Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 11, 2025

Sky High Stakes: Satellite Communications Rollercoaster Short Interest.

Eutelsat's short interest soared to 18% amid Starlink fears, then plummeted to 6% after clinching a vital EU satellite deal.

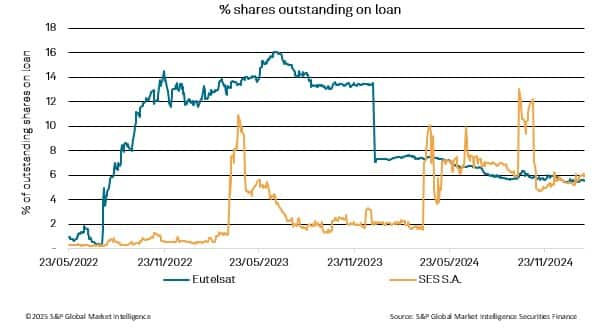

The short interest in Eutelsat has seen significant fluctuations, rising to 18% of shares outstanding on loan before a notable decline to around 6% following the company's pivotal satellite deal with the European Union in December 2024. This tumultuous period reflects a broader market sentiment shaped by the competitive landscape of satellite communications, particularly in light of the rapid expansion of Elon Musk's Starlink.

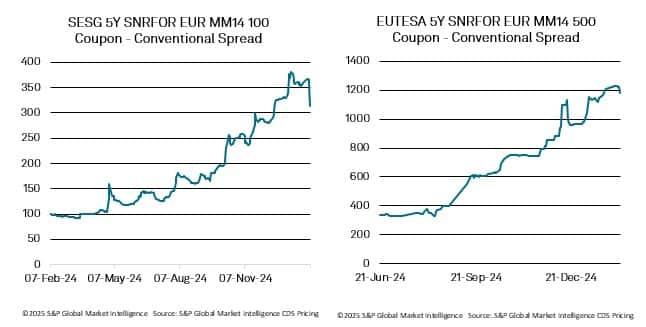

As competition within this sector has intensified, the cost of SES and Eutelsat's credit default swaps (CDS) has increased, indicating increased risk of default. Eutelsat, along with SES of Luxembourg, have reportedly faced pressure as their combined debts approached €7 billion[1]. It appears that the legacy operators have struggled to keep pace with the swift advancements in low Earth orbit (LEO) satellite technology, which had begun to overshadow their traditional higher-orbit broadcasting services. Starlink's aggressive growth, boasting over 6,000 satellites and a significant market share in sectors such as in-flight connectivity has heightened competition within the industry.

[1] https://www.ft.com/content/a5cfd3b1-2013-40b9-adac-ea05688af050

As a response to the increased competition, both companies sought consolidation, with Eutelsat acquiring OneWeb and SES purchasing Intelsat. Despite these strategic moves, the CDS spreads and short interest for Eutelsat continued to climb.

However, the signing of the €10.6 billion deal with the EU for the Iris² satellite project marked a turning point for Eutelsat. As the largest private sector investor in this initiative, committing €2 billion, the company aimed to leverage this partnership to bolster its next-generation satellite offerings. This strategic pivot helped to alleviate some of the short interest, as the market began to reassess Eutelsat's prospects in light of this significant investment.

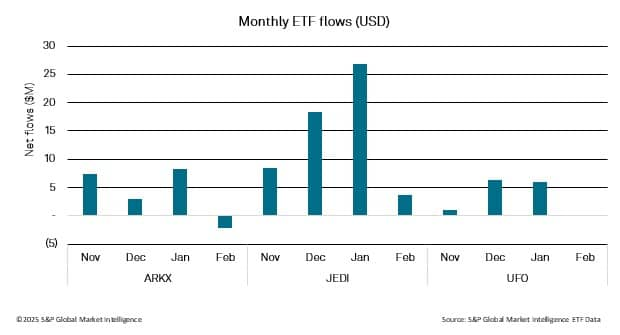

ARKX, JEDI, and UFO are exchange-traded funds (ETFs) that strategically invest in the burgeoning field of satellite technology and its applications. ARKX, managed by ARK Invest, focuses on companies that are pioneering advancements in space exploration, including satellite technology for communication, Earth observation, and data analytics. JEDI, or the "Joint Enterprise Defense Infrastructure," emphasizes investments in defense technologies that leverage satellite systems for enhanced national security, intelligence gathering, and military operations. UFO, or the "Procure Space ETF," directly invests in firms involved in satellite manufacturing, launch services, and related infrastructure, highlighting the growing significance of satellite technology in various sectors, including telecommunications and space tourism. Collectively, these three ETFs have attracted positive net flows of $87 million over the last three months.

This positive trend suggests a growing confidence among investors in the potential of satellite technology and its applications, reflecting an overall optimistic sentiment toward the sector's future growth prospects despite some companies facing increased competition.

Investor sentiment across the satellite communications sector is increasingly optimistic, despite the challenges faced by legacy operators. The recent drop in Eutelsat's short interest, following its pivotal EU satellite deal, indicates a renewed confidence in the company's prospects. Additionally, the positive net inflows of $87 million into ETFs such as ARKX, JEDI, and UFO highlight a growing belief in the potential of satellite technology and its applications. This overall sentiment suggests that while competition remains fierce, investors are recognizing the opportunities for growth and innovation within the sector, paving the way for a more favorable outlook in the coming years.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsky-high-stakes-satellite-communications-rollercoaster-short-i.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsky-high-stakes-satellite-communications-rollercoaster-short-i.html&text=Sky+High+Stakes%3a+Satellite+Communications+Rollercoaster+Short+Interest.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsky-high-stakes-satellite-communications-rollercoaster-short-i.html","enabled":true},{"name":"email","url":"?subject=Sky High Stakes: Satellite Communications Rollercoaster Short Interest. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsky-high-stakes-satellite-communications-rollercoaster-short-i.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sky+High+Stakes%3a+Satellite+Communications+Rollercoaster+Short+Interest.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsky-high-stakes-satellite-communications-rollercoaster-short-i.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}