meeting, but that the path to further rate cuts in 2026 remains very data dependent, as policymakers await confirmation that price pressures are going to soften materially as the year proceeds.

Sluggish economy picks up pace

UK business activity picked up momentum in December, linked partly to the lifting of uncertainty following November's Budget. At 52.1, the PMI headline Composite Output Index regained almost all the ground lost from a fall to 51.2 in November, reaching the third-highest level seen over the past 15 months, according to the initial flash estimate. The current PMI is broadly consistent with GDP growing at a near 0.2% quarterly cadence in December, albeit with a more modest 0.1% gain signalled for the fourth quarter as a whole. This follows a 0.1% rise in GDP in the third quarter, as signalled by both the official GDP data and the PMI.

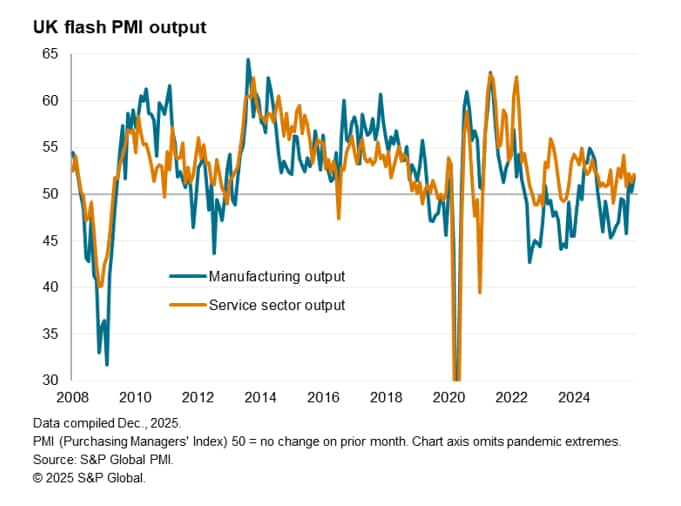

December's improved performance was helped by a small uptick in service sector growth, albeit remaining somewhat sluggish and limited to financial services and tech. There was also better news from the manufacturing sector. Although factory output growth also remained weak, it was nonetheless the largest monthly gain reported since September 2024, and one of the best gains seen since the pandemic.

Improving demand

Further encouragement in relation to the service sector comes from a rise in new business inflows following a decline in November, while factory new orders edged back into growth for the first time in 15 months. Furthermore, foreign demand for UK goods came close to stabilizing in December. The fractional drop in export sales was the joint-smallest recorded since exports began falling back in February 2022.

Measured across both goods and services, new orders rose at the fastest rate for 14 months in December. This improvement signals reviving demand that was in many instances cited as being driven by the removal of some uncertainty following the November Budget (companies had previously reported that spending decisions had often been delayed pending news on any policy changes in the Budget).

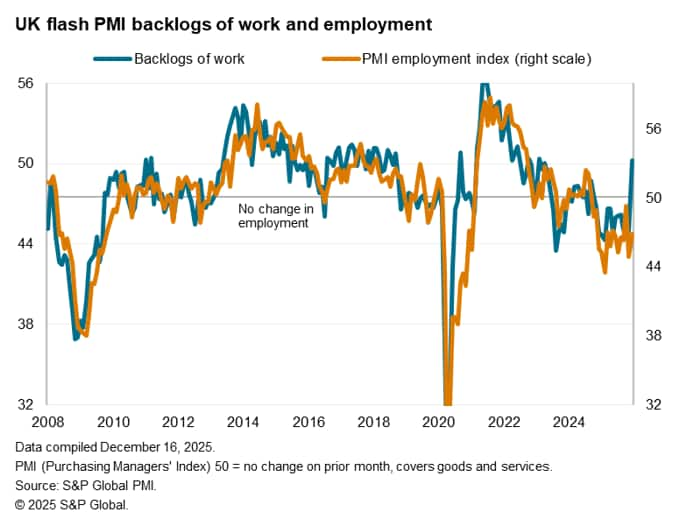

Backlogs of work also rose - albeit only marginally -for the first time since February 2023, pointing to operating capacity failing to meet current demand growth. Rising backlogs were especially noted in tech and financial services.

Further steep job losses

The lack of capacity is reflective of a fifteenth successive month of job losses in December. Jobs have now been cut continually since the 2024 Budget, which saw a rise in the Minimum Wage and higher payroll taxes announced. Job cuts in December were again generally attributed to higher operating costs, which in turn were often linked to policies announced in the last two Budgets.

Confidence ticks higher after Budget

If sustained, rising backlogs of work tend to be followed by rising employment and investment as firms expand capacity to meet demand, especially if associated with improving business confidence.

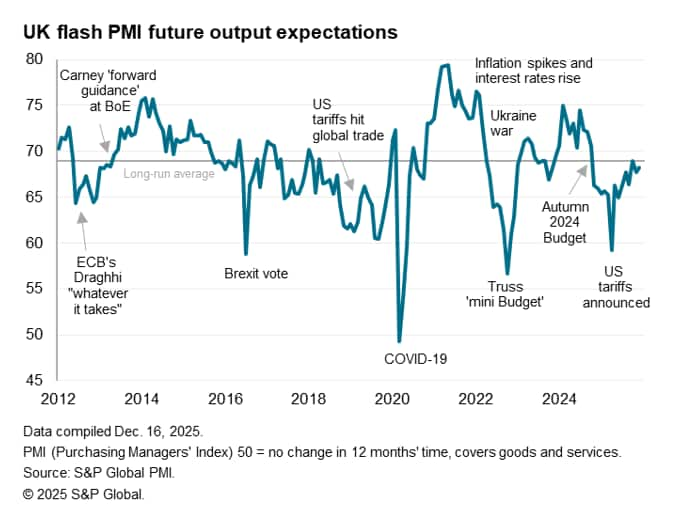

In this respect, confidence brightened slightly in December. Although still below its long-run trend, the flash PMI index of future output expectations edged up to its second-highest level recorded over the past 14 months. This post-Budget improvement in business confidence contrasts markedly with the slump seen immediately after the 2024 Autumn Budget.

Inflation revives

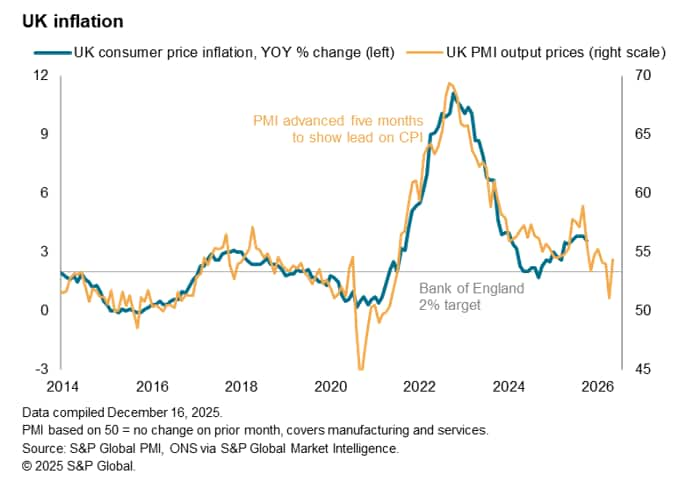

Having slowed sharply amid increased discounting in November, selling price inflation across goods and services re-accelerated in December, though remained relatively modest by recent standards. Comparisons with official inflation data suggest that the survey gauge is broadly indicative of consumer price inflation running at around 3%, so above the Bank of England's 2% target but down from the current level of 3.6%.

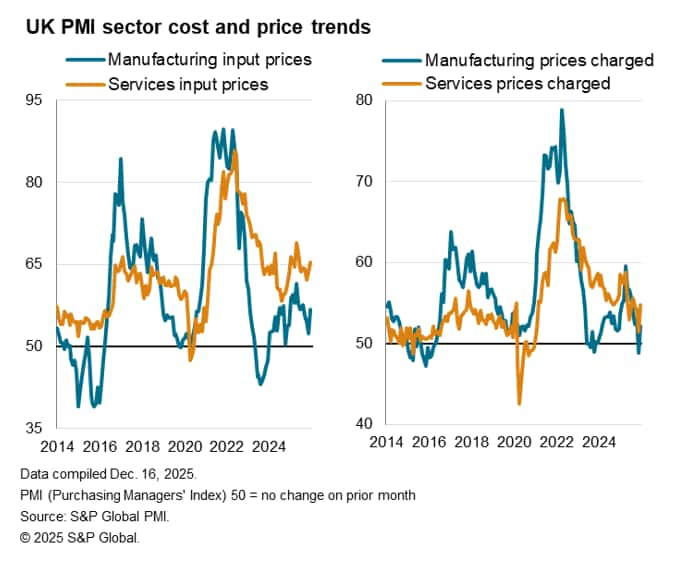

Input cost growth also re-accelerated, with expenses rising at the fastest rate since May. Cost growth remained especially elevated in the service sector. Inflation was often linked to measures from the past two Budgets, notably higher staffing costs, but were also commonly linked to increased raw material prices, especially for food.

Rate cut odds shorten

The further sharp fall in employment and relatively lacklustre pace of output growth signalled by the flash December PMI surveys will likely cement the odds of a further cut to interest rates when the Bank of England's Monetary Policy Committee meets this week. That would take the Bank Rate down to 3.75%.

Recent policy meetings have seen split decisions, however, and December may see some further dissenting voices as rate setters balance concerns over falling employment against stubbornly high price pressures. The rise in prices and costs signalled by the flash PMI will add further fuel to these worries.

Whether rates will be cut further in 2026 will depend both on the growth and inflation trajectories. On one hand, the survey data suggest that demand conditions remain sufficiently sluggish to restrain firms' pricing power and help lower inflation further in the new year. On the other hand, some policymakers are going to need to see some concrete evidence of materially cooling price pressures before moving policy into significantly more accommodative territory, meaning decisions will inevitably be very data dependent.

Read the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-higher-growth-and-optimism-postbudget-but-inflation-also-lifts-higher-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-higher-growth-and-optimism-postbudget-but-inflation-also-lifts-higher-Dec25.html&text=UK+flash+PMI+signals+higher+growth+and+optimism+post-Budget%2c+but+inflation+also+lifts+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-higher-growth-and-optimism-postbudget-but-inflation-also-lifts-higher-Dec25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals higher growth and optimism post-Budget, but inflation also lifts higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-higher-growth-and-optimism-postbudget-but-inflation-also-lifts-higher-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+higher+growth+and+optimism+post-Budget%2c+but+inflation+also+lifts+higher+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-higher-growth-and-optimism-postbudget-but-inflation-also-lifts-higher-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}