Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 05, 2020

April 2020 Model Performance Report

Research Signals - April 2020

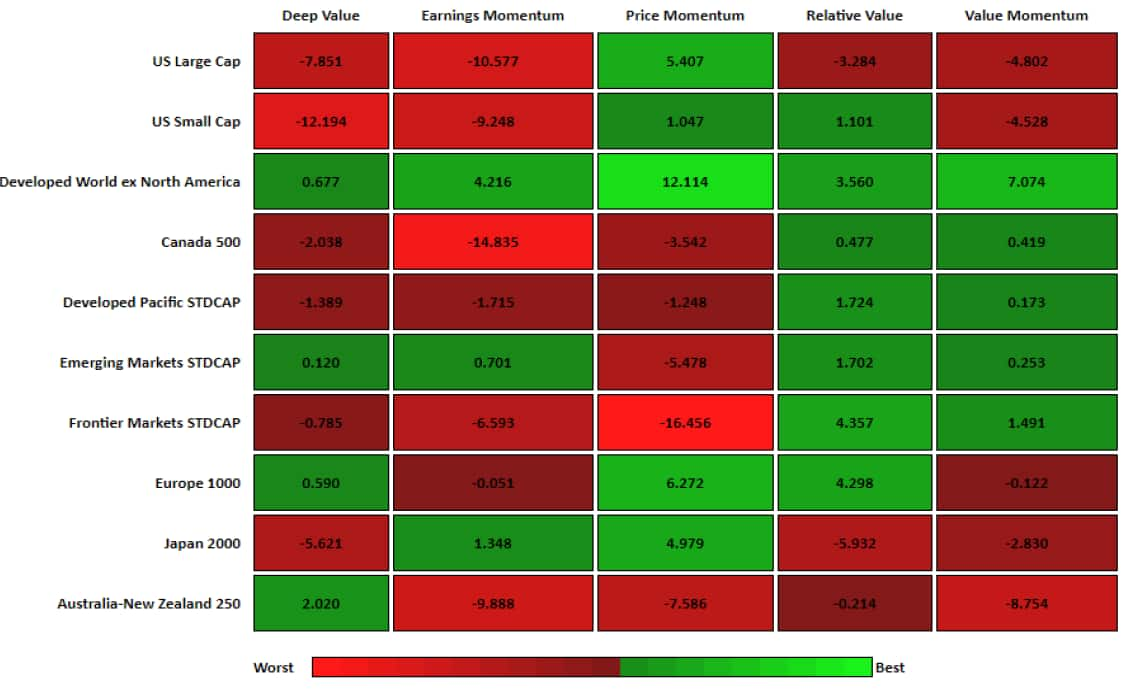

- US: Within the US Large Cap universe the Price Momentum model had the strongest one month decile return spread performance, returning 5.41%, while the Earnings Momentum model lagged. Over the US Small Cap universe our Value Momentum 2 model had the strongest one month decile return spread performance, returning 1.66%, while the Deep Value model lagged. The performance of the Value Momentum 2 model was driven by the performance of the long portfolio.

- Developed Europe: Within the Developed Europe universe our Price Momentum model was the top performer on a one month decile return spread basis, returning 6.27%, while the Value Momentum model trailed.

- Developed Pacific: Over the Developed Pacific universe, the Relative Value model had the strongest one month decile return spread performance, returning 1.72%, while the Earnings Momentum model lagged. The Price Momentum model's one year cumulative performance is currently 9.32%.

- Emerging Markets: Within the Emerging Markets universe our Relative Value model had the strongest one month decile return spread performance, returning 1.70%, while the Deep Value model lagged. The Earnings Momentum model's one year cumulative performance is the highest for the EM universe at 17.43%.

- Sector Rotation: The US Large Cap Sector Rotation model returned -4.50%. The Tech sector had a favorable ranking and the Energy sector had an unfavorable ranking.The US Small Cap Sector Rotation model struggled returning -11.90%. The Tech sector had a favorable ranking and the Energy sector had an unfavorable ranking.The Developed Europe Sector Rotation model returned 4.50%. The Healthcare sector had a favorable ranking and the Energy sector had a unfavorable ranking.

- Specialty Models: Within our specialty model library the Bank and Thrift 2 and the Insurance models had the strongest one month decile return spread performance returning 12.43% and 8.61%, respectively, while the Semiconductor and the Retail models struggled. The Insurance model's one year cumulative performance is the highest at 20.51% while the Retail model's performance is the lowest at -6.28%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-2020-model-performance-report.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-2020-model-performance-report.html&text=April+2020+Model+Performance+Report+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-2020-model-performance-report.html","enabled":true},{"name":"email","url":"?subject=April 2020 Model Performance Report | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-2020-model-performance-report.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=April+2020+Model+Performance+Report+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-2020-model-performance-report.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}