Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 05, 2019

PMI shows Hong Kong SAR economy suffering biggest fall in output for over two decades

- IHS Markit Hong Kong SAR Whole Economy PMI™ sinks to lowest since November 2008

- Protests and trade wars blamed for steepest output fall since survey started in 1998

- New orders fall sharply, dragged down by record fall in demand from mainland China

- Business sentiment at new record low

Hong Kong SAR's private sector remained mired in one of its worst downturns for the past two decades during October, according to the latest IHS Markit PMI data. The survey also brought signs of a deepening economic malaise, as the impact of the ongoing political unrest and a worsening global trade environment continued to dampen business activity and hurt investment.

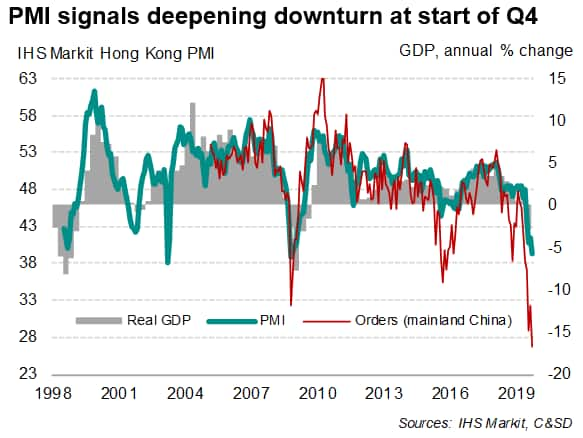

With PMI data signalling accurately (and well in advance) the steep GDP decline in the third quarter as indicated by official data, October PMI results suggest the economy is heading towards a deeper recession in the final quarter of the year.

Economic woes

The IHS Markit Hong Kong PMI™ fell from 41.5 in September to 39.3 in October, indicating the worst deterioration in the health of the private sector economy since November 2008. The latest reading is consistent with GDP contracting at a year-on-year rate of close to 5% at the start of the fourth quarter.

The latest decline means business activity shrank for a nineteenth straight month, marking one of the deepest and longest downturns for the past 20 years.

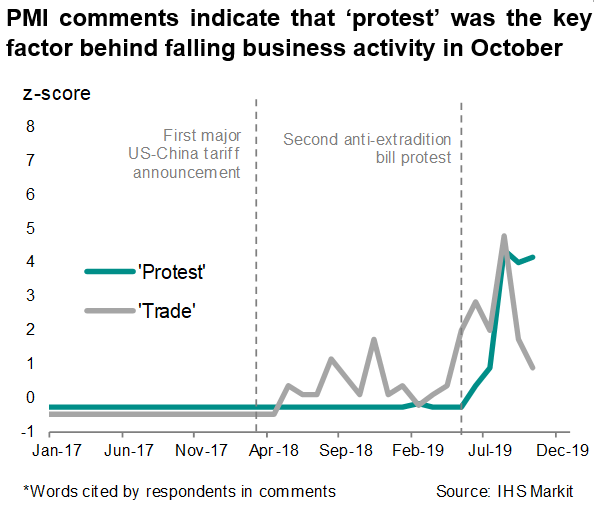

The PMI is a composite index based on five key survey variables, some of which showed even steeper declines. Most notably, output fell to the greatest extent since the survey began in July 1998, often attributed to demand being hit by protest-related disruptions and increasing trade protectionism. New business intakes showed the steepest decline since the start of 2009.

Driving the reduction in demand was a record drop in orders from mainland China, as well as another sharp fall in overseas sales.

Delving further into the survey details revealed particularly steep sales declines in the services and wholesale/retail sectors. Anecdotal evidence also continued to highlight that retail and tourism sectors remained affected by the domestic situation.

Business gloom intensifies

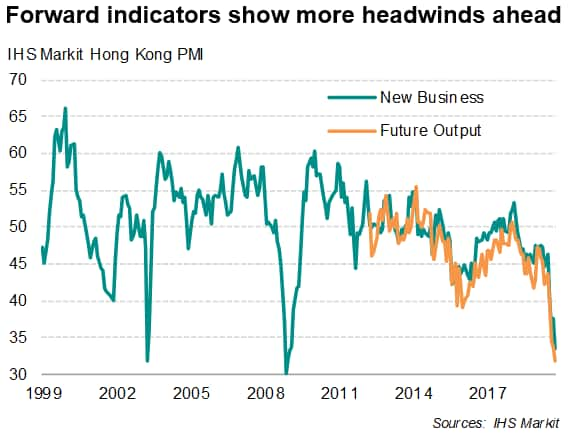

As overall demand conditions continued to worsen, private sector firms became increasingly pessimistic about the outlook. Business expectations about output in the year ahead fell to the lowest since data on this indicator were first available just over seven-and-a-half years ago. Companies were especially concerned about the impact of protests and a deterioration in the global trade environment on economic activity.

Rising costs

Adding to the economic woes were rising input costs. Following three months of decline, overall input prices rose in October, driven by a combination of higher prices for purchases and increased wages. Firms not only had to absorb the rise in costs amid the economic downturn but also provided price discounts to boost sales, thereby compressing margins. Prices charged for goods and services fell for a fourth month running, though the rate of decrease moderated from September.

Outlook

With headwinds from China-US trade conflicts and political crisis showing no signs of letting up in coming months, the worst for the Hong Kong SAR's economy may still not be over yet. Should the city-wide unrest extend over to next year with a further escalation in protest violence, we expect a 0.2% decline in real GDP for 2019, followed by only a marginal 0.1% rise in 2020.

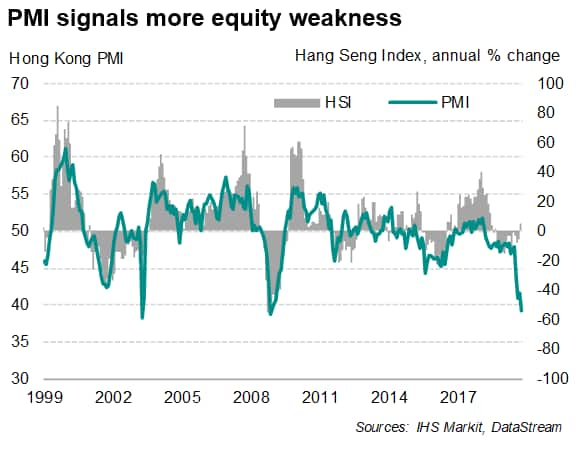

In the meantime, strong volatility in the local stock market is expected, with the PMI pointing to greater downward pressure on equity prices.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Press release

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-HKSAR-economy-suffering-biggest-fall-in-output-for-over-two-decades-Nov19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-HKSAR-economy-suffering-biggest-fall-in-output-for-over-two-decades-Nov19.html&text=PMI+shows+Hong+Kong+SAR+economy+suffering+biggest+fall+in+output+for+over+two+decades+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-HKSAR-economy-suffering-biggest-fall-in-output-for-over-two-decades-Nov19.html","enabled":true},{"name":"email","url":"?subject=PMI shows Hong Kong SAR economy suffering biggest fall in output for over two decades | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-HKSAR-economy-suffering-biggest-fall-in-output-for-over-two-decades-Nov19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+shows+Hong+Kong+SAR+economy+suffering+biggest+fall+in+output+for+over+two+decades+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-shows-HKSAR-economy-suffering-biggest-fall-in-output-for-over-two-decades-Nov19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}