Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 30, 2020

Stocks enjoy a breath of fresh air

Research Signals - March 2020

In a sharp turn of events, US stocks posted three consecutive daily gains last week for the first time since mid-February when the growing coronavirus panic set in. Stocks emerged out of what was the shortest bear market in history even as the weekly report for total number of initial unemployment claims spiked to its highest level on record. We have closely monitored daily factor and style model performance in light of the continued significant day-to-day swings in market returns, and continue our weekly performance reviews of daily style exposures in the US, as well as month-to-date results from non-US regions.

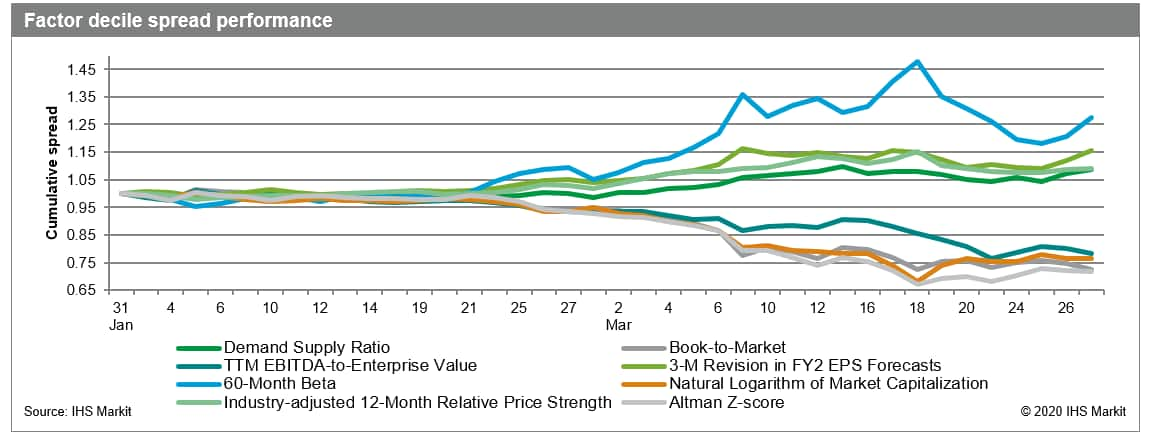

- US investors demonstrated renewed interest in analyst outlook last week, with high earnings revisions making a run at the low risk trade's cumulative lead since January, while deep value stocks trailed, moving more in line with the weak cumulative performance associated with high bankruptcy risk firms

- Each of our style models enjoyed positive cumulative spreads in the fourth week of March, led by Price Momentum, though it still trails cumulatively since January, while Historical Growth Model maintained its solid lead

- The risk off trade remained a positive signal and high bankruptcy risk firms were disfavored in both developed and emerging markets, while Developed Pacific saw a strong downturn in small caps at the same time that Emerging Asia saw a rebound to this size segment

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-enjoy-a-breath-of-fresh-air.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-enjoy-a-breath-of-fresh-air.html&text=Stocks+enjoy+a+breath+of+fresh+air+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-enjoy-a-breath-of-fresh-air.html","enabled":true},{"name":"email","url":"?subject=Stocks enjoy a breath of fresh air | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-enjoy-a-breath-of-fresh-air.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+enjoy+a+breath+of+fresh+air+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-enjoy-a-breath-of-fresh-air.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}