Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2025

December flash PMI rounds off eurozone's best quarter for two and a half years

The Eurozone economic recovery lost a little momentum at the end of 2025, according to the flash PMI, though still rounded off the region's best quarterly performance for two and a half years.

While service sector growth remained encouragingly robust, there were disappointing signs of a renewed downturn in manufacturing output as factory orders fell for a second successive month. However, businesses expect some convergence of performance in the coming months, with manufacturing future optimism rising to the highest for nearly four years while service sector growth expectations slipped to a seven-month low.

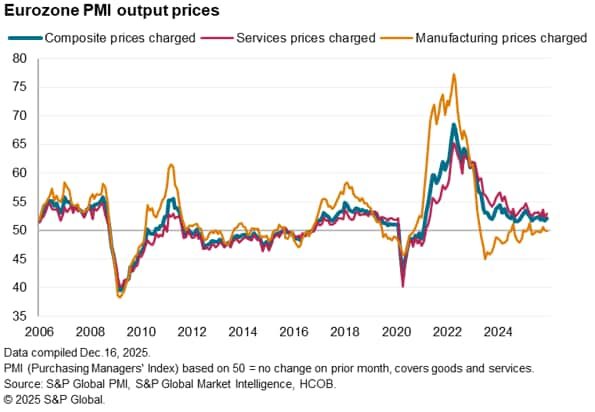

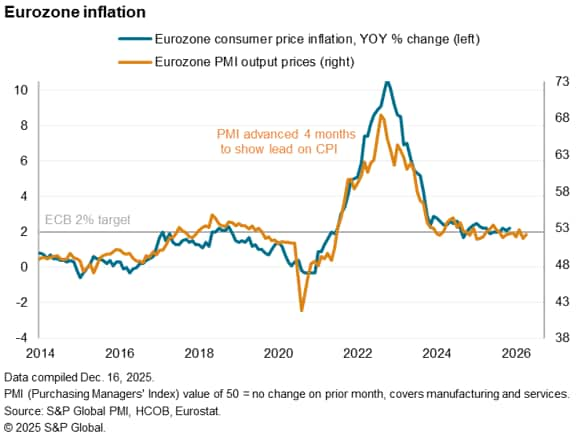

Selling price inflation meanwhile remained largely in line with a rate of consumer price inflation that is consistent with the ECB's 2% target.

Eurozone grows for 12th straight month

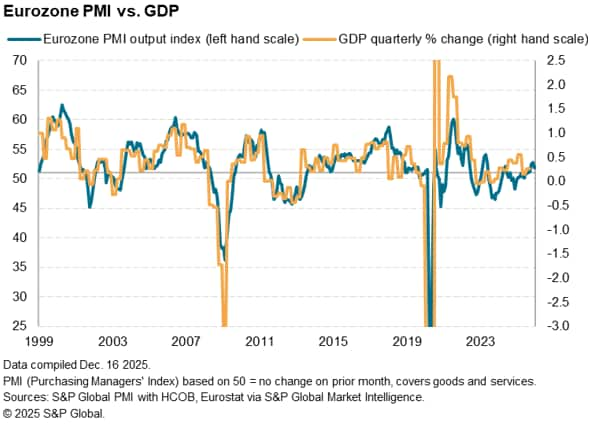

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, dipped to 51.9 in December, down from a final reading of 52.8 in November. Being above the 50.0 no-change mark, the PMI thereby signalled a further monthly expansion in business activity at the end of 2025, and, despite the fall the December reading rounds off the eurozone's best calendar quarter's performance since the second quarter of 2022.

Output has also now increased in each of the past 12 months, indicating the first full year of calendar growth since 2019, with the PMI over the fourth quarter so far consistent with quarterly GDP growth of just over 0.3%.

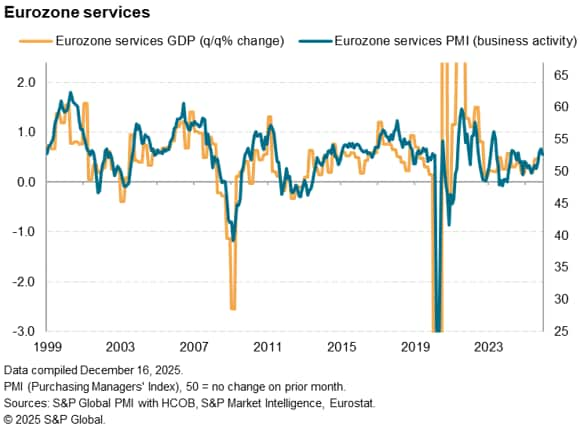

Growth was again driven by the service sector, where business activity increased for the seventh month running. The rate of expansion was solid, albeit softer than that seen in November, yet completed the sector's best quarter since the second quarter of 2024.

In contrast, manufacturing production decreased marginally in December, down for the first time since February. The production decline was fueled by a second consecutive monthly drop in factory orders, which fell at the steepest rate for ten months.

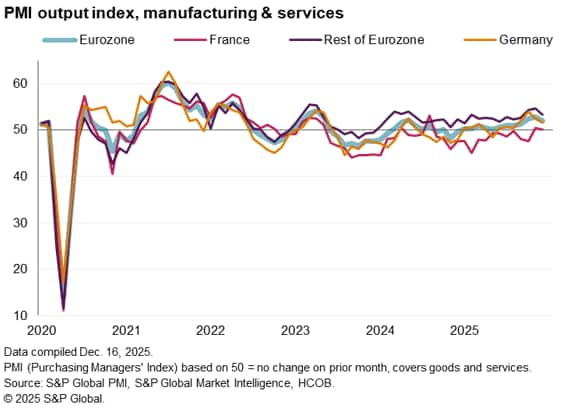

German growth edges lower as France remains stalled

Business activity remained largely unchanged in France for a second successive month, though that represents an improvement on the 14 months of continual decline seen prior to November. A marginal rise in French services output was accompanied by one of the smallest drop in manufacturing output recorded over the past seven months, the latter linked in part to the largest rise in French goods export orders received for nearly four years.

Business activity growth meanwhile slowed in Germany, cooling to a four-month low, yet remained one of the strongest expansions recorded over the past three years. However, a softening of services growth was exacerbated by the first fall in Germany's factory output since February, in turn fueled partly by the steepest drop in goods exports for a year. While German exports had risen during the four months to July, aided by the front-running of US tariffs, recent months have seen trade deteriorate as these beneficial tariff impacts have faded.

A similar deterioration in manufacturing export performance has also been evident in the rest of the eurozone, contributing in December to the slowest - albeit still robust - overall expansion of business activity outside of France and Germany since September.

Future expectations send mixed signals

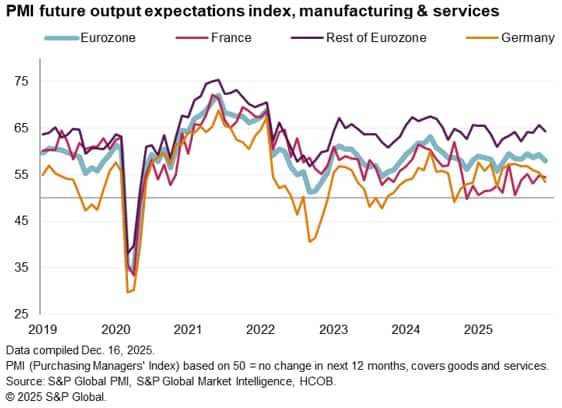

There were marked differences in changes in business sentiment between the two monitored sectors in December, which moved in opposing directions to current output growth.

Whereas service providers reported solid current output growth in December, their future confidence fell to the lowest since May (largely due to services optimism in Germany slumping to a near two-and-a-half year low). In contrast, the fall in manufacturing output in December was accompanied by a rise in future output optimism to the highest since February 2022.

This suggest that firms are expecting output trends to converge in the coming months, with some of the pace being lost in the services economy while some of December's weakness in manufacturing proves temporary.

At the combined level, business confidence in the euro area dipped to the lowest in seven months as the drop in services sentiment outweighed the improvement in optimism in manufacturing.

Future output expectations notably fell in Germany to a level below that seen in France thanks to weakened service sector optimism, though German manufacturing optimism is now running at its joint-highest since February 2022.

Benign inflation

The rate of inflation in output prices meanwhile remained modest when measured across eurozone goods and services. A slightly faster rise in services charges was reported but was accompanied by broadly unchanged selling prices in the manufacturing sector.

Measured overall, at its current level the PMI's selling price gauge is broadly consistent with the ECB's inflation target of 2%.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecember-flash-pmi-rounds-off-eurozones-best-quarter-for-two-and-a-half-years-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecember-flash-pmi-rounds-off-eurozones-best-quarter-for-two-and-a-half-years-Dec25.html&text=December+flash+PMI+rounds+off+eurozone%27s+best+quarter+for+two+and+a+half+years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecember-flash-pmi-rounds-off-eurozones-best-quarter-for-two-and-a-half-years-Dec25.html","enabled":true},{"name":"email","url":"?subject=December flash PMI rounds off eurozone's best quarter for two and a half years | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecember-flash-pmi-rounds-off-eurozones-best-quarter-for-two-and-a-half-years-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=December+flash+PMI+rounds+off+eurozone%27s+best+quarter+for+two+and+a+half+years+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecember-flash-pmi-rounds-off-eurozones-best-quarter-for-two-and-a-half-years-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}