Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 15, 2024

Stimulus Surge: China's Measures Spark Short Selling increase across Asian Financial Services.

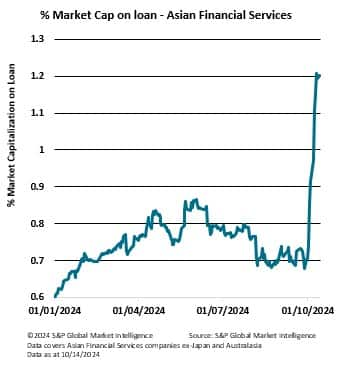

The recent stimulus package announced by the Peoples Bank of China has led to a sharp increase in the market capitalization on loan of Financial Services companies across Asia.

The recent stimulus package in China has led to an increase in short interest across Asian financial service companies, reflecting a shift in investor sentiment. As the government implements measures to stimulate economic growth, market participants are closely monitoring the potential impacts on financial institutions. This heightened scrutiny has resulted in a rise in short selling as investors seek to capitalize on perceived volatility across the sector.

Moreover, the stimulus measures appear to have generated mixed reactions among analysts and investors. While some view the package as a positive step toward economic recovery, others remain cautious about the long-term implications for financial service companies. This divergence in opinions has created an environment where short selling becomes a strategic move for those looking to hedge against potential fluctuations in stock prices, driven by the evolving economic landscape.

Additionally, as financial service companies navigate the complexities introduced by the stimulus, the increased short interest, as shown by the percentage of market capitalization on loan across the sector, can be seen as a reflection of broader market dynamics. Investors may currently be weighing the potential benefits of the stimulus against existing challenges within the sector, leading to a more nuanced approach to trading. This trend underscores the importance of ongoing analysis and adaptation as the market responds to the evolving economic conditions in China and beyond.

When looking across the top ten most shorted Asian financial services companies, ranked by the percentage of their current market capitalization on loan, eight out of the ten are listed on the Hong Kong exchange.

As the market continues to assess the effectiveness and long-term implications of these measures, there is potential for this metric to decline. Once the impacts of the stimulus are fully understood and quantified, investor sentiment may shift, leading to a recalibration of positions in Asian financial service companies. This transition could result in a decrease in short selling activity, reflecting a more stable outlook as market participants gain clarity on the economic landscape.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstimulus-surge-chinas-measures-spark-short-selling-increase-ac.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstimulus-surge-chinas-measures-spark-short-selling-increase-ac.html&text=Stimulus+Surge%3a+China%27s+Measures+Spark+Short+Selling+increase+across+Asian+Financial+Services.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstimulus-surge-chinas-measures-spark-short-selling-increase-ac.html","enabled":true},{"name":"email","url":"?subject=Stimulus Surge: China's Measures Spark Short Selling increase across Asian Financial Services. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstimulus-surge-chinas-measures-spark-short-selling-increase-ac.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stimulus+Surge%3a+China%27s+Measures+Spark+Short+Selling+increase+across+Asian+Financial+Services.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstimulus-surge-chinas-measures-spark-short-selling-increase-ac.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}