Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 04, 2024

Turkey as a supply chain reshoring center: Opportunities and challenges

Learn more about our data and insights

Logistics network disruptions have highlighted Turkey's potential as a manufacturing hub for European, Middle Eastern, and US east coast markets.

Turkey's exports are highly diversified, with the seven largest categories accounting for a combined 40.2% of the total across all regions and 52.6% of shipments to the EU. Leading categories of goods include the automotive industry, apparel, power grid equipment and home appliances.

Leading raw materials and semi-manufactured goods include steel and aluminum, refined oil products, and raw minerals and ores ranging from building materials like marble to industrial metals such as chromium, copper and lead. Minerals and ores only accounted for a small percentage of total exports, but nearly half of shipments to mainland China.

Trade agreements

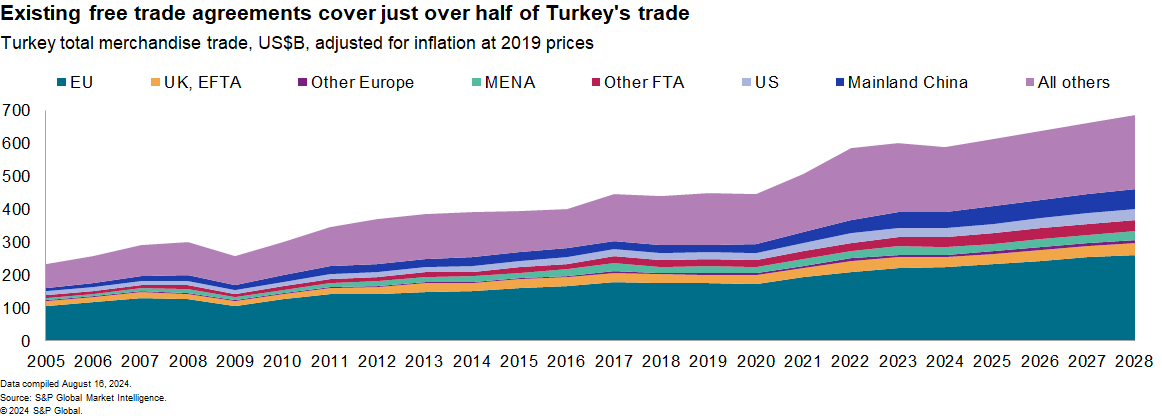

Turkey has 23 free trade agreements (FTAs) in place, including the Turkey-EU Customs Union, which allows for preferential tariffs covering 37.9% of Turkey's exports and 44.1% of EU exports. Officials in the EU and Turkey are negotiating updates to the customs union, with remaining challenges including visa procedures. Both sides have an interest in modernizing the agreement, which was signed in 1995 and was only meant to be temporary.

Turkey does not yet have trade deals with either mainland China or the United States, representing potential greenfield opportunities for further integration into global supply chains. Minerals and ores accounted for 49.4% of shipments to mainland China. Exports to the US are more diversified than those to the EU, including by precious metals and jewelry as well as homewares including carpets, but with key export lines such as autos and apparel under-represented there may be an opportunity for a free trade deal to unlock higher exports of those products.

The slowdown in exports to all trade partners in the next five years compared with the past five years provides an incentive to widen the base of FTAs. It may also spur efforts to encourage manufacturers to relocate to Turkey, particularly to access its FTA partners in the EU and elsewhere.

Domestic markets

Another increasingly important factor for attracting manufacturing investment for export markets is the availability of large and growing domestic markets. That's proven particularly advantageous for Mexico (to access North America via USMCA) and India.

In Turkey's case, that is less applicable. While the country's 86.3 million population is expected to generate $444 billion of consumer spending on goods in 2024, the rate of expansion in the next five years is expected to slow to 2.6%.

Turkey may need to rely on its proximity to the Middle Eastern and European consumer markets as a reason for reshoring manufacturing there.

Hear our global economist talk about macroeconomic themes

Labor and wages

From a cost perspective, Turkey has to deal with emergent competitors from North Africa, existing suppliers in eastern Europe, and the ASEAN countries that have been taking on manufacturing relocated from mainland China.

Turkey's well-documented inflation challenges have led to 49% annual growth in wages in local currency terms in the past five years. That alone hasn't proven to be a big challenge for its attraction as a reshoring center as the lira has depreciated and many costs in the economy are dollarized.

Still, our estimates indicate the average manufacturing compensation per hour in Turkey in 2024 was nearly double that of Romania, three times that of India and Vietnam, and over four times that of some North African locations.

Labor cost inflation is forecast to be 9.8% annually over the next five years in dollar terms, even with the availability of additional workers from Turkey's younger demographic and immigration from Syria. While that's lower than Romania's labor cost inflation, it's significantly above Asian and North African peers.

Foreign direct investment

Turkey's economic challenges have restricted its attraction as a reshoring location, as shown by foreign direct investment (FDI) of just $4.4 billion in the 12 months to June 2024. Taking direct investment excluding financials is well below other major reshoring centers including Vietnam and Mexico.

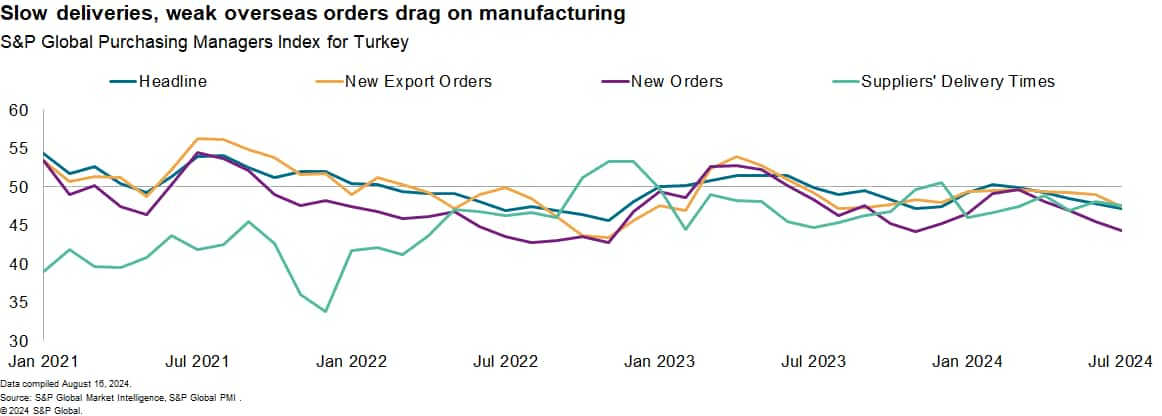

In the shorter term, manufacturing has been in decline in Turkey, with the headline S&P Global Purchasing Managers' Index (PMI) dipping to 48.2 in July, marking a fifth straight contraction and the fastest rate of decline since October 2022. A slowdown in new export orders has been partly to blame, falling every month since June 2023, with overall new orders being even weaker.

One challenge may be supplier delivery times, which have seen mounting delays through 2024, likely in part due to delays in deliveries from Asia linked to restrictions through the Red Sea. Those delays are set to continue at least through the rest of 2024.

Reshoring of manufacturing has not been seen as a source of growth for Turkish firms. A May 2024 S&P Global survey of Turkish manufacturers found just 22% expect growth from reshoring in the next 12 months, with 61% not expressing an opinion.

Perhaps unsurprisingly given the FDI data, 71% of firms cited capital cost and availability as a challenge to reshoring, while 64% cited labor availability. A small minority also cited access to raw materials as a challenge.

Political risks

Political and policy risks in Turkey are generally low. Government policy is expected to remain broadly stable ahead of the next elections in May 2028, though the regulatory burden in Turkey is higher than most peers, due to the risk of limited US and EU sanctions on Russia-linked businesses.

Turkey's geopolitical position has largely been defined by defense relations between NATO and Russia. From a supply chain perspective, the outlook for trade protectionism (or liberalization) will in part depend on the outcome of the US elections. One key area of trade protectionism has come in the restriction of trade with Israel, where Turkey has currently banned all exports to Israel over Israel's military operations in Gaza.

Natural gas availability has posed challenges previously, with Turkey attempting to source increased flows from Central Asia to reduce the countries' reliance on Russia. Turkey's trade with Russia has increased while the US, EU and its allies have restricted trade in connection to the war in Ukraine.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-supply-chain-reshoring-center-opportunities-challenges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-supply-chain-reshoring-center-opportunities-challenges.html&text=Turkey+as+a+supply+chain+reshoring+center%3a+Opportunities+and+challenges+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-supply-chain-reshoring-center-opportunities-challenges.html","enabled":true},{"name":"email","url":"?subject=Turkey as a supply chain reshoring center: Opportunities and challenges | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-supply-chain-reshoring-center-opportunities-challenges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkey+as+a+supply+chain+reshoring+center%3a+Opportunities+and+challenges+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fturkey-supply-chain-reshoring-center-opportunities-challenges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}