Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 03, 2025

Securities Finance December, Q4, H2 and Full Year Snapshot 2024

2024 ends on a high as December revenues +5% YoY

- Monthly revenues reach $976M

- Americas revenues decline 9% YoY

- ETP average fees increase 30% YoY as revenues soar

- Full year 2024 revenues of $11.74B

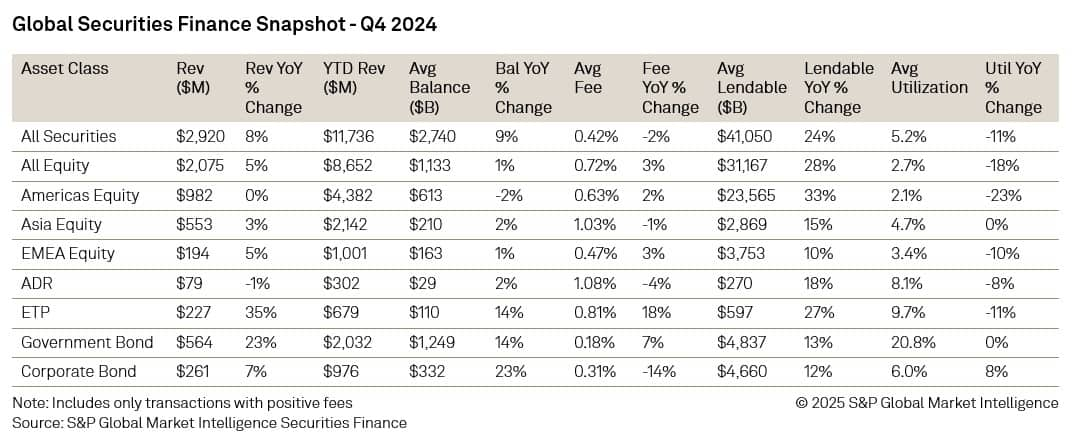

In December, the securities lending markets generated monthly revenues of $976M, reflecting a 5% year-over-year increase. This growth occurred despite a 4% decline in average fees across all securities, as on-loan balances rose to $2.79 trillion. Notably, Q4 recorded the highest average balances of the year at $2.74 trillion, driven by a continued upward trend in equity market valuations.

All equity revenues increased by 3% year-over-year to $690 million. This growth was primarily fueled by a 9% rise in revenues from Asia, amounting to $183 million, and a 14% increase in EMEA revenues, which totaled $66 million. Although EMEA equity revenues rebounded after a challenging start to the year, they experienced a 27% decline in full-year revenues compared to 2023.

Despite finishing Q4 flat compared to Q4 2023, revenues from Americas equity markets ended the year 14% lower, totaling $4.3 billion versus $5.1 billion in the previous year. December revenues were 9% lower than those recorded in December 2023, with average fees declining both month-over-month and year-over-year. December marked a low for average fees in 2024 for Americas equities, which fell to 56 basis points.

In Asia, equity revenue performance remained robust, with an 9% year-over-year increase. Annual revenues in the region experienced only a modest decline of 2% compared to 2023, which is commendable given the challenges faced. Taiwan stood out as a key performer in 2024, with monthly revenues surging 30% year-over-year to $66 million, accompanied by average fees of 280 basis points. Additionally, Hong Kong saw a remarkable 47% year-over-year growth in lending revenues during December, with balances increasing by 25% and average fees rising 17% to 184 basis points—the highest monthly fee recorded in 2024.

Exchange-traded products demonstrated strong performance as investors increasingly utilized these assets in their thematic strategies. Monthly revenues surged by an impressive 57% year-over-year to $76 million during December, achieving the highest monthly revenues of 2024. This positive trend was consistent throughout Q4 and the entire year, with year-over-year revenues growing by 35% and 7%, respectively.

Fixed income assets concluded the year on a robust note, with December government bond revenues rising 12% year-over-year to $193 million during the month, and corporate bond revenues increasing by 6% to $86 million. Government bond revenues exhibited notable growth in the second half of the year, particularly in Q4, which saw a 23% year-over-year increase (compared to 15% in Q3, -4% in Q2, and -3% in Q1). Corporate bonds also excelled in Q4, with revenues increasing by 7%, marking the only positive year-over-year growth for any quarter in 2024. Despite average fees remaining steady at 31 basis points throughout the year, average balances grew by 17% year-over-year, with a 23% increase in Q4 alone.

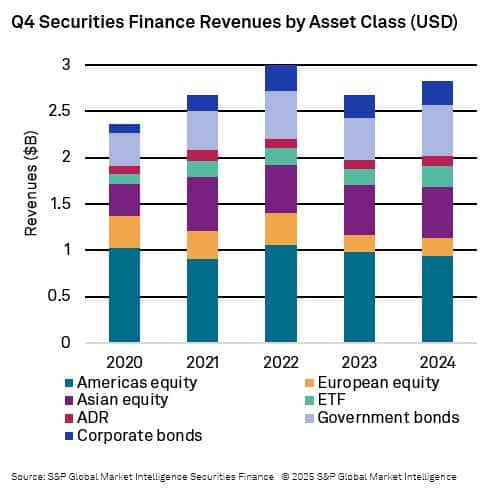

In the securities lending markets, quarterly revenues exhibited strong year-over-year performance, with all asset classes showing positive growth except for American Depositary Receipts (ADRs). The quarter benefited from rising equity market valuations and an escalating interest in fixed income assets. Favorable market conditions for corporate bonds resulted in heightened demand, with balances increasing by 23% year-over-year. Additionally, the growing uncertainty surrounding future path of interest rates in the US spurred significant demand for US Treasuries.

As illustrated by the accompanying graph, Q4 revenues were notably robust when compared to previous fourth quarter periods, reflecting a 9% year-over-year increase. This quarter provided investors with numerous opportunities to engage in securities lending, particularly as interest rate expectations were recalibrated and attention shifted from the current US administration to the incoming President-elect. Exchange-traded funds (ETFs) and fixed income assets emerged as the standout asset classes for the quarter, driven by increased positioning around market events. These asset classes are expected to maintain their momentum as we move into 2025.

SAVE THE DATE

Q4 & 2024 Securities Finance Market Review

Our regular Q4 Webinar will be taking place on January 23rd3PM UK / 10AM EST. During the webinar we will be sharing the most recent Q4 data, and Alexandre Roques from Clearstream Banking will discuss some of the trends seen across fixed income markets in 2024. He will also be providing insights on what to expect at the upcoming Clearstream Global Funding and Financing conference taking place on the 28th-30th January.

To register for the webinar, please click HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-q4-h2-and-full-year-snapshot-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-q4-h2-and-full-year-snapshot-2024.html&text=Securities+Finance+December%2c+Q4%2c+H2+and+Full+Year+Snapshot+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-q4-h2-and-full-year-snapshot-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance December, Q4, H2 and Full Year Snapshot 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-q4-h2-and-full-year-snapshot-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+December%2c+Q4%2c+H2+and+Full+Year+Snapshot+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-q4-h2-and-full-year-snapshot-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}