Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 24, 2025

Tariff Tensions: Uncertainty Fuels Rise in EM Bond shorts.

DOWNLOAD PDF VERSION HERE

Investors increase short positions in Emerging Market bonds as a defensive strategy against potential economic downturns.

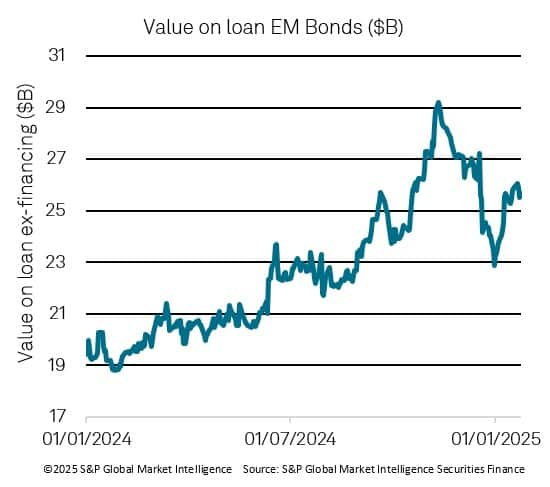

In recent months, the global economic landscape has been characterized by heightened uncertainty surrounding the imposition of potential trade tariffs. This uncertainty is significantly impacting the value of emerging market currencies, leading to a growing trend of short positions in emerging market government bonds.

As countries grapple with the potential for increased tariffs, investors are increasingly wary of the economic repercussions. Trade tariffs can lead to increased costs for imported goods, which may stifle economic growth and inflationary pressures in emerging markets. Consequently, currencies in these regions often face downward pressure. A weaker currency diminishes the purchasing power of local consumers and can lead to capital outflows as investors seek safer assets. This volatile environment creates opportunities for short sellers, as investors look to hedge against potential losses.

The relationship between currency value and bond markets is intricate. When emerging market currencies weaken, the yield on government bonds often rises to compensate for the heightened risk. However, this increase in yield may not be sufficient to attract investors, particularly when global economic conditions remain uncertain. As a result, many investors are opting to short emerging market bonds, anticipating that their values will decline in response to ongoing economic challenges.

Furthermore, the uncertainty surrounding trade tariffs can lead to increased volatility in emerging markets. Investors are acutely aware that any sudden announcements regarding tariffs can trigger sharp movements in currency values, further complicating the investment landscape. This unpredictability encourages a more defensive investment strategy, prompting many to adopt short positions in bonds as a safeguard against potential downturns.

Additionally, the rise in short positions reflects a broader trend of risk aversion among investors. With geopolitical tensions and trade disputes at the forefront of global markets, many are reassessing their exposure to emerging markets. The combination of weakening currencies and rising bond yields creates a perfect storm for short sellers, who are increasingly confident that the value of these bonds will decline.

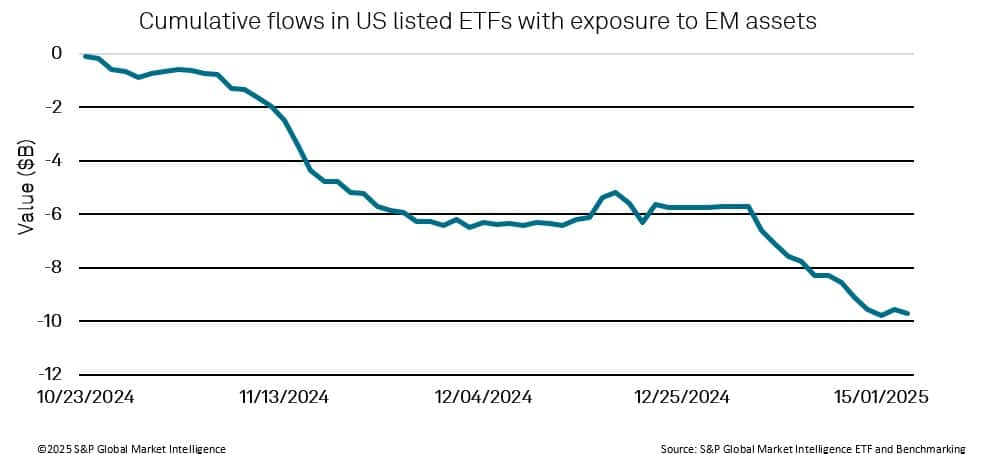

The uncertainty surrounding trade tariffs and the subsequent volatility in emerging market currencies have also had a notable impact on exchange-traded funds (ETFs) that focus on these regions. Recently, there has been a significant outflow of emerging market assets from U.S.-listed ETFs with exposure to emerging market assets, as investors seek to minimize their exposure to the heightened risks associated with economic instability. This trend reflects a growing sentiment of caution among investors, who are reallocating their portfolios towards safer assets amid fears of currency depreciation and rising bond yields. The outflow from emerging market ETFs not only underscores the shifting investor confidence but also exacerbates the downward pressure on emerging market currencies and bonds, creating a feedback loop that further complicates the investment landscape in these regions. As a result, ETF managers may need to adapt their strategies to address these challenges and attract investors back to emerging markets.

The uncertainty surrounding trade tariffs and the subsequent volatility in emerging market currencies have also had a notable impact on exchange-traded funds (ETFs) that focus on these regions. Recently, there has been a significant outflow of emerging market assets from U.S.-listed ETFs with exposure to emerging market assets, as investors seek to minimize their exposure to the heightened risks associated with economic instability. This trend reflects a growing sentiment of caution among investors, who are reallocating their portfolios towards safer assets amid fears of currency depreciation and rising bond yields. The outflow from emerging market ETFs not only underscores the shifting investor confidence but also exacerbates the downward pressure on emerging market currencies and bonds, creating a feedback loop that further complicates the investment landscape in these regions. As a result, ETF managers may need to adapt their strategies to address these challenges and attract investors back to emerging markets.

The uncertainty surrounding trade tariffs is having a profound impact on emerging market currencies, leading to increased short positions across emerging market bonds and outflows across emerging market asset classes. As investors navigate this complex landscape, the interplay between currency fluctuations and asset values will continue to shape market dynamics. With the potential for further tariff developments, the outlook for emerging markets remains uncertain, prompting many to adopt a cautious approach in their investment strategies.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-tensions-uncertainty-fuels-rise-in-em-bond-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-tensions-uncertainty-fuels-rise-in-em-bond-shorts.html&text=Tariff+Tensions%3a+Uncertainty+Fuels+Rise+in+EM+Bond+shorts.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-tensions-uncertainty-fuels-rise-in-em-bond-shorts.html","enabled":true},{"name":"email","url":"?subject=Tariff Tensions: Uncertainty Fuels Rise in EM Bond shorts. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-tensions-uncertainty-fuels-rise-in-em-bond-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tariff+Tensions%3a+Uncertainty+Fuels+Rise+in+EM+Bond+shorts.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-tensions-uncertainty-fuels-rise-in-em-bond-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}