Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 14, 2025

O Canada: A Decline in Shorts as Trade Tariffs Take Hold

The escalating trade tensions between Canada and the US have led to a decline in short interest in the TSX60 and an increase in the S&P500.

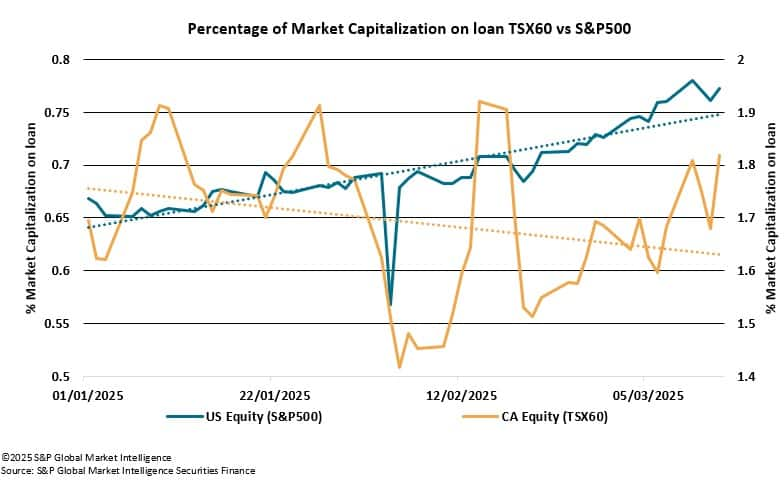

The recent escalation of trade tensions between Canada and the United States has sparked concern among investors and economists alike. The imposition of tariffs by both nations has strained their long-standing trade relationship and influenced market behaviours. As these trade disputes unfold, a closer examination reveals a notable divergence in investor sentiment, reflected in the market capitalization on loan, suggesting a decline in short interest in Canada (TSX 60) while the US (S&P 500) experiences the opposite trend.

International trading relationships have gained prominence during Donald Trump's presidency, leading to threats of tariffs to address what he views as an inequitable trade relationship. Currently, the US has imposed tariffs on steel and aluminum, citing national security concerns, prompting Canada to retaliate with tariffs on $21 billion worth of US goods. This reciprocal strategy has heightened tensions and raised concerns about the future of trade between the two nations, especially as the US trade deficit with Canada reaches a two-decade high.

The tariffs have significant economic implications, increasing costs for businesses and consumers, with US automakers reporting reduced profitability. Canadian farmers are particularly affected by higher costs and limited access to the US market. Amid these tensions, short selling activity has diverged: Canada is seeing a decline in short selling on the TSX 60, indicating cautious investor sentiment, while the US S&P 500 is experiencing an increase, reflecting a more pessimistic outlook among investors amid ongoing uncertainty. This situation underscores the interconnectedness of trade policies and market dynamics.

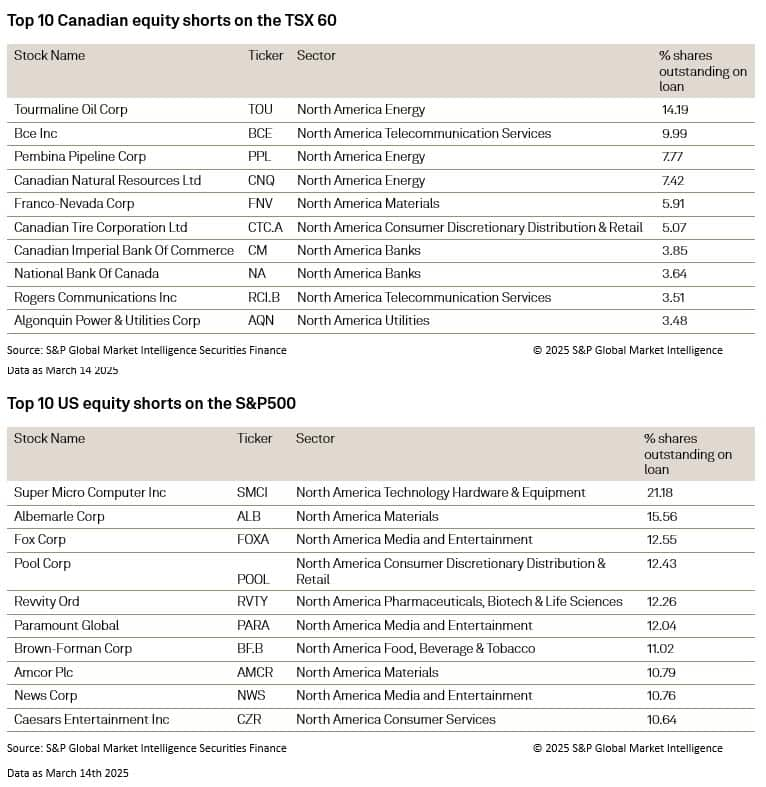

Building on the current landscape of trade tensions, the most shorted companies in both Canada and the US further illustrate the divergent investor sentiments that have emerged amid these economic uncertainties. In Canada, Tourmaline Oil Corp (TOU) leads the TSX 60 with 14.19% of its shares currently on loan, followed by BCE Inc (BCE) at 9.99% and Pembina Pipeline Corp (PPL) at 7.77%. These figures indicate a cautious outlook among Canadian investors, particularly in sectors like energy and telecommunications, which are significantly affected by the tariffs and market volatility. In contrast, the US market reveals a more pronounced trend, with Super Micro Computer Inc (SMCI) topping the S&P 500 with 21.18% of the company's shares on loan, followed by Albemarle Corp (ALB) at 15.56% and Fox Corp (FOXA) at 12.55%. This heightened short selling activity in the US, particularly within technology and media sectors, suggests a more pessimistic sentiment among investors as they brace for potential market downturns driven by the ongoing trade disputes. The contrasting short selling patterns between the two countries not only underscore the varying levels of confidence among investors but also highlight the broader implications of the current trade climate on market behaviors and economic outlooks.

The examination of short selling activity in Canada and the US amidst the escalating trade tensions provides a data-driven perspective on the contrasting investor sentiments in both markets. The stark differences in short selling patterns underscore the varying levels of confidence among investors in both countries and highlight the broader implications of the ongoing trade disputes on market dynamics, further complicating the economic landscape as stakeholders seek to adapt to the changing environment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fo-canada-a-decline-in-shorts-as-trade-tariffs-take-hold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fo-canada-a-decline-in-shorts-as-trade-tariffs-take-hold.html&text=O+Canada%3a+A+Decline+in+Shorts+as+Trade+Tariffs+Take+Hold+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fo-canada-a-decline-in-shorts-as-trade-tariffs-take-hold.html","enabled":true},{"name":"email","url":"?subject=O Canada: A Decline in Shorts as Trade Tariffs Take Hold | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fo-canada-a-decline-in-shorts-as-trade-tariffs-take-hold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=O+Canada%3a+A+Decline+in+Shorts+as+Trade+Tariffs+Take+Hold+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fo-canada-a-decline-in-shorts-as-trade-tariffs-take-hold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}