Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 21, 2025

November flash PMI adds to signs of improved fourth quarter eurozone growth

The Eurozone economic recovery continued into November, according to the flash PMI, meaning the fourth quarter so far has seen the best upturn in business activity for two and a half years. Growth remains relatively modest, however, tempered by subdued business optimism about the economic outlook and uncertainty over the political landscapes both domestically and internationally.

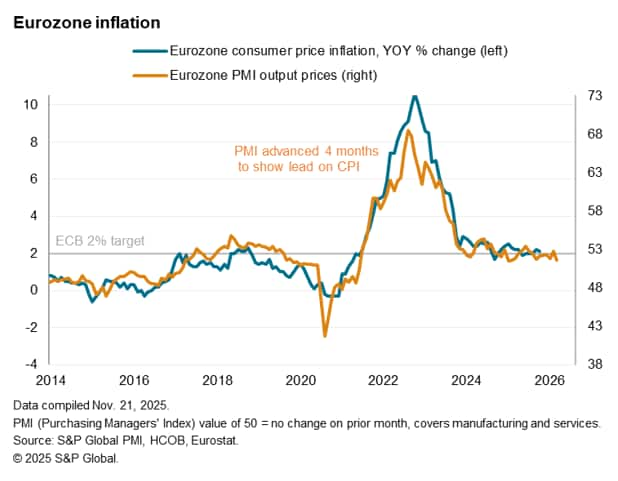

Selling price inflation meanwhile cooled which, alongside the modest but improved growth performance seen in recent months, likely leaves the ECB in a holding position in terms of monetary policy.

Eurozone growth sustained into November

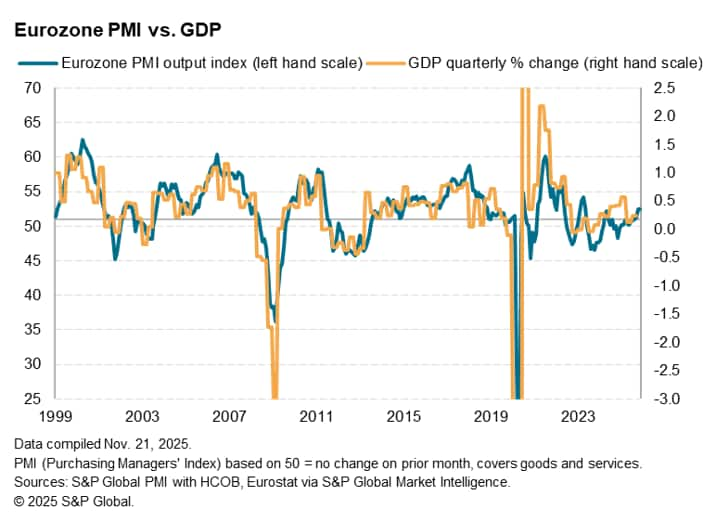

A solid rise in output in November after an improved performance in October represents the best back-to-back monthly expansions for eurozone businesses since the spring of 2023. The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, posted 52.4 in November, down only fractionally from 52.5 in October and therefore signalling a further solid monthly rise in business activity.

Output has now increased in each of the past 11 months, with the PMI over the fourth quarter so far consistent with quarterly GDP growth of just over 0.3%.

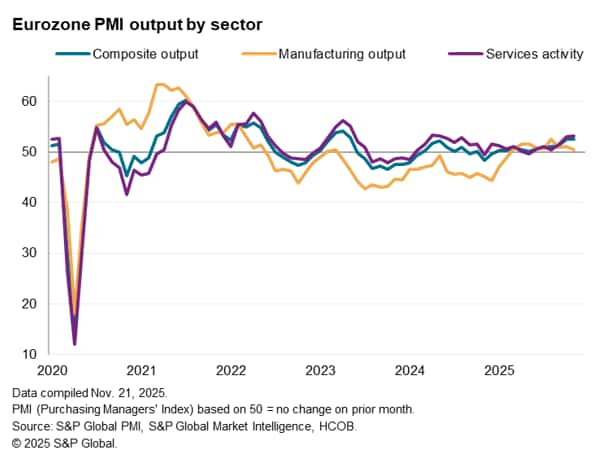

The expansion in business activity continued to be centred on service providers, where activity grew in November at the fastest pace for a year-and-a-half.

Although manufacturing production increased only slightly, the current nine-month growth spell has been the best reported by the goods-producing sector since 2022.

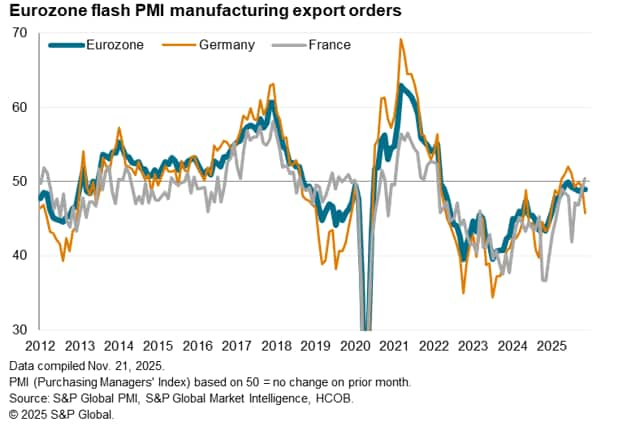

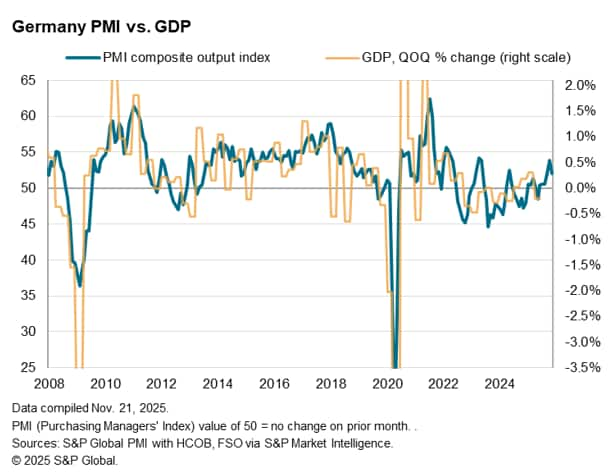

By country, output growth slowed in Germany but the flash composite PMI was nevertheless still the second highest recorded over the past 18 months at 52.1. Growth was again led by the services economy as Germany's factories reported a slowing in output growth, linked in part to a fading of the tariff front-loading that had helped boost output in prior months, as factories shipped goods to the US. German manufacturing exports fell steeply, dropping at the sharpest rate since last December.

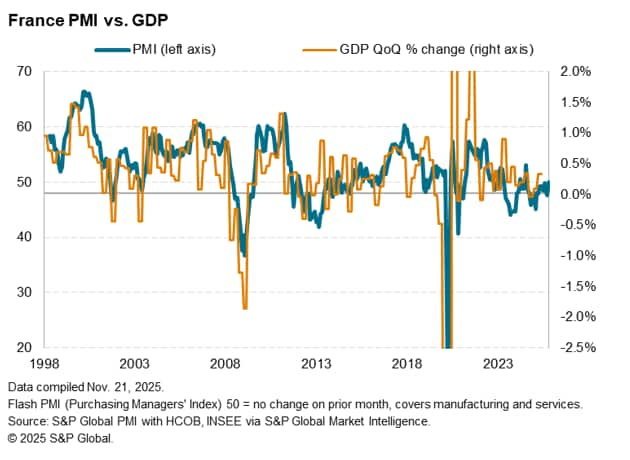

As growth slowed in Germany, France saw a welcome near-stabilization of business activity. The French composite flash PMI rose to a 15-month high of 49.9, helped by a return to growth in the service sector for the first time in 15 months. In contrast, French manufacturing output fell at the sharpest rate for nine months, as a drop in domestic demand more than offset the first rise in goods exports since February 2022.

The best performance in November, however, was seen in the rest of the eurozone, where output rose at the fastest pace since April 2023. These countries collectively reported a further strong rise in services output alongside the second-largest increase in manufacturing output seen since the pandemic.

Measured overall, the flash PMI data are indicative of GDP rising at an approximate 0.3% quarterly pace in Germany so far in the fourth quarter but signal broadly stalled French economic growth of just under 0.1%.

Future expectations edge higher but remain subdued

Business sentiment ticked up in November but nonetheless remains below the survey's long-run average. Companies were again concerned by global economic worries, widely linked to uncertainty over US trading policies, as well as more domestically focused issues, such as policy instability in France and competitiveness.

Sentiment improved across Germany, France and the rest of the eurozone. Although France continued to lag in terms of optimism, largely reflecting concerns over domestic political stability, some of these political concerns eased during November.

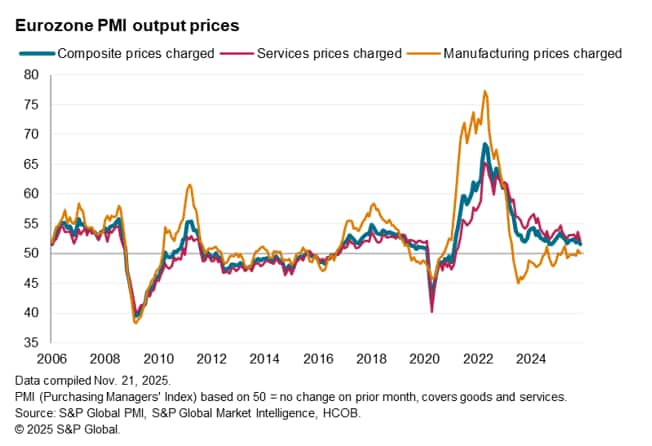

Inflation at target

Output price inflation cooled in November, slowing to the weakest in just over a year and pointing to only a modest monthly rise in charges across the eurozone. Manufacturers kept their selling prices unchanged, while in services the pace of inflation eased to the slowest since April 2021.

At its current level, the PMI's selling price gauge is broadly consistent with the ECB's inflation target of 2%.

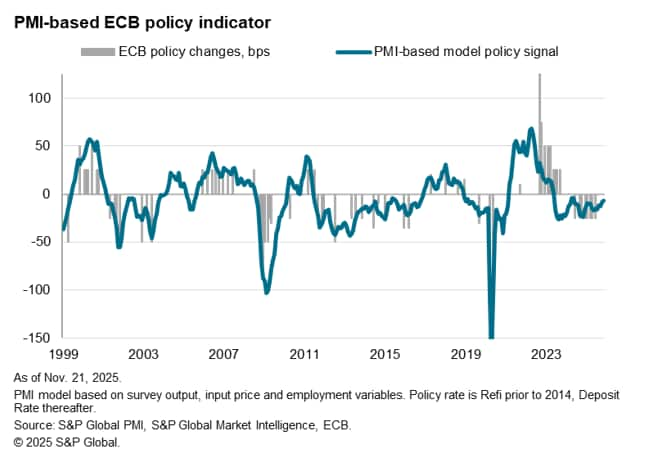

Policy signal closer to neutral

A composite ECB policy indicator based on key PMI gauges suggests an ongoing easing bias to policymaking. However, this indicator has risen to its highest since May 2024 to suggest that the economic environment is moving toward a more neutral interest rate setting.

As such the survey data point to a high bar to any further imminent rate cuts. The ECB has already reduced interest rates by 25 basis points eight times in this cycle, taking the Deposit Rate to 2.00% from a peak of 4.00% in the first half of 2024.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnovember-flash-pmi-adds-to-signs-of-improved-fourth-quarter-eurozone-growth-nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnovember-flash-pmi-adds-to-signs-of-improved-fourth-quarter-eurozone-growth-nov25.html&text=November+flash+PMI+adds+to+signs+of+improved+fourth+quarter+eurozone+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnovember-flash-pmi-adds-to-signs-of-improved-fourth-quarter-eurozone-growth-nov25.html","enabled":true},{"name":"email","url":"?subject=November flash PMI adds to signs of improved fourth quarter eurozone growth | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnovember-flash-pmi-adds-to-signs-of-improved-fourth-quarter-eurozone-growth-nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=November+flash+PMI+adds+to+signs+of+improved+fourth+quarter+eurozone+growth+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnovember-flash-pmi-adds-to-signs-of-improved-fourth-quarter-eurozone-growth-nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}