Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 12, 2020

Week Ahead Economic Preview: Week of 15 June 2020

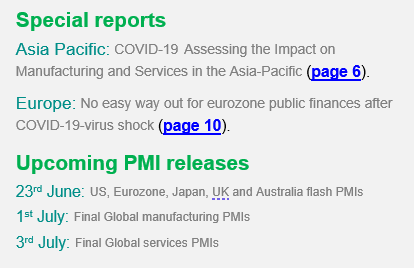

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Industrial production and retail sales updates for the US and China

- Central bank meetings in the UK, Japan, Brazil and Russia

Key releases in the coming week include industrial production and retail sales for the US and China, helping to gauge manufacturing and consumer trends as the world's two largest economies eased lockdowns. Jobs data are meanwhile issued in the US, China and the UK, while inflation numbers are updated in the Eurozone, Japan and UK.

It's also a busy week for central banks, with markets looking for views from policymakers on expected recovery speeds and whether any new tools might be deployed to help ease downturns. Policy decisions are due in the UK, Japan, Brazil, Russia, Indonesia and Taiwan. Minutes from prior meetings are meanwhile published in Japan and Australia.

Industrial production and retail sales data for the US are updated for May, and will be eagerly awaited for confirmation that the worst of the economic downturn from the pandemic has passed. IHS Markit PMI surveys, which fell into contraction back in February, look to have bottomed out in April, rising in both manufacturing and services in May. Other US data releases include the current account, housing starts, business inventories, surveys from the Empire State and Philly Fed, plus weekly jobless claims.

In Asia, the focus is on China with production and retail sales data eagerly awaited to assess the extent to which economic activity may be recovering after the relatively early relaxation of virus restrictions. Surveys show domestic demand driving the rebound in China, with trade dragging. Fresh trade data from Japan, Singapore and Taiwan will therefore also draw scrutiny to help gauge global trade. Two sets of monetary policy meeting minutes will be released: while Japan's central bank offered new support for smaller firms, the RBA turned the focus to fiscal stimulus.

In Europe, markets will be expecting the Bank of England to announce more asset purchases and will seek clues as to policymakers' appetite for negative interest rates. The Monetary Policy Committee meeting is preceded by updates to inflation and labour market data, and followed by retail sales numbers. A relatively quiet week for Eurozone economics sees the release of final inflation, construction and trade data.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-june-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+15+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-june-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 15 June 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+15+June+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-15-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}