Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 05, 2020

Risk-on trades defy stay-at-home order

Research Signals - April 2020

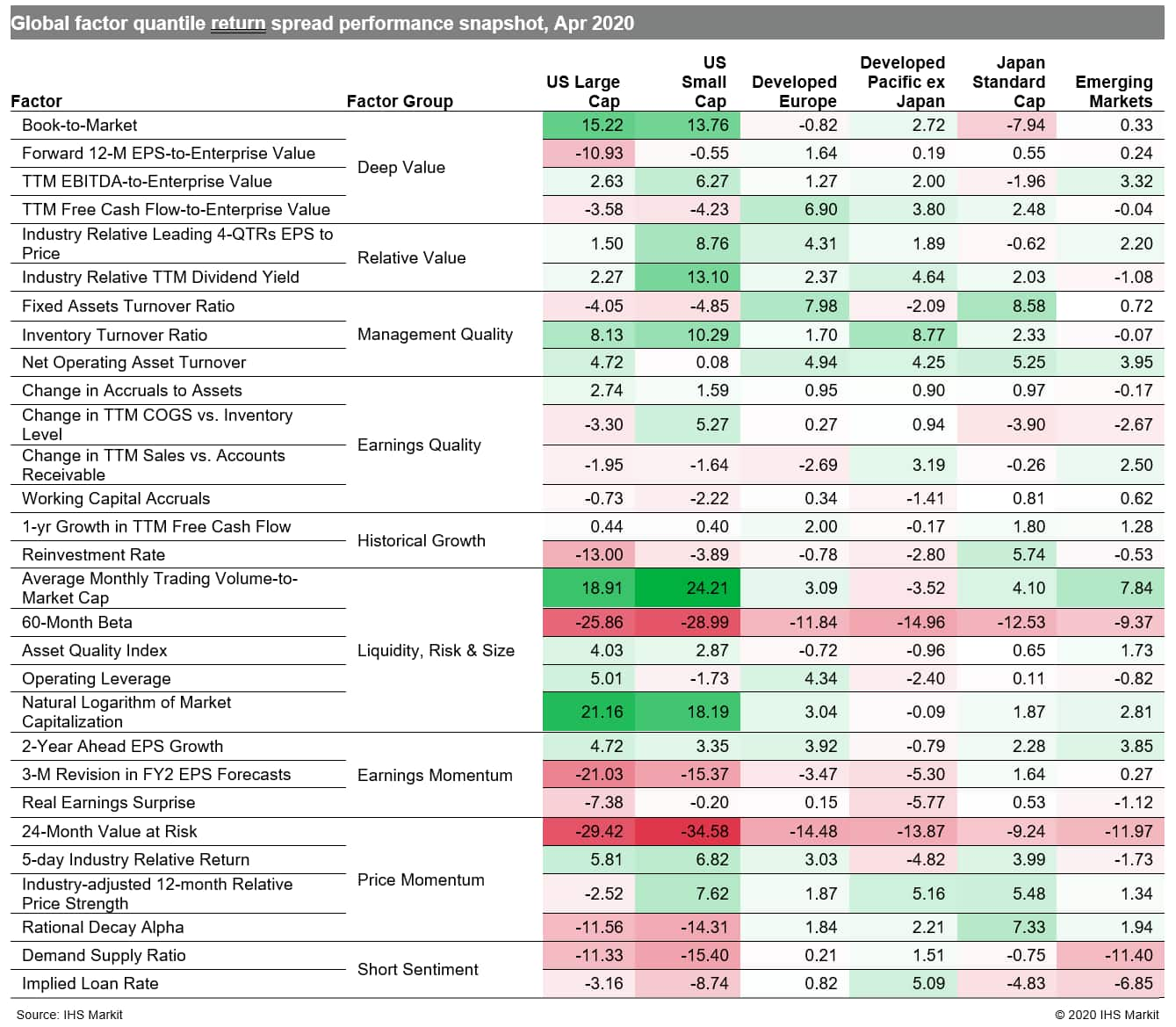

The global COVID-19 pandemic continued to cause significant economic disruption in April, as confirmed by the lowest reading in the J.P.Morgan Global Manufacturing PMI since the financial crisis, though softened by the relatively resilient China PMI from its severe downturn in February. However, investors who sought the safety of low risk stocks during the height of the pandemic energetically reversed course, as a breath of fresh air rejuvenated the risk-on trade (Table 1).

- US: After surging in performance among large caps the prior month, 60-Month Beta recorded its largest monthly percentage point drawdown in our factor history in April

- Developed Europe: Investors increased exposure to small caps gauged by Natural Logarithm of Market Capitalization (USD) and higher risk stocks captured by 24-Month Value at Risk

- Developed Pacific: High quality firms, such as those with favorable Fixed Assets Turnover Ratio scores, outperformed for a second month in Japan, while Implied Loan Rate was a strong performer in markets outside Japan

- Emerging markets: Valuation measures such as TTM EBITDA-to-Enterprise Value were positively rewarded

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-on-trades-defy-stay-at-home-order.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-on-trades-defy-stay-at-home-order.html&text=Risk-on+trades+defy+stay-at-home+order+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-on-trades-defy-stay-at-home-order.html","enabled":true},{"name":"email","url":"?subject=Risk-on trades defy stay-at-home order | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-on-trades-defy-stay-at-home-order.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk-on+trades+defy+stay-at-home+order+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-on-trades-defy-stay-at-home-order.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}