Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 18, 2025

UK economy wobbles amid tax hikes and tariffs, but confidence has shown signs of rebounding

Business survey signals of a sluggish UK economy and deteriorating labour market are now being corroborated by official data showing mounting job losses and falling GDP. Inflation has meanwhile risen compared to earlier in the year.

These worrying trends were triggered by the combination of higher taxes announced in last year's Budget and uncertainty created by US trade policy.

However, the surveys also provide some signs that these trends are now starting to become less concerning, with business confidence having notably rebounded in May. We will know more as to whether this represents the start of an improving trend, with April having potentially marked a low-point in the economic cycle, with the upcoming flash PMI data.

Heightened uncertainty

Since last October's Autumn's Budget, the business surveys have been sending warning signals on the health of the economy, with business gloom having intensified in the spring amid uncertainty relating to US tariffs.

Last year's Budget sought to fill a 'black hole' in the country's finances via £40bn worth of tax hikes, notably including £25bn of additional tax on employers' National Insurance contributions - a form of payroll tax - as well as increases to the national Minimum Wage, further pushing up employers' staffing costs.

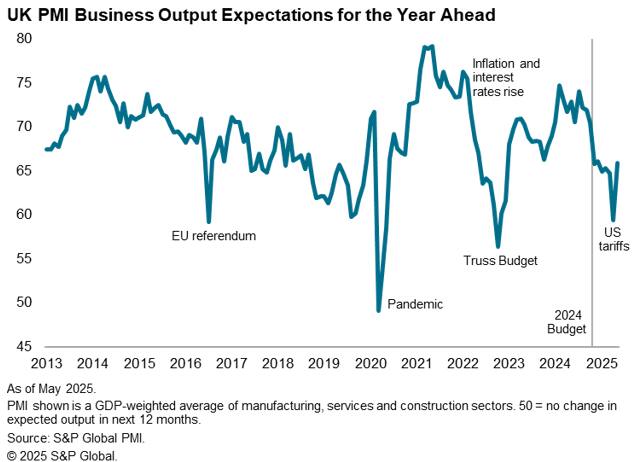

These measures were not implemented until April 2025. However, the adverse reaction to the Budget from business was immediate. Having already lost some ground in October amid speculation that the upcoming Budget was going to see potentially large tax hikes, business confidence, as measured by the S&P Global PMI surveys for the UK, covering manufacturing, construction and services, slumped in November. Business optimism about the year ahead in fact hit the lowest since December 2022, during the pandemic.

Confidence took a further knock in April, as the US made a series of tariff announcements, which not only unsettled exporters but also shook financial markets.

Mounting job losses

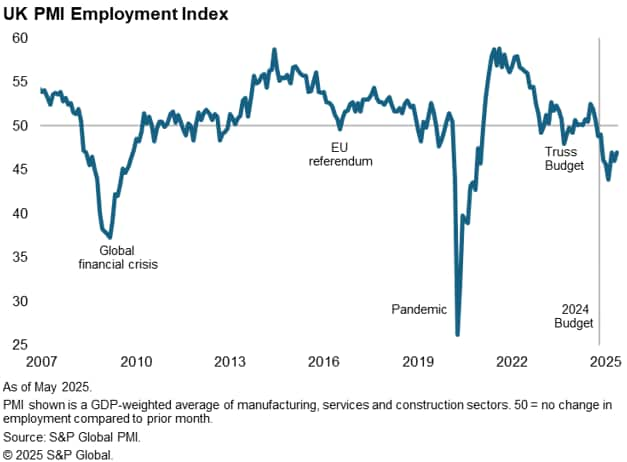

While actual output continued to grow in the immediate months following the Budget, according to the PMI surveys, the rate of growth slowed sharply compared to the upbeat pace seen in the summer of that year. By December, companies were reporting falling demand and only sluggish output growth. More strikingly, but the end of the year survey respondents were reporting the most severe rate of job cutting reported since the pandemic lockdowns of early 2021. Barring the pandemic, such a pace of job losses had not been recorded by the surveys since the global financial crisis in 2009.

Employment has continued to fall in 2025 so far. As of May, the PMI surveys have recorded eight months of consecutive job cutting in the UK private sector. This represents the longest continual spell of downsizing seen since the global financial crisis if the pandemic is excluded. While the rate of job losses appears to have peaked in February, as of May the rate of job cuts signaled by the PMI remained strong by historical standards.

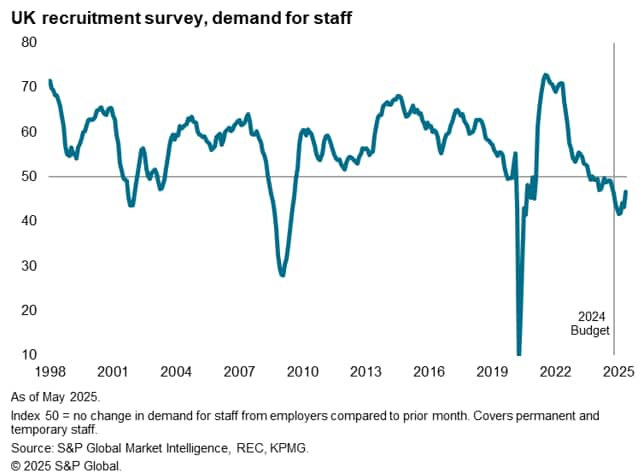

Similar signs of labour market weakness have been captured by the REC/KPMG monthly survey of recruiters, also compiled by S&P Global. This survey showed demand for staff from employers falling at an increasingly marked rate late last year, with the decline persisting (albeit at a reduced rate) up to May of this year. As with the PMI, the labour market deterioration signalled by the UK recruitment survey since the Budget has been the most severe recorded since the global financial crisis barring only that seen during the pandemic.

Official data add to the gloomy picture

Signs of economic weakness are also evident in the official data.

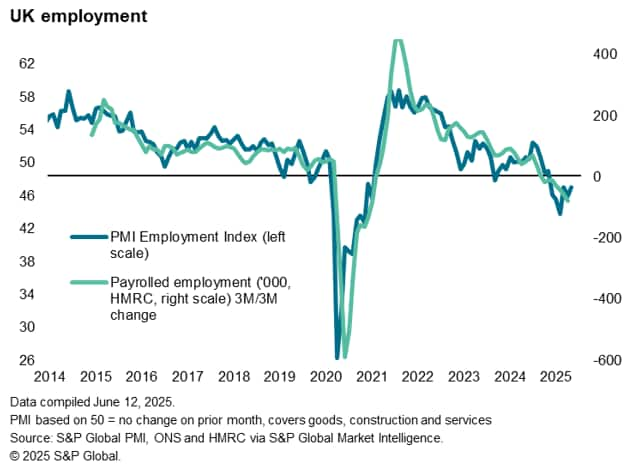

Early estimates of private sector payrolled employment in May indicated a drop of 147,000. While these data tend to get revised, this represented the biggest decline since late 2020, during the pandemic. These data, compiled by HMRC, are only available back to 2014, but show the current bout of job shedding to be unusually large by standards seen outside of the pandemic, broadly in line with the signals from the surveys. Job losses have in fact been reported in each month since last year's Budget, taking the tally so far to 276,055.

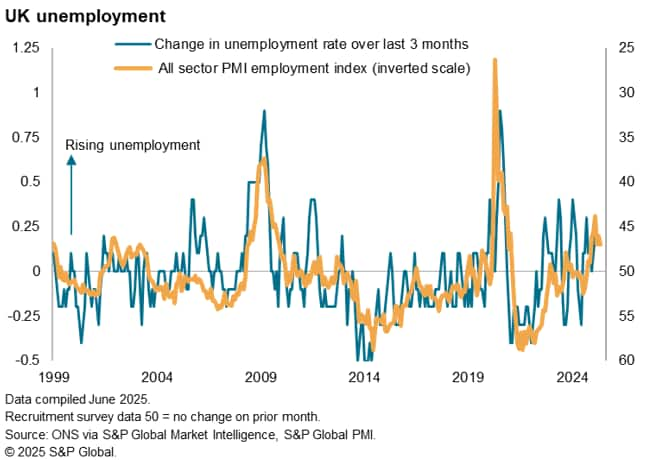

The unemployment rate has also started to edge higher, moving up from 4.4% in the three months to last October to 4.6% in the three months April (the latest month for which data are available), its highest since mid-2021.

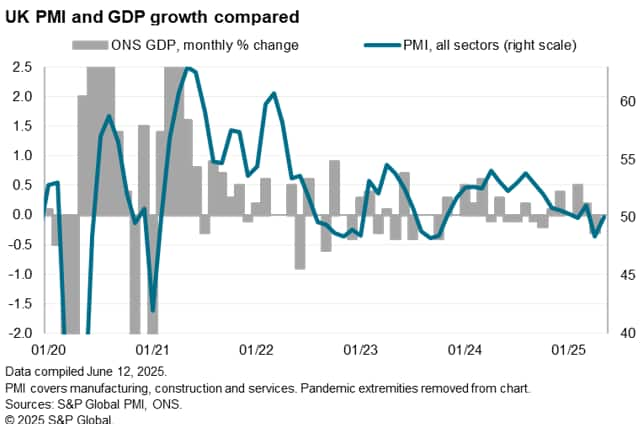

The key area of encouraging resilience had been in the GDP data, which showed a 0.7% expansion during the first quarter. However, this appears to have in part reflected the advance shipment of exports ahead of US tariffs, with April's data registering a 0.3% decline. That starts to bring the GDP data more into line with the business surveys, suggesting that - behind the noise being created by exports - the underlying pace of economic growth is worryingly lacklustre.

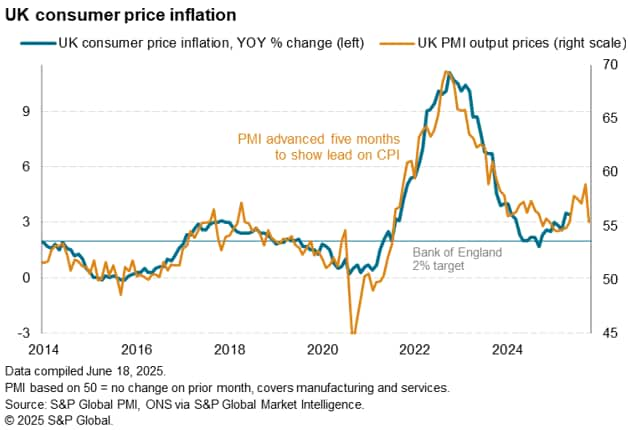

Inflation has meanwhile picked up in recent months, cooling only slightly in May to 3.4% from a 15-month high of 3.5% in April. While the PMI hints at some stubbornness to inflation in the near-term, attributed by survey contributors in many cases to the increase in staffing costs associated with the Budget, some of these pressures clearly started to moderate in May, in part due to the impact of a softening labour market.

Brighter May gives hope for outlook

The May surveys also showed a welcome rebound in business confidence from the gloom recorded in April. To some degree this reflected news of a trade deal between the UK and US, and the pauses on broader global tariffs by President Trump.

We look now to the flash PMI data for June, published on 23rd June, to provide an update on how businesses are faring in this rapidly changing economic environment. The June data collection has taken place over a period of escalating instability in the Middle East, which has pushed oil prices sharply higher, while business has also had time to digest the implications of the government's spending review.

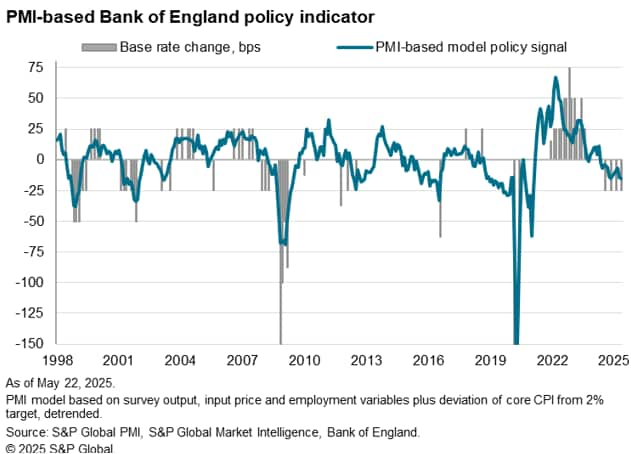

However, in advance of the next PMI release, the Bank of England meets to set interest rates.

Since August 2024, the Bank of England has reduced its Bank Rate four times, with the recent May meeting seeing the rate fall to 4.25%. No cut is expected by the markets at the June meeting, but we note that the further drop in output signaled by the PMI in May, accompanied by sustained marked job losses and cooling price pressures, have helped push the survey gauges into territory that would normally be associated with the Bank of England erring toward cutting interest rates. We therefore anticipate two more cuts at the August and November policy meetings as policymakers maintain a quarterly cadence of rate cuts to help support the sluggish economy. We expect the UK economy to grow by just 0.6% in 2025, down from 1.1% in 2024.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-wobbles-amid-tax-hikes-and-tariffs-but-confidence-has-shown-signs-of-rebounding-jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-wobbles-amid-tax-hikes-and-tariffs-but-confidence-has-shown-signs-of-rebounding-jun25.html&text=UK+economy+wobbles+amid+tax+hikes+and+tariffs%2c+but+confidence+has+shown+signs+of+rebounding+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-wobbles-amid-tax-hikes-and-tariffs-but-confidence-has-shown-signs-of-rebounding-jun25.html","enabled":true},{"name":"email","url":"?subject=UK economy wobbles amid tax hikes and tariffs, but confidence has shown signs of rebounding | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-wobbles-amid-tax-hikes-and-tariffs-but-confidence-has-shown-signs-of-rebounding-jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+wobbles+amid+tax+hikes+and+tariffs%2c+but+confidence+has+shown+signs+of+rebounding+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-wobbles-amid-tax-hikes-and-tariffs-but-confidence-has-shown-signs-of-rebounding-jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}