Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 05, 2018

Japan PMI surveys point to another solid quarterly expansion

- Composite PMI dips to 52.2 in February, but rate of business activity growth remains robust

- PMI signals 0.5-0.6% quarterly GDP growth rate

- Strong job gains seen in manufacturing while service sector employment rises marginally

- Input cost inflation eases, but still strong

Japanese economic growth remained robust in February despite losing a bit of momentum, putting the economy on course for a ninth straight quarterly expansion.

Manufacturing–led upturn

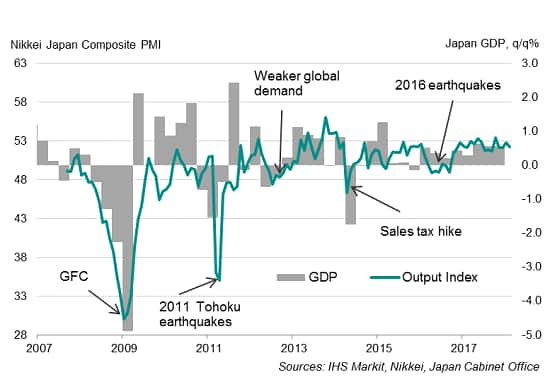

The Nikkei Japan Composite PMI™ Output Index slipped from 52.8 in January to 52.2 in February, but still signalled another firm improvement in the health of the private sector. The readings so far this year are historically consistent with the economy expanding at a quarterly rate of around 0.5–0.6%.

Japan PMI and economic growth

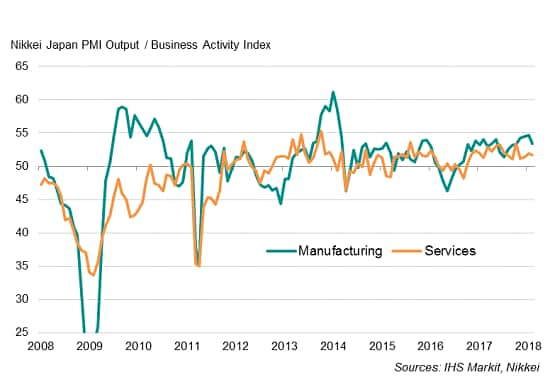

While the upturn was generally broad-based, it was the manufacturing sector that has driven much of the growth in recent months, including February. Although dipping, the latest manufacturing PMI reading remained among the highest seen in the past four years, with survey data indicating that rising domestic and external demand helped contribute to the upturn. Meanwhile, services activity continued to show steady growth.

Japan PMI: manufacturing and service sectors

Employment

A sustained upturn in demand encouraged firms to raise staff numbers, with job creation seen for a fifteenth consecutive month during February. Factory employment growth reached an 11-year high, while service sector headcounts grew marginally.

The labour market is clearly tight, and looks set to be squeezed further. The official unemployment rate is running close to a 24-year low, while job vacancies are the highest on record. With capacity constraints continuing to be reported, as signalled by a further rise in backlogs of work, hiring demand is unlikely to ease in the months ahead.

Price pressures

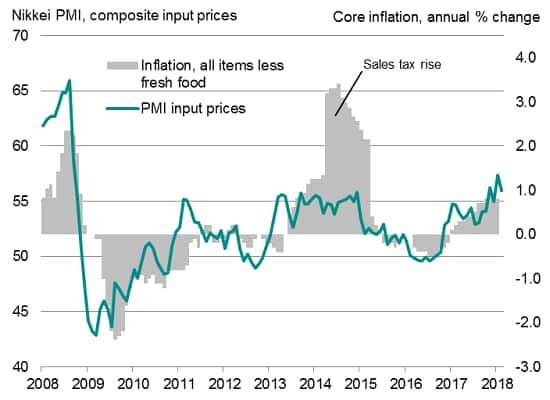

Firms continued to grapple with rising costs. Although easing from a nine-year high in January, input cost inflation remained marked in February. Increased costs for oil and raw materials, in particular aluminium, copper, steel and paper, were widely reported. Service providers also attributed higher input costs to increased prices for vegetables and wage inflation.

PMI output prices and core inflation

Strong cost increases prompted companies to raise selling prices to protect margins, albeit to a lesser extent than January, which hinted at downward pressure on overall profits. However, the stronger yen could help contain some of the rise in imported inflation in coming months.

Outlook

Looking at the survey sub-indices, further growth is signalled for coming months. New order growth remained firm, while business expectations for the year ahead stayed positive.

Robust economic growth will add to expectations that the central bank could soon start to adopt a more hawkish tone, but core inflation has remained subdued and below the Bank of Japan’s target, highlighting the challenge faced by policymakers trying to revive price pressures. BOJ governor Kuroda recently said there’s no need to conduct another comprehensive assessment as to why the central bank failed to meet its inflation target, suggesting that no significant changes will be made to its monetary easing stance for the time being.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-another-solid-quarterly-expansion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-another-solid-quarterly-expansion.html&text=Japan+PMI+surveys+point+to+another+solid+quarterly+expansion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-another-solid-quarterly-expansion.html","enabled":true},{"name":"email","url":"?subject=Japan PMI surveys point to another solid quarterly expansion&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-another-solid-quarterly-expansion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+surveys+point+to+another+solid+quarterly+expansion http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-another-solid-quarterly-expansion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}