Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 12, 2025

Strong currency appreciation opens door to interest rate cuts in Ghana

The S&P Global Ghana PMI for May signalled that the recent marked appreciation of the cedi against the US dollar had a positive impact on the country's private sector. Input costs and output prices decreased, helping growth of output and new orders to hit seven-year highs. Moreover, firms hired staff at the strongest rate in over a decade of data collection. The easing of inflationary pressures opens the door to potential interest rate reductions over the second half of the year.

Currency appreciation leads to drop in prices

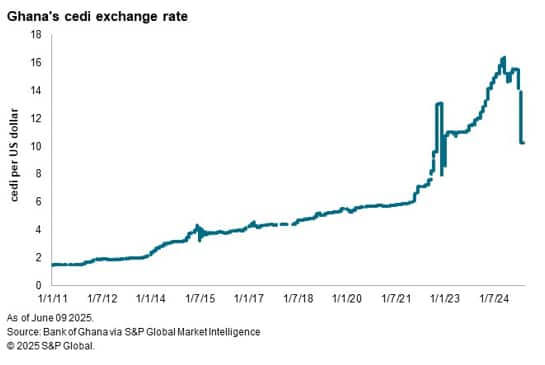

The Ghanaian cedi has appreciated by around 30% versus the US dollar over the first half of 2025, linked by the Bank of Ghana to a range of factors including tight monetary policy, fiscal consolidation, rising foreign reserves and improved market sentiment.

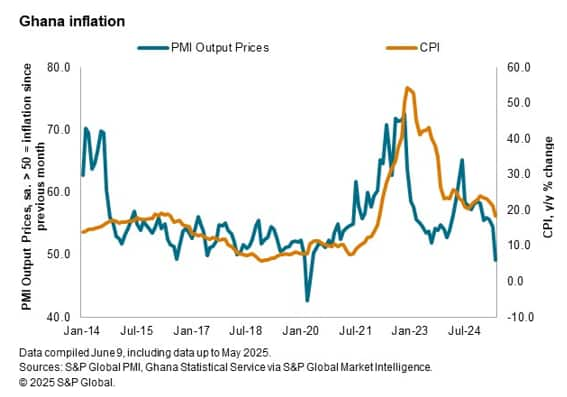

Cedi appreciation has helped to bring down inflation, according to both the PMI data and official measures of inflation. Consumer prices rose 18.4% year-on-year in May, the slowest pace of inflation in more than three years. Moreover, May saw companies in Ghana report outright monthly reductions in both input costs and selling prices for the first time in five years, with survey respondents often linking lower prices to the stronger currency. The PMI data therefore suggest that the official inflation numbers could have further to fall in the months ahead.

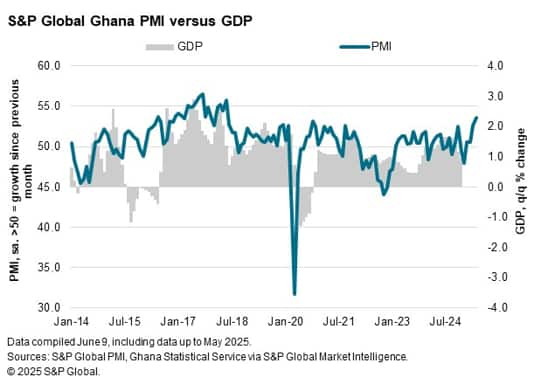

Record pace of job creation

Reduced selling prices helped companies in Ghana to secure new business at an accelerated pace in May. The rate of growth in new orders quickened to the sharpest in seven years, with firms responding by raising their business activity to the largest extent since May 2018 as well. The latest data suggest that GDP data will show an accelerated pace of growth over the first half of this year relative to the end of 2024.

Higher new orders and confidence for the future meant that companies ramped up their hiring activities in May. Moreover, the pace of job creation was the strongest since the survey began in January 2014.

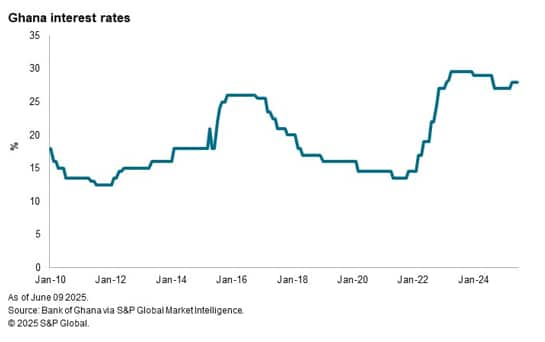

Interest rates could fall later in 2025

While referencing these positive developments, including the PMI data, in the minutes from their Monetary Policy Committee (MPC) meeting in late-May, the Bank of Ghana opted to keep interest rates unchanged at 28% due to inflation remaining high and well above the medium-term target of 8% (±2%). However, since then the latest PMI release and official data publications have shown a much more benign inflationary picture, potentially opening the door to a reduction in interest rates at one of the three remaining meetings of the MPC this year, should these trends continue.

The June PMI data published on July 4th will therefore be an important release to watch.

Access the press release here.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 134 432 8196

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-currency-appreciation-opens-door-to-interest-rate-cuts-in-ghana-jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-currency-appreciation-opens-door-to-interest-rate-cuts-in-ghana-jun25.html&text=Strong+currency+appreciation+opens+door+to+interest+rate+cuts+in+Ghana+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-currency-appreciation-opens-door-to-interest-rate-cuts-in-ghana-jun25.html","enabled":true},{"name":"email","url":"?subject=Strong currency appreciation opens door to interest rate cuts in Ghana | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-currency-appreciation-opens-door-to-interest-rate-cuts-in-ghana-jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+currency+appreciation+opens+door+to+interest+rate+cuts+in+Ghana+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-currency-appreciation-opens-door-to-interest-rate-cuts-in-ghana-jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}