Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 11, 2020

Transportation sector nosedives amid COVID-19 related travel restrictions

- Transportation among the worst-performing sectors as modes of travel and distribution largely halted during COVID-19 crisis

- Travel restrictions hampering tourism have also impacted overall transport activity

- Record job losses at transport firms as new business dwindles, according to IHS Markit Global Markit Sector PMI data

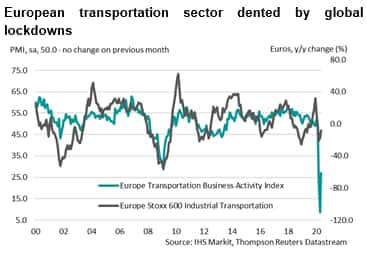

As economies tentatively begin to reopen following the crippling impact of the coronavirus disease 2019 (COVID-19) outbreak during 2020 so far, a divergence in sectoral fortunes is becoming more apparent. Although some segments of industry were able to operate during lockdowns, returns to work during May were more widespread as firms adapted to COVID-19 compliant health and safety practices. That said, large swathes of the service sector remained shut, or only partially operational, as emergency public health measures continued to prohibit or restrict many of their previous business practices.

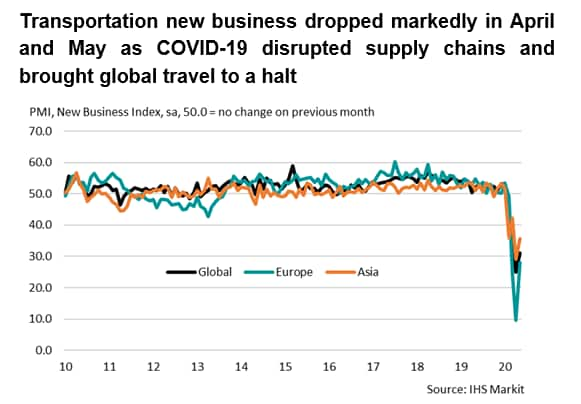

Notable sectors that have struggled include transportation. Although included in this are courier and postal services, which have been important to many consumers during lockdowns, household deliveries are a typically low-margin area of any courier business. Airline services, cargo, freight and storage have all meanwhile been stymied by travel restrictions and supply chain delays. Ranking second from bottom in the May output league table, according to the latest IHS Markit Global Sector PMI data, the latest contraction in transportation activity was exceeded only by that seen for tourism & recreation.

Demand unlikely to regain strength until travel restrictions are lifted

The transportation sector plays a pivotal role in logistics and supply chain movements across the world, with the impact of COVID-19 travel restrictions on the day-to-day operations of storage and cargo firms heavily denting supplier performance in the manufacturing sector, placing downward pressure on supplier margins. Although supplier prices for some items were reported to have risen due to shortages, 12 of the 15 PMI surveys for which composite data are available registered lower cost burdens in May. Nonetheless, at the global and European level, companies stated that the rate of decline in output prices outpaced that of input prices as firms sought to attract new clients and retain existing customers.

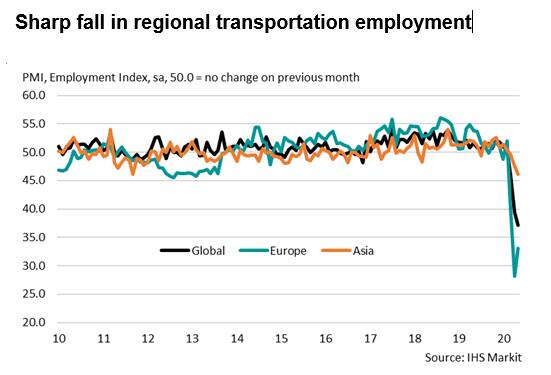

Essential travel only and weak demand leads to job cuts

Meanwhile, confusion surrounding quarantine periods and discussions regarding reciprocal travel arrangements for those from countries with low infection rates has led to calls from travel firms for greater clarity. Without clearer guidelines on who can travel where, companies fear greater drains on demand, especially for air travel. The mass grounding of fleets has led to vast job losses at airline service providers across the world, with British Airways alone expecting to make 12,000 redundancies as the pandemic continues. Cuts to transportation employment were recorded across all monitored regions for which comparable sector PMI data are available in May. European companies registered the sharpest contraction in workforce numbers as travel across the region remained minimal and hopes for peak season tourism were muted.

Despite the rate of job cuts easing in May, it was still the second-fastest since data were available more than 22 years ago, with expectations of a challenging tourism season across Europe likely to lead to cases of prolonged unemployment. The drop in demand may also lead to a greater deterioration in labour market conditions than was seen during the global financial crisis, especially if uncertainty surrounding the virus and a vaccine remains.

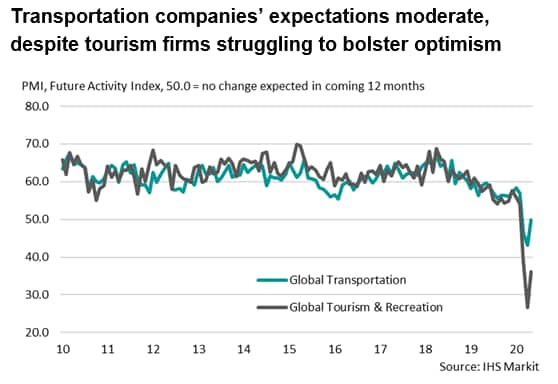

That said, hopes of more widespread easing of lockdowns boosted transportation firms' expectations towards output over the coming year. Although companies were (on balance) not confident of an increase in activity, they no longer foresee further sharp drops in demand. This contrasts markedly with companies in the tourism & recreation sector who continue to foresee a decline in activity over the next year.

Forthcoming economic data releases:

- June 23rd: IHS Markit Eurozone and US Composite, Manufacturing and Services Flash PMI (June data)

- July 1st: IHS Markit Eurozone Manufacturing PMI (June data)

- July 6th: IHS Markit Global and US Sector PMI (June data)

- July 8th: IHS Markit Europe and Asia Sector PMI (June data)

Siân Jones, Economist, IHS Markit

Tel: +44 1491 461017

sian.jones@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftransportation-sector-nosedives-amid-covid19-related-travel-restrictions-june2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftransportation-sector-nosedives-amid-covid19-related-travel-restrictions-june2020.html&text=Transportation+sector+nosedives+amid+COVID-19+related+travel+restrictions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftransportation-sector-nosedives-amid-covid19-related-travel-restrictions-june2020.html","enabled":true},{"name":"email","url":"?subject=Transportation sector nosedives amid COVID-19 related travel restrictions | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftransportation-sector-nosedives-amid-covid19-related-travel-restrictions-june2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Transportation+sector+nosedives+amid+COVID-19+related+travel+restrictions+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftransportation-sector-nosedives-amid-covid19-related-travel-restrictions-june2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}