Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 22, 2025

UK flash PMI shows downturn moderating after April's slump, with price pressures also cooling

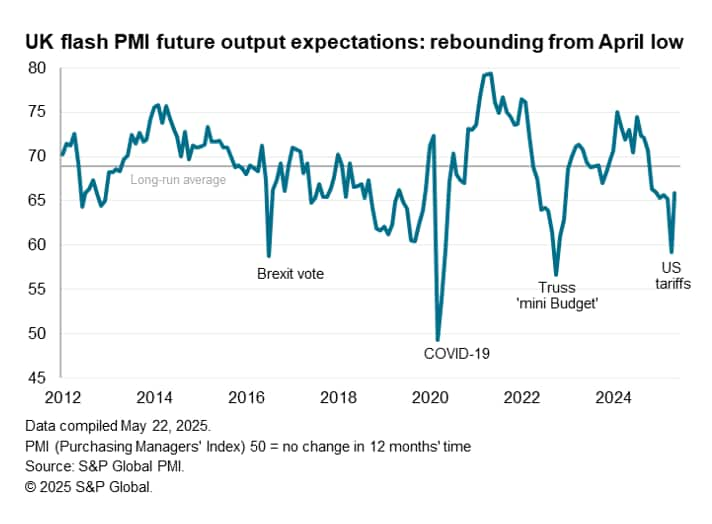

After an 'awful April', business reported a milder May. Business confidence has rebounded from April's recent low, which had seen confidence collapse to a degree not seen since the Truss Budget of 2022, and price pressures have moderated after spiking higher. Sunny weather also provided a welcome boost to business activity in some parts of the economy.

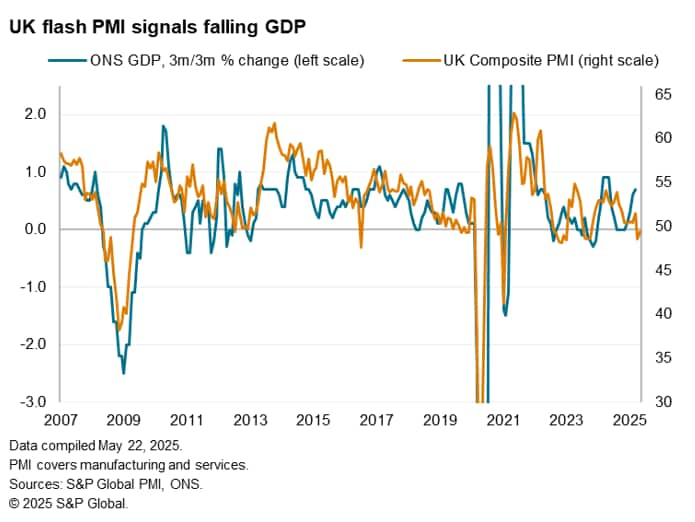

However, output still fell slightly when measured across all goods and services for a second successive month, hinting at the possibility of the economy contracting in the second quarter.

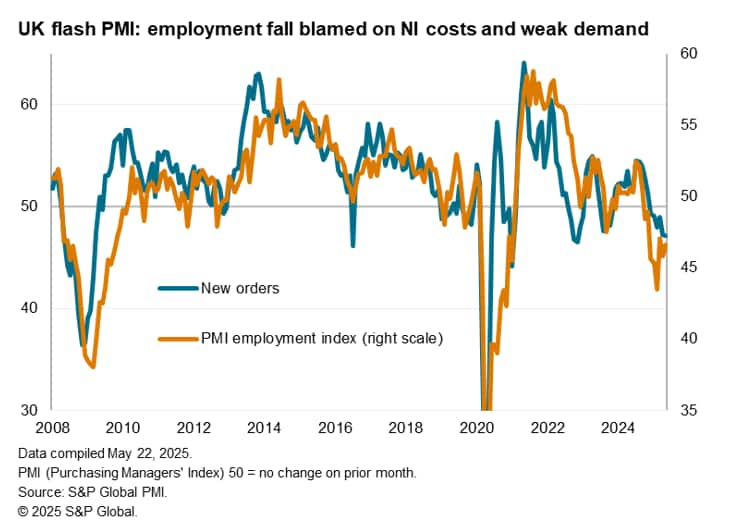

Furthermore, although brighter news on tariffs and trade appears to have helped restore some confidence among businesses, sentiment about prospects in the year ahead is still subdued. Job cutting consequently remains worryingly aggressive, especially in manufacturing, as concerns about weak demand have been exacerbated by the rise in staff costs linked to the National Insurance and minimum wage changes that came into effect in April.

More encouraging was the news on prices, with inflationary pressures moderating considerably from the spike seen in April. These reduced price pressures, coupled with signs of faltering economic growth and job losses, likely keeps the door open for further interest rate cuts in the coming months.

Output falls for second month running

At 49.4 in May, up from 48.5 in April, the headline seasonally adjusted S&P Global Flash UK PMI Composite Output Index remained below the neutral 50.0 level to signal a second successive monthly decline, albeit with the rate of contraction only marginal, having moderated compared to April.

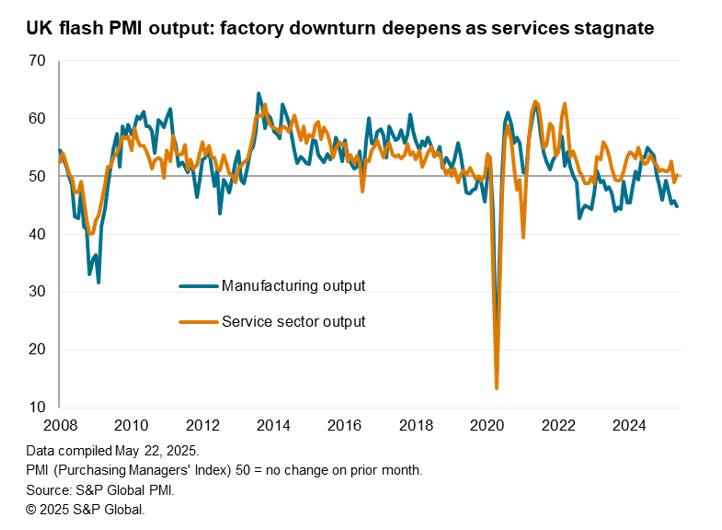

Manufacturing remained the major drag on the economy, with output falling in May at a rate not seen since October 2023. While services eked out a marginal expansion, buoyed in part by good weather, its largely stalled performance was the second-weakest since late 2023.

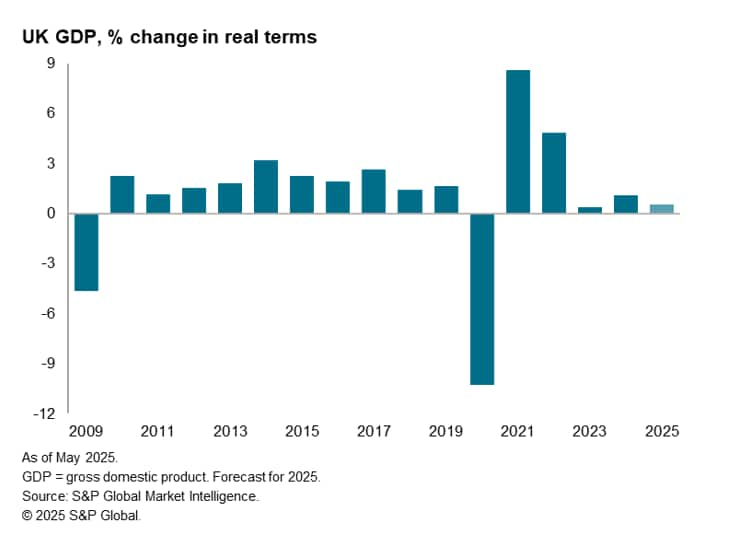

The further drop in output signalled in May means the composite PMI is indicating a minor contraction of GDP so far in the second quarter. A robust June reading could therefore help avoid a quarterly decline, and in this respect, an improvement in business confidence in May from April's two-and-a-half year low bodes well.

Confidence rebounds as export losses moderate

The upturn in confidence was often linked to reduced concerns over trade and tariffs, the May data having been collected after the US pause on its additional tariffs and the subsequent UK-US trade announcement.

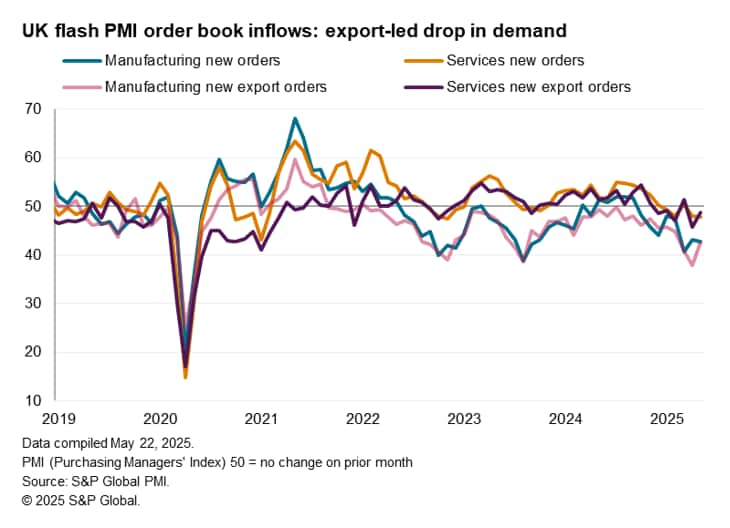

Although goods exports continued to fall, the decline was the weakest in three months. Exports of services, which had also been hit by heightened global economic uncertainty in April, also fell at a reduced rate. The overall drop in exports nonetheless remained steep by recent standards, with overseas sales dropping for a seventh successive month and at the second-fastest rate since August 2023.

However, the fact that overall orders of goods and services fell at slightly increased rates in May, despite the smaller decline in exports, suggests that domestic demand conditions deteriorated. Although good weather helped support current activity in some sectors such as leisure, companies reported weakness in forward bookings amid low customer confidence levels. Demand softness was especially notable in consumer-facing sectors, alongside a renewed dip in demand for financial services.

Job losses sustained, but at slower rate

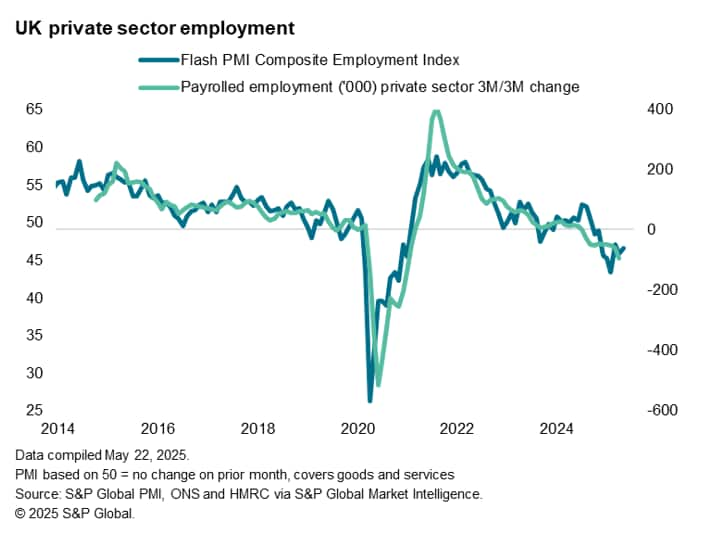

Furthermore, despite the rebound in future business expectations, the overall degree of optimism remains below the survey's long-run average. Firms reported widespread concerns over global trade, the adverse macroeconomic environment and weak customer demand, all of which were exacerbated by worries over domestic government policy. Companies cited concerns in particular in relation to the potential demand, investment and labour market impacts from the prior Budget's tax increases. The latter remained visible through the survey's employment index, which signalled a drop in private sector employment for an eighth successive month in May.

Jobs have therefore been cut successively in each month since the Autumn Budget, in which higher National Insurance contributions and other measures, such as the increased minimum wage, were announced. Although the May survey showed that the pace of job losses moderated slightly, the rate of decline remained among the steepest seen since the global financial crisis of 2008-9 barring only the pandemic.

Of particular concern is a worsening job picture in manufacturing, with May seeing job losses accelerate further from April, which in turn had seen the steepest decline of all economies surveyed by S&P Global. If early pandemic months are excluded, the latest survey indicated that manufacturing jobs are being lost at a rate not seen since May 2009.

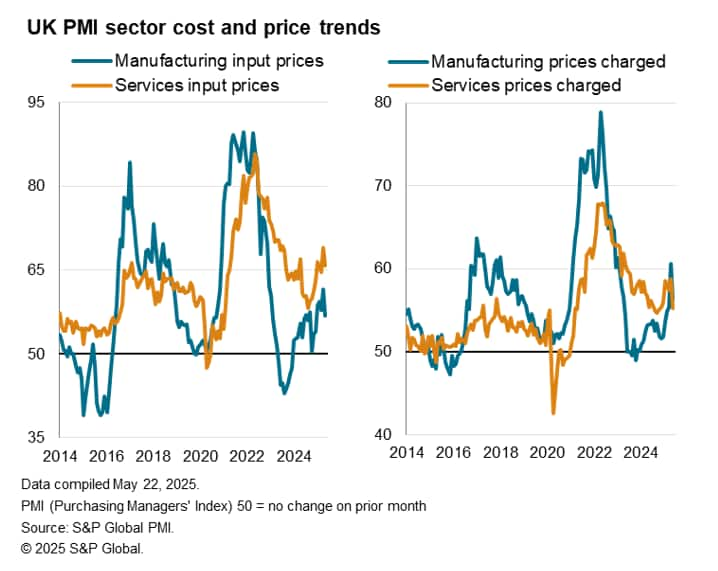

Cost pressures cool from April's spike

Having spiked higher in April on the introduction of NI and other labour market measures announced in the Autumn Budget, price pressures moderated in May. However, input costs in the service sector continued to rise sharply, the rate of increase cooling from April's 21-month high but remaining at one of the steepest recorded since mid-2023, often reportedly on the back of higher staff costs.

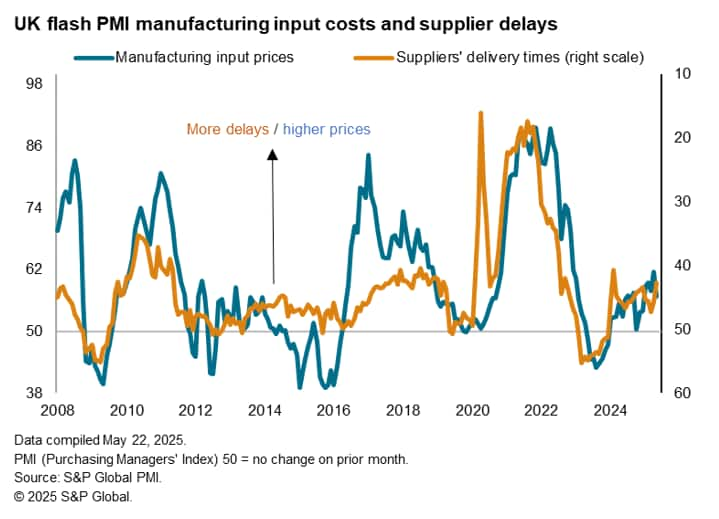

Input cost inflation also cooled in manufacturing, though likewise remained elevated by post-pandemic standards. Higher raw material prices were often linked to supply shortages, in turn reflecting shipping constraints, including port delays. Average supplier delivery times lengthened in May to the greatest extent since the initial Red Sea disruptions at the start of 2024. This follows marked delays in April which had been more prevalent than in any other economy surveyed by S&P Global's PMIs bar only war-torn Myanmar.

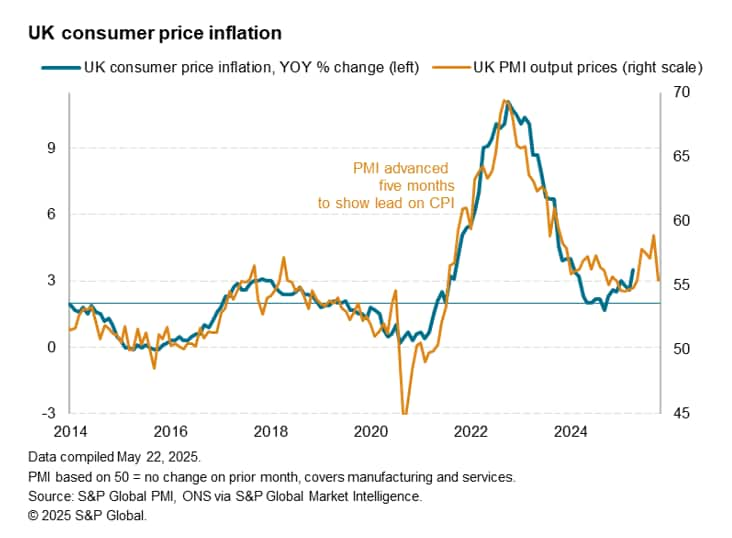

While higher costs were passed on to customers to drive a further increase in selling prices for goods and services, the overall increase was the softest for five months, the rate of inflation having moderated sharply from April' s 23-month high.

The current rate of selling price inflation is indicative of consumer price inflation running close to 3%, so still well above the Bank of England's 2% target but less so than the temporary spike seen in April. The latest official data indicated an annual rate of 3.5%.

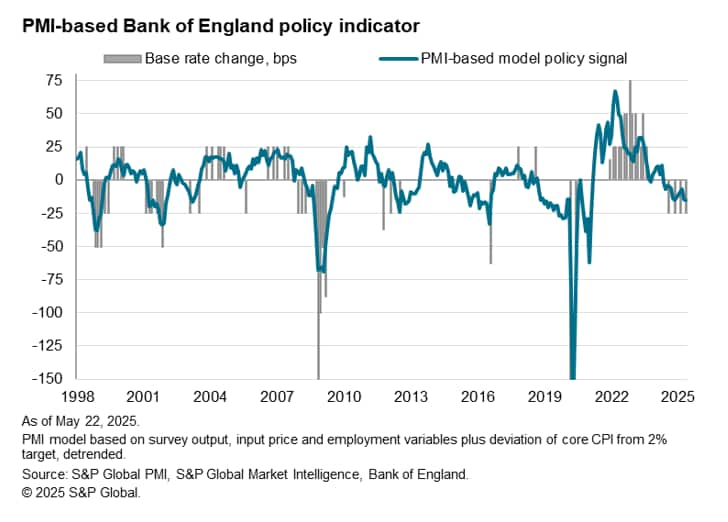

Further policy loosening signalled

From a policy perspective, the further drop in output accompanied by sustained marked job losses and cooling price pressures helped push the survey gauges into territory that would normally be associated with the Bank of England cutting interest rates. Since August 2024, the Bank of England has reduced its Bank Rate four times, with the recent May meeting seeing the rate fall to 4.25%. Although the latest decision was not unanimous, we anticipate two more cuts at the August and November policy meetings as policymakers maintain a quarterly cadence of rate cuts to help support the sluggish economy. We expect the UK economy to grow by just 0.6% in 2025, down from 1.1% in 2024.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-shows-downturn-moderating-after-aprils-slump-with-price-pressures-also-cooling-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-shows-downturn-moderating-after-aprils-slump-with-price-pressures-also-cooling-may25.html&text=UK+flash+PMI+shows+downturn+moderating+after+April%27s+slump%2c+with+price+pressures+also+cooling+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-shows-downturn-moderating-after-aprils-slump-with-price-pressures-also-cooling-may25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI shows downturn moderating after April's slump, with price pressures also cooling | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-shows-downturn-moderating-after-aprils-slump-with-price-pressures-also-cooling-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+shows+downturn+moderating+after+April%27s+slump%2c+with+price+pressures+also+cooling+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-shows-downturn-moderating-after-aprils-slump-with-price-pressures-also-cooling-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}