Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 17, 2023

Previewing the May flash PMI surveys: assessing growth resilience and inflation indicators

Ahead of the flash PMI releases for the US, Eurozone, UK, Japan and Australia, released on 23rd May, we recap on the latest survey findings from the April S&P Global PMI surveys and pick five key themes to watch in the upcoming releases.

Will resurgent demand for services continue to boost economic growth?

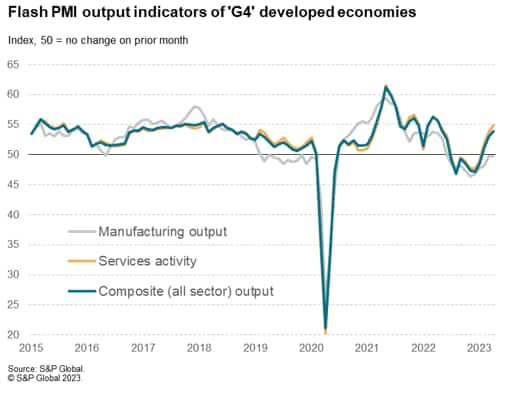

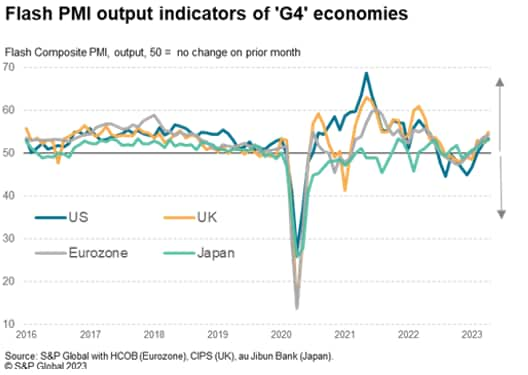

April's surveys pointed to better than anticipated performances, beating expectations in all four major economies. US output rose for a third successive month and at the fastest rate for 11 months as growth accelerated in both manufacturing and services. The UK and eurozone saw their best performances for 12 and 11 months respectively, albeit heavily skewed towards services as factory output fell in both cases. Japan's upturn meanwhile slowed amid a further slide in factory output but, having now seen services-led growth for four months, Japan's economy is also faring well overall.

In all cases, the robust growth picture seen in April was driven by resurgent service sector activity, with demand for services recovering sharply most notably among consumers thanks to a post-pandemic tailwind for travel and tourism. However, financial services activity has also meanwhile stabilised after a marked downturn last year - notably in the US - amid an improvement in financial conditions. However, these financial conditions are now tightening again, especially in the US. There are also question marks over how long the consumer will retain an appetite to spend on services in the face of headwinds such as the increased cost of living and the further hikes in interest rates imposed in the US and Europe.

We will therefore be eager to gauge the rate of growth of service sector new business inflows and respective business activity growth rates for clues as to the ongoing resilience of these important drivers of economic expansions.

Can manufacturing growth revive?

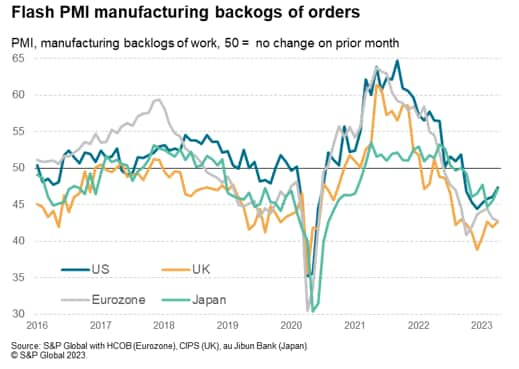

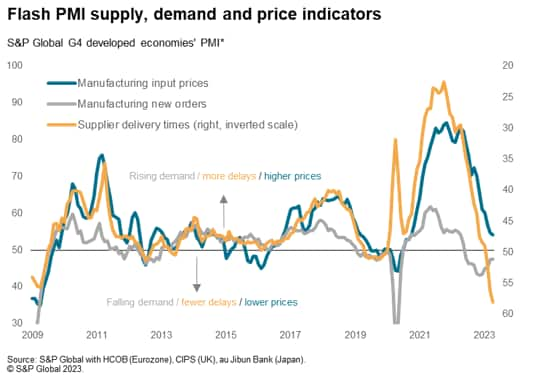

Manufacturing output has stabilised across the G4 economies as a whole over the past two months, representing an improvement on the downturn seen late last year, but this better situation principally represents healing supply chains. Worryingly, new orders inflows continued to fall in April, acting as a drag on production growth.

The improved supply situation has enabled factories to reduce their backlogs of orders, which had accumulated at an unprecedented rate during the pandemic as component shortages curbed production. However, these backlogs will eventually be depleted and, in the absence of new order inflows, could mean production will fall again in the months ahead.

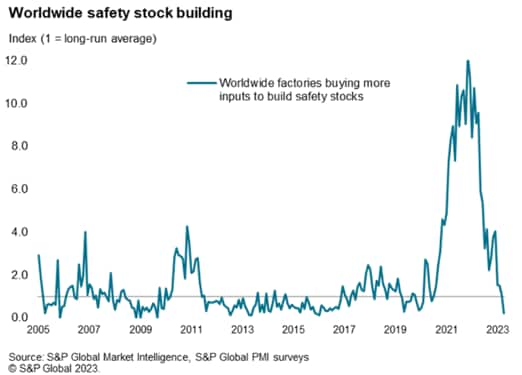

An additional drag on the manufacturing sector has been an unwinding of safety stocks - many of which are components manufactured by other companies. Safety stock building hit record levels amid supply fears during the pandemic, but is now acting as a negative influence on global production as companies seek to reduce these inventories for cost considerations in response to weak sales.

In addition to watching the manufacturing new orders and backlogs of orders data, the May manufacturing inventory and input purchasing data will therefore be important to watch to assess whether this inventory unwind is showing signs of being completed.

Are supply chains continuing to heal?

The extent to which supply chains are continuing to heal will also be revealed, as this will not only have a bearing on the extent to which manufacturers can expand production but also on producer price inflation.

Easier supply means fewer price pressures, so recent months have seen the improving supply situation accompanied by a marked cooling of manufacturing input cost inflation. Falling demand has naturally also helped reduce inflation pressures.

The May flash PMI Suppliers' Delivery Times Index data will therefore be an important barometer of the supply chain stress and provide a valuable insight into inflation trends within the goods producing sector in particular.

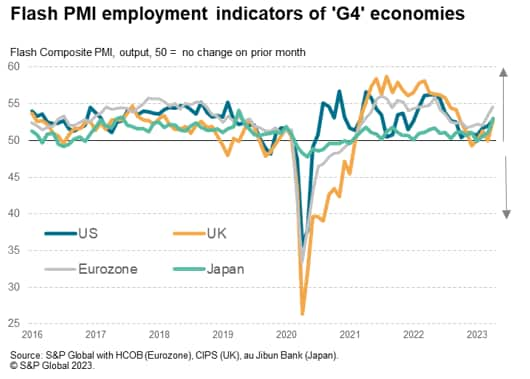

How resilient are labour markets?

Looking beyond manufacturing, a key source of inflationary pressure has been the labour market, with upward wage growth a major concern in the US and Europe. Jobs growth accelerated in all G4 economies in April, led by accelerated hiring in the service sectors. Upcoming Employment Index data will therefore be keenly awaited to gain further insights into whether strengthening demand for staff poses further upside risks to labour market tightness and wage pressures.

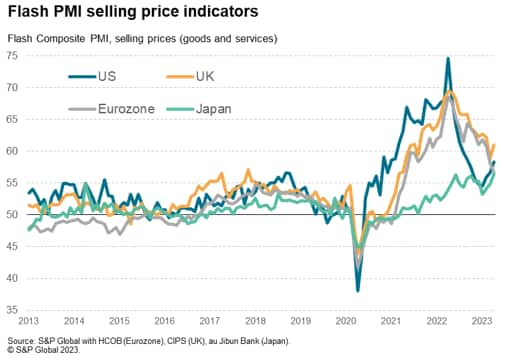

How sticky does inflation look?

Determining the broader inflation trends for selling prices amid the various supply chain, energy market and labour market cost factors will clearly be important, especially after April PMI surveys showed some surprising upward trends.

In the US, average selling price inflation for goods and services accelerated for a third successive month in April, hitting a seven-month high. The rate of inflation also reaccelerated in the UK and hit an all-time high in Japan. The eurozone bucked the trend, thanks mainly to its greater exposure to recent energy price falls after the spikes seen last year, but even in the eurozone the overall rate of increase remained elevated by historical standards, thanks mainly to higher service sector charges.

May flash PMIs

May's flash PMI data will consequently be eagerly anticipated for signs that the recent resurgent economic growth seen in the major developed economies of the world has continued into the middle of the second quarter, to thereby ally fears of imminent recessions. However, the sustainability of these upturns remains under close scrutiny, and the details of the breadth and quality of growth - especially in relation to demand conditions as indicated by new orders and backlogs of work indices - will be crucial in assessing whether recessions might be seen later in the year. The surveys' Future Output Indices will also provide guidance on business optimism about the outlook for the year ahead.

These growth and demand dynamics will naturally have bearings on inflation which - although showing signs of peaking - continues to reflect stubborn stickiness, notably in the service sectors. Watch out for the Suppliers' Delivery Times Index and Employment Indices for supply chain and labour market cost developments, as well of course as the Input Cost and Selling Price/Charge Indices.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-may-flash-pmi-surveys-May23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-may-flash-pmi-surveys-May23.html&text=Previewing+the+May+flash+PMI+surveys%3a+assessing+growth+resilience+and+inflation+indicators+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-may-flash-pmi-surveys-May23.html","enabled":true},{"name":"email","url":"?subject=Previewing the May flash PMI surveys: assessing growth resilience and inflation indicators | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-may-flash-pmi-surveys-May23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Previewing+the+May+flash+PMI+surveys%3a+assessing+growth+resilience+and+inflation+indicators+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-may-flash-pmi-surveys-May23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}