Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 03, 2020

Stocks injected with a shot of hope

Research Signals - November 2020

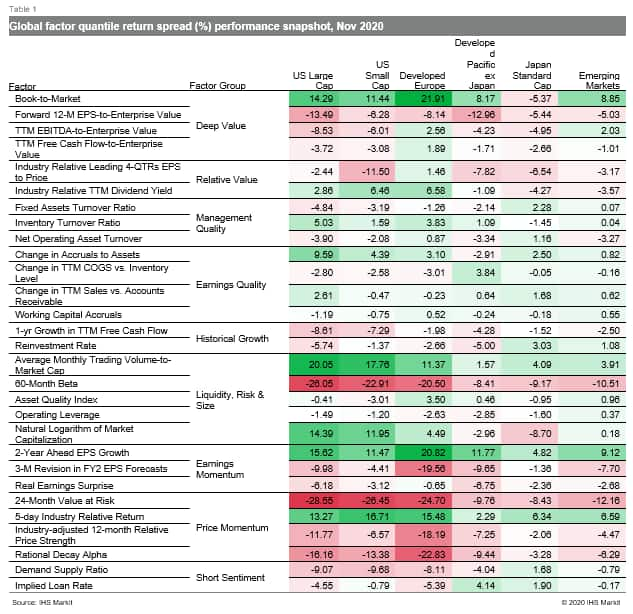

Encouraging vaccine news boosted equity markets worldwide, with many major regional indexes notching solid double-digit monthly gains. As investors looked beyond the virus on hopes of life returning to normal in the coming year, coupled with reduced uncertainty with the US election in the rear-view mirror, high risk and beaten-down value stocks that would benefit from economic growth outperformed (Table 1). Optimism for the economic recovery taking hold was buttressed by the J.P.Morgan Global Manufacturing PMI posting a 33-month high, furthered by firmer sentiment in future output on vaccine hopes.

- US: The high-risk trade was prominent in US markets, dragging down measures that favor lower risk, including 60-Month Beta and 24-Month Value at Risk

- Developed Europe: Traditional value measures of Book-to-Market led the expanded rotation to value stocks

- Developed Pacific: In markets outside Japan, 2-Year Ahead EPS Growth was highly rewarded, while Short Sentiment signals including Demand Supply Ratio and Implied Loan Rate outperformed in Japan

- Emerging markets: Investors favored undervalued and high-risk names, gauged by Book-to-Market and 60-Month Beta, respectively

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-injected-with-a-shot-of-hope.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-injected-with-a-shot-of-hope.html&text=Stocks+injected+with+a+shot+of+hope+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-injected-with-a-shot-of-hope.html","enabled":true},{"name":"email","url":"?subject=Stocks injected with a shot of hope | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-injected-with-a-shot-of-hope.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+injected+with+a+shot+of+hope+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-injected-with-a-shot-of-hope.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}