Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 03, 2020

Risk factors shrug off virus concerns

Research Signals - August 2020

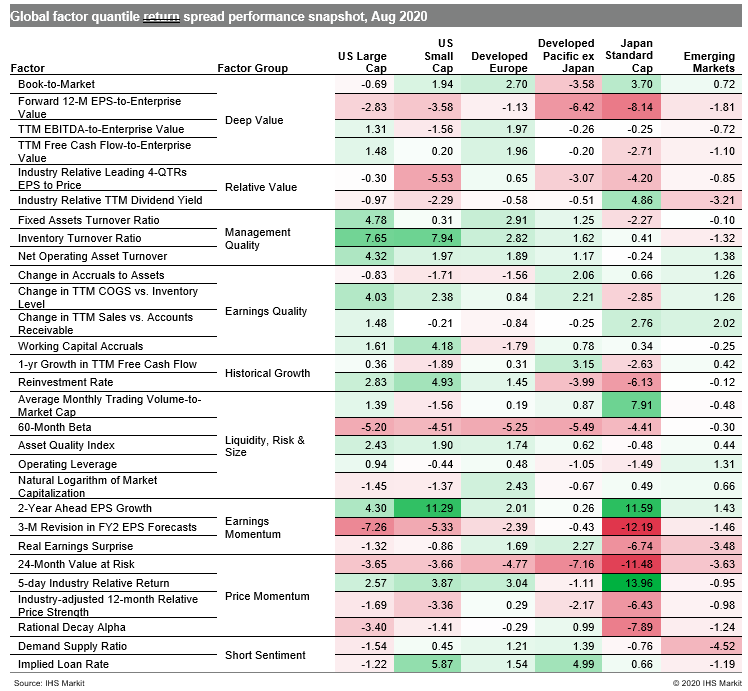

While concerns of a COVID-19 resurgence and the potential for another round of shutdowns cast shadows on the global economic recovery, investors remained optimistic for equities, contributing to outperformance of higher risk names captured by 60-Month Beta and 24-Month Value at Risk across each of our coverage universes (Table 1). Investors put their hopes on vaccine developments and a continuation of the US Federal Reserve's low rate policy as it shifts to average inflation targeting. The recovery of the global manufacturing sector also gathered pace in August for a second month, following five consecutive declines, with the J.P.Morgan Global Manufacturing PMI rising to a 21-month high.

- US: While positive earnings revisions was a negative signal, outperformance to 2-Year Ahead EPS Growth was particularly pronounced for small caps, posting its highest spread for this cohort since May 2003

- Developed Europe: 60-Month Beta struggled last month as investors sought higher risk names, a trend that has been in place in general since April

- Developed Pacific: Implied Loan Rate, a Short Sentiment indicator measuring the cost of borrowing a stock, was a highly rewarded indicator in markets outside Japan

- Emerging markets: A broad set of styles were represented among the weakest performing factors, including Demand Supply Ratio, 24-Month Value at Risk and Real Earnings Surprise

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-factors-shrug-off-virus-concerns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-factors-shrug-off-virus-concerns.html&text=Risk+factors+shrug+off+virus+concerns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-factors-shrug-off-virus-concerns.html","enabled":true},{"name":"email","url":"?subject=Risk factors shrug off virus concerns | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-factors-shrug-off-virus-concerns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+factors+shrug+off+virus+concerns+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-factors-shrug-off-virus-concerns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}