Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Jan 20, 2020

Greater pressure on Czech National Bank to raise interest rates after further pick-up in inflation

- December CPI posts above upper bound of target inflation rate at 3.2%

- Challenging manufacturing conditions weigh on industrial production

- Outlook for 2020 includes reduced uncertainty according to CNB

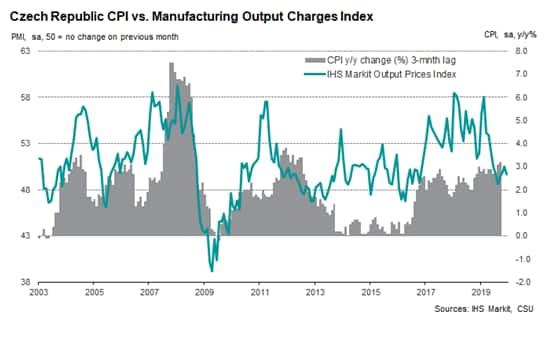

Despite difficult external demand conditions and a stalling manufacturing sector, the rate of inflation in the Czech Republic picked up in December to 3.2%, the fastest since October 2012. Strong rises in housing and utility costs pushed prices higher, leading to greater calls for an increase in interest rates. Although the Czech National Bank held its policy rate at 2% in December, there were two of the seven members of the bank's board who voted for a rise, with the governor leaving the door open for a potential increase in the headline rate as soon as the next board meeting, which takes place in February.

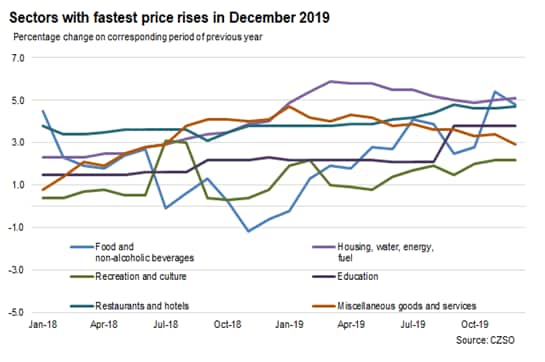

Sharp rise in prices at end of 2019

With the rate of inflation pushing further above the upper limit of the Czech National Bank's tolerance boundary (the bank has an inflation target of 2% with a tolerance band of one percentage point in either direction), it highlighted some of the risks to price pressures across the Czech economy for 2020. Upside risks include the potential for the price of Brent crude oil moving higher than currently forecast, and food costs posting above expectations.

The rate of core consumer price inflation (excluding volatile items such as food and fuel) also continued to run above the 2% mark in December.

A partial driver of inflation is domestic spending. Despite weaker growth across the economy as a whole, and slower than expected increases in wages, consumer confidence remains above the historic trend, helping to spur further growth in retail sales

November retail data also pointed to non-food sales driving the upturn, as domestic demand was supported by internet and specialist goods sales.

Monetary policy in 2020

The Czech National Bank has made it clear that monetary policy will now focus on its price stability mandate, with adjustments to the headline rate made only if price pressures remain above the threshold's upper bound. Nonetheless, it has been suggested that such movements would take into consideration the severity of difficult demand conditions across the Czech economy, and may therefore depend on the outlook improving. If any increase to the rate were to be made, it would most likely be only a small, temporary adjustment as the Czech National Bank tries to tread a fine line between maintaining growth under challenging external demand conditions and bringing inflation back to the target rate.

We currently expect a small hike in the opening months of 2020, but for the interest rate to remain stable through the rest of the year, due to uncertain external conditions. Any adjustment to this forecast may come if upside risks - such as a shock depreciation to the koruna - to inflation intensify.

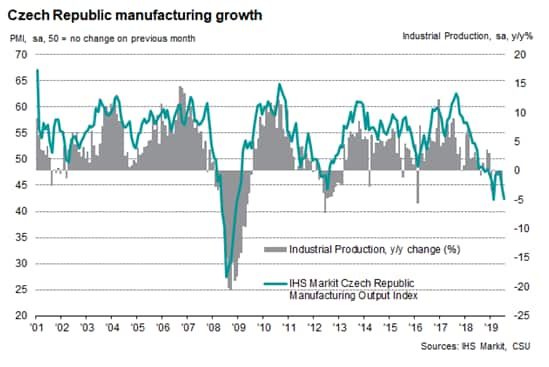

Weaker manufacturing performance weighs on outlook

Compounding the issue of faster increases in prices is a malaise in the Czech manufacturing sector. The goods-producing economy has been hit hard by a global slowdown and troublesome demand conditions in the closely-linked German manufacturing sector. The latest IHS Markit Czech Republic Manufacturing PMI data failed to signal a pick-up in fortunes in December and pointed towards a marked deterioration in operating conditions, with export orders continuing to fall sharply.

The outlook for 2020 still seems relatively uncertain as we wait to find out the longevity of the recent downturn in manufacturing. Headwinds remain ever present as any improvement in export conditions among key trading partners will take time to filter through to Czech firms, with many also waiting for greater clarity surrounding the future trends in automotive production. Greater moves towards electrification and the manufacture of electric vehicles could result in upheaval across established supply chains.

Forthcoming economic data releases:

- 3rd February 2020: IHS Markit Czech Republic Manufacturing PMI (January), IHS Markit Germany Manufacturing PMI (February)

- 6th February 2020: Czech Industrial Production (December), CNB Interest Rate Decision

- 14th February 2020: Czech Preliminary GDP (Q4), Czech Inflation Rate (January)

Siân Jones, Economist, IHS Markit

Tel: +44 1491 461017

sian.jones@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpressure-on-cnb-to-raise-rates-after-inflation-pickup-jan20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpressure-on-cnb-to-raise-rates-after-inflation-pickup-jan20.html&text=Greater+pressure+on+Czech+National+Bank+to+raise+interest+rates+after+further+pick-up+in+inflation++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpressure-on-cnb-to-raise-rates-after-inflation-pickup-jan20.html","enabled":true},{"name":"email","url":"?subject=Greater pressure on Czech National Bank to raise interest rates after further pick-up in inflation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpressure-on-cnb-to-raise-rates-after-inflation-pickup-jan20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greater+pressure+on+Czech+National+Bank+to+raise+interest+rates+after+further+pick-up+in+inflation++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpressure-on-cnb-to-raise-rates-after-inflation-pickup-jan20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}