Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2025

October IMI data indicate expectations for positive market returns in the near-term

The latest S&P Global Investment Manager Index (IMI) pointed to a recovery in risk sentiment among US equity investors at the start of the fourth quarter, supported principally by lower US interest rates. The was as S&P Global's US Purchasing Managers' Index (PMI) survey indicated how business activity was being supported by recent buoyancy of equity markets and lower borrowing costs. That said, whether central bank policy will be a bigger positive influence upon US equity returns in the near term remains a question, amid mixed signals for future FOMC rate decisions from PMI data showing softening US growth and still elevated price pressures.

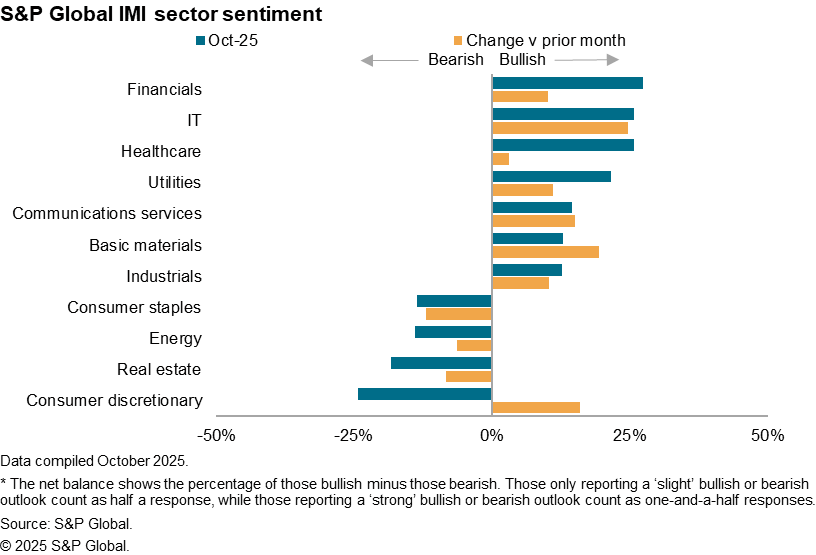

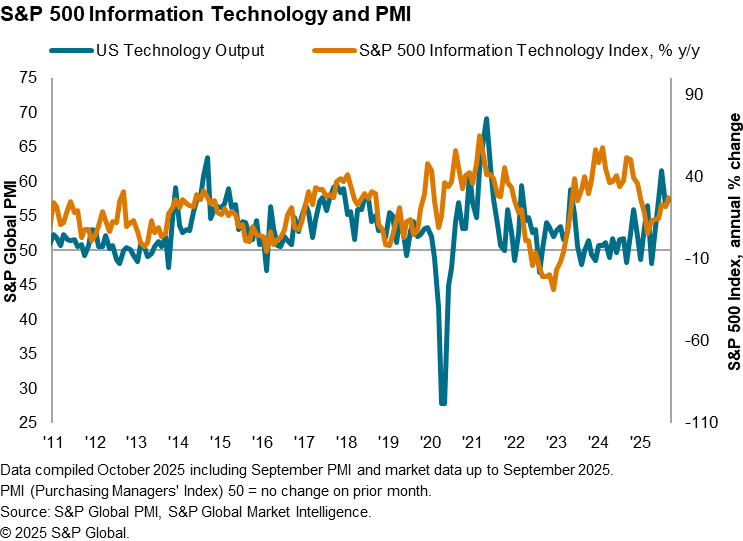

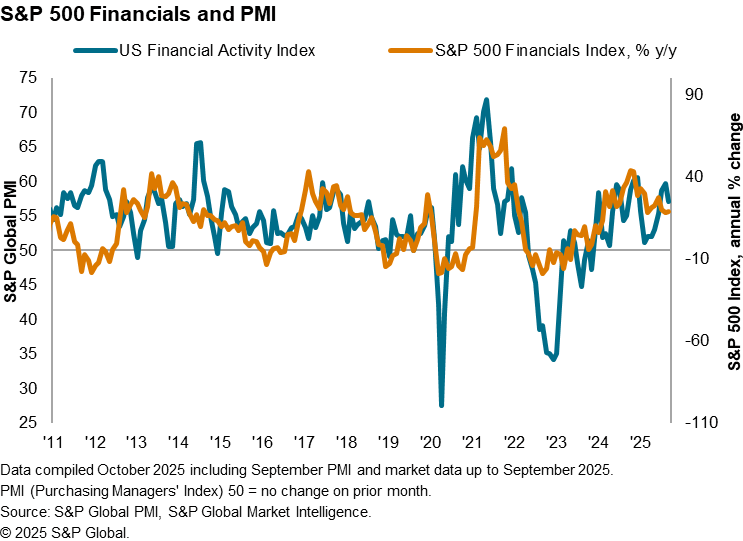

Looking at sector specifics in more detail, US equity investors are the most bullish towards the financial and information technology sectors, which are also the sectors providing much of the support to the recent US PMI data, underscoring the dependence of both the economy and equity market on these sectors.

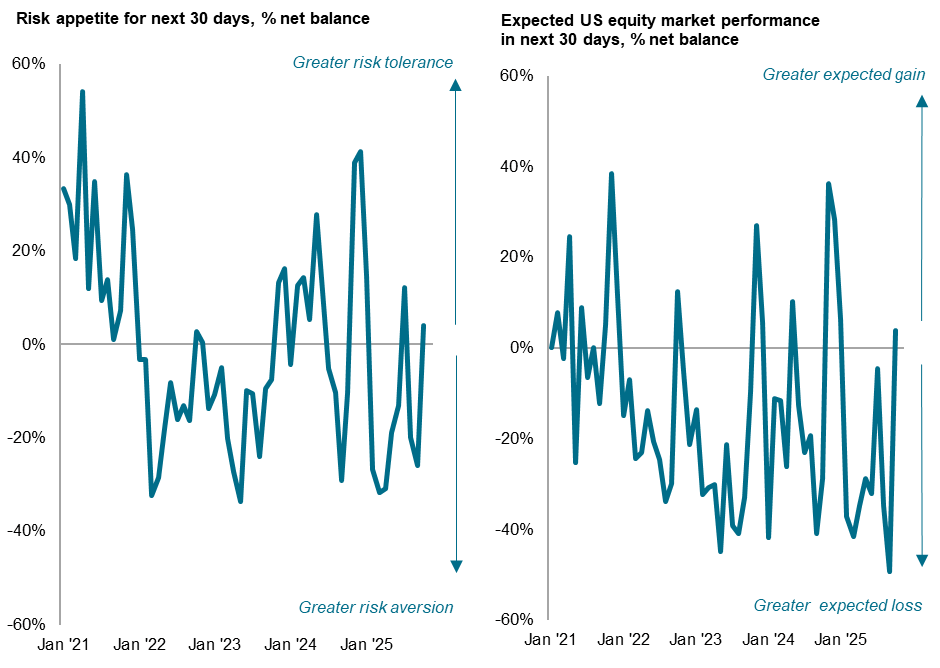

US equity investor risk appetite returns for the first time since July

The October S&P Global Investment Manager Index survey, which tracks views from a panel of just under 300 participants employed by firms that collectively represent approximately $3,500 billion assets under management, revealed that both risk sentiment and market performance expectations recovered in October. The IMI's Risk Appetite Index edged back into positive territory for the first time since July, rising from -26% in September to +4%.

Source: S&P Global

Similarly for the survey's equity returns index, the net balance returned to positive territory for the first time since January, pointing to expectations for further equity market gains in the month ahead.

While the data collection period (October 6-9) was just ahead of news of potential additional tariffs on Chinese imports to the US, the swift recovery in equity prices, as both the US and mainland China authorities attempted to de-escalate the situation, suggests that the market is currently looking past the event.

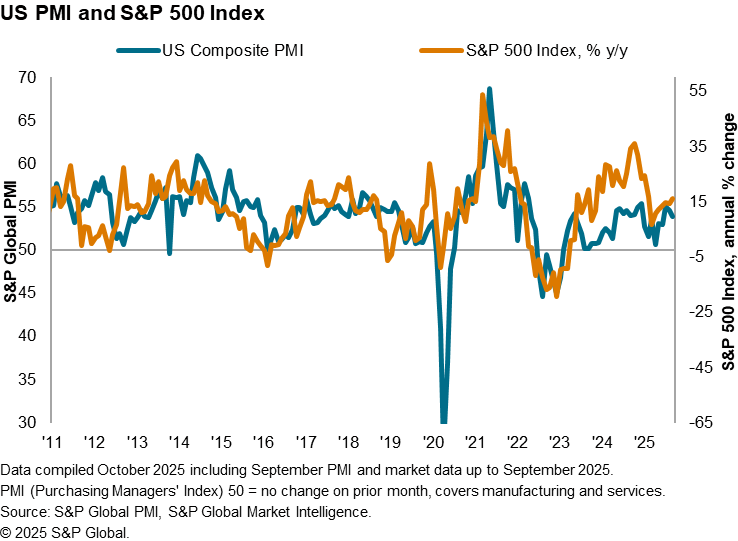

US PMI and the S&P 500 index

Rising over 3.5% in September, the S&P 500 index's monthly gains have certainly been among the better seen so far this year. As such, concerns over elevated prices have persisted and that has also been reflected in the latest IMI survey's question on market drivers. Little changed from the peak recorded at the start of September, concerns regarding equity valuations remain elevated among US equity investors in October, acting as the biggest drag on near-term equity performance of all factors tracked by the IMI.

Certainly, a comparison of the S&P 500 index and the US PMI revealed a widening divergence at the end of the third quarter, which will be worth monitoring.

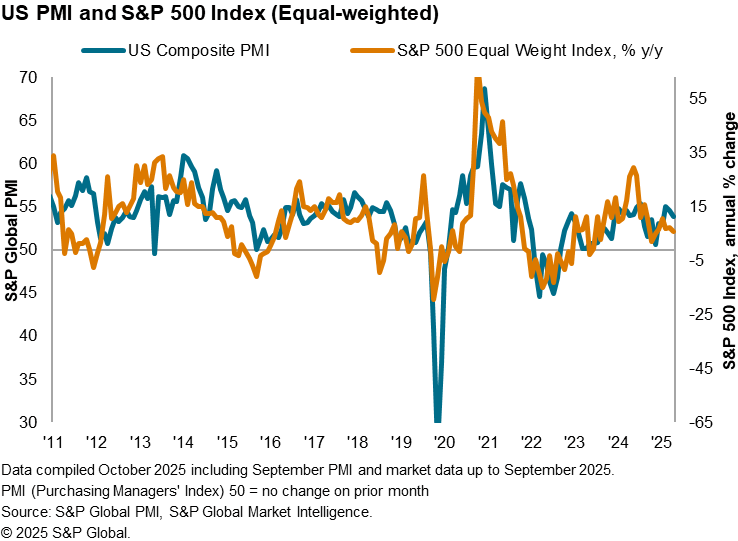

However, a similar comparison between the equal-weighted S&P 500 index and the US PMI, which are more closely aligned due to the absence of large swings attributed to a handful of large-cap stocks, showed that the S&P 500 index's gains are in fact falling short of the trend suggested by PMI data.

Even with recent gains, the equal-weighted index may still have room to go on the upside, and US equity investors are anticipating US central bank policy to be the wind beneath the wings for further equity market gains in the near-term. Notably, optimism for central bank policy to be a supportive factor for equity market returns is at the highest for a year, according to the IMI survey.

Overall, despite investor sentiment having improved, the PMI data are suggesting that economic fundamentals may be shifting, especially in the manufacturing sector, in ways that will be worth watching in the coming months.

Most notably, inventory data suggest that recent US manufacturing production growth has been buoyed by goods producers working through their stockpiles of inputs, accumulated prior to the implementation of higher tariffs. On one hand, the potential for eventual payback poses a risk to US economic growth, and we may see some discounting as producers seek to shift this inventory accumulation. ON the other hand, further down the line, the delayed passthrough of higher tariffs to rising CPI as the stockpiles deplete adds to odds of lesser rather than more Fed cuts in 2026. For now, at least, the IMI survey reflected that US equity investors continue to recognize threats from the US macroeconomic environment to a similar degree in September.

Financial and tech stock comparisons

Zooming into sector preferences among US equity investors at the start of the final quarter of 2025, the recent IMI survey revealed that investors are expecting a more broad-based improvement in equity performance by sector, with investors now bullish towards seven of the 11 sectors, the highest in three months. This corresponds to the abovementioned likelihood for further gains on the equal-weighted S&P 500 index with a broadening out of the rally.

Most notably, the financial sector reclaimed the top spot as bullish sentiment climbed to a three-month high. However, it is the information technology (IT) sector that is in the limelight with the biggest monthly uplift of bullish sentiment among the 11 sectors tracked. With the ongoing positive sentiment still circling the AI-led technology cycle, the latest data showed that investors have become more bullish towards the IT sector into the final quarter of the year.

That said, sector comparison between the S&P 500 technology sector index and the US Technology sector PMI showed that prices have risen on trend presently. Any outsized gains for the S&P technology sector index, especially amid subdued PMI future output expectations could point to deviations between equity market and economic fundamentals.

A comparison between the financial sector PMI and the corresponding equity index meanwhile showed that there remains room for further equity price gains in this sector given the macro fundamentals, with the PMI future activity index having also climbed to an above-average level in September.

Access the S&P Global Investment Manager Index press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foctober-imi-data-indicate-expectations-for-positive-market-returns-in-the-nearterm-oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foctober-imi-data-indicate-expectations-for-positive-market-returns-in-the-nearterm-oct25.html&text=October+IMI+data+indicate+expectations+for+positive+market+returns+in+the+near-term+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foctober-imi-data-indicate-expectations-for-positive-market-returns-in-the-nearterm-oct25.html","enabled":true},{"name":"email","url":"?subject=October IMI data indicate expectations for positive market returns in the near-term | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foctober-imi-data-indicate-expectations-for-positive-market-returns-in-the-nearterm-oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=October+IMI+data+indicate+expectations+for+positive+market+returns+in+the+near-term+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foctober-imi-data-indicate-expectations-for-positive-market-returns-in-the-nearterm-oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}