Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 10, 2025

PRIV: Turning Private very Public.

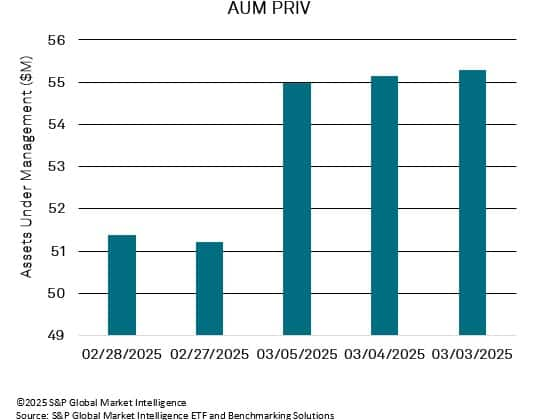

The recently launched SPDR SSGA Apollo IG Public & Private Credit ETF (PRIV) attracts $3.7million in first week of trading.

The financial landscape continues to evolve, with innovative investment vehicles emerging to meet the diverse needs of investors. One such vehicle is the newly launched SPDR SSGA Apollo IG Public & Private Credit ETF (ticker: PRIV), which aims to provide exposure to both public and private credit markets. This ETF represents a significant addition to the growing suite of private equity and credit offerings available to investors.

The SPDR SSGA Apollo IG ETF is designed to provide investors with access to a diversified portfolio of investment-grade public and private credit. This dual exposure can be particularly appealing in a low-interest-rate environment where traditional fixed-income investments may offer limited returns. By incorporating private credit into the mix, the ETF allows investors to tap into potentially higher yields that are often associated with less liquid, private market investments.

One of the primary benefits of investing in ETFs like PRIV is their liquidity. Unlike traditional private equity funds, which often have lock-up periods and limited redemption options, ETFs can be traded on exchanges throughout the day. This feature provides investors with greater flexibility and the ability to react quickly to market changes. Additionally, the ETF structure typically comes with lower fees compared to actively managed funds. This cost efficiency can enhance overall returns, making it an attractive option for cost-conscious investors.

However, investing in the SPDR SSGA Apollo ETF is not without its risks. While private credit investments can offer higher yields, they also come with increased risk due to their illiquid nature and potential for credit defaults. The performance of the ETF will be closely tied to the underlying credit quality of the assets it holds. In times of economic downturn, the risk of default may rise, impacting the ETF's overall performance. Moreover, the ETF's initial week of trading saw modest inflows of only USD 3.7M from February 27 to March 5. This lukewarm reception may indicate a cautious approach from investors, who may be weighing the risks associated with private credit against the potential rewards.

Despite the initial hesitance, the popularity of private equity and credit in capital markets has been on the rise. Several factors contribute to this trend. First, as institutional investors seek to enhance their portfolios' yield and diversification, private equity and credit offer unique opportunities that are not typically available in public markets. The pursuit of higher returns has led many to explore alternative investments, including private credit, which has gained traction due to its resilience during economic fluctuations. Furthermore, the growth of ETFs as investment wrappers of choice has played a significant role in this trend. As investors increasingly favour passive investment strategies, the ease of access and lower costs associated with ETFs have made them a preferred vehicle for gaining exposure to various asset classes, including private equity and credit. The ability to buy and sell shares on the open market aligns well with the modern investor's demand for liquidity and flexibility.

The launch of the SPDR SSGA Apollo IG Public & Private Credit ETF (PRIV) marks an important development in the investment landscape, offering a unique blend of public and private credit exposure. While the ETF presents potential benefits, including liquidity and cost efficiency, it also carries inherent risks that investors must consider. As the appetite for private equity and credit continues to grow, the evolution of ETFs as a primary investment vehicle will likely play a crucial role in shaping the future of capital markets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpriv-turning-private-very-public.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpriv-turning-private-very-public.html&text=PRIV%3a+Turning+Private+very+Public.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpriv-turning-private-very-public.html","enabled":true},{"name":"email","url":"?subject=PRIV: Turning Private very Public. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpriv-turning-private-very-public.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PRIV%3a+Turning+Private+very+Public.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpriv-turning-private-very-public.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}