Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 11, 2019

New construction opportunities for the REIT model

Research Signals - February 2019

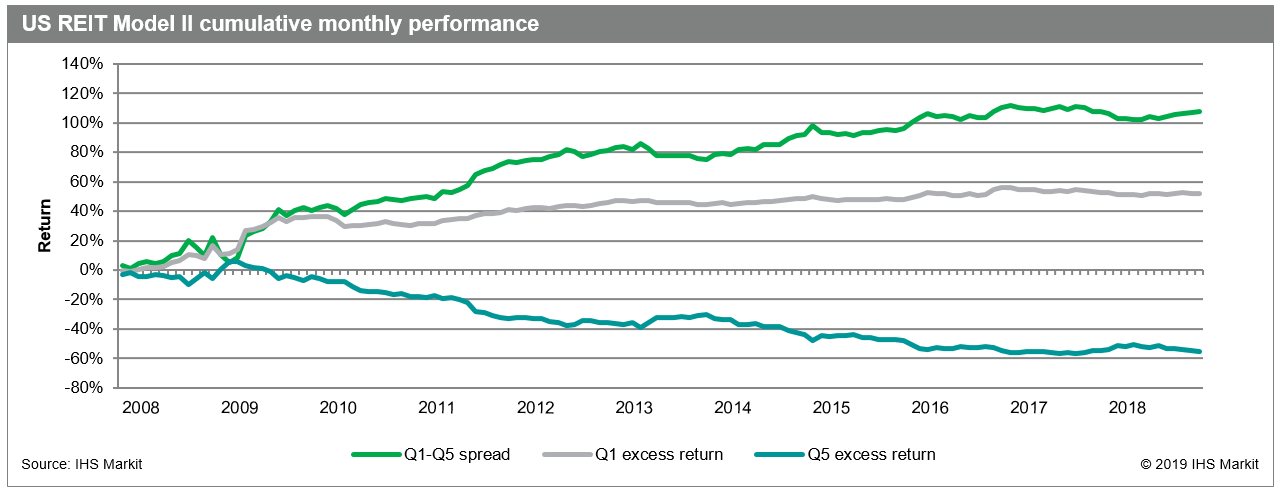

The Research Signals REIT Model II combines various fundamental indicators, property-level metrics, demographic trends and investor sentiment to differentiate leaders and laggards in the real estate sector. We review recent enhancements in the construction of the model, with the underlying methodology remaining a rigorous bottom-up approach designed to systematically evaluate publicly traded US REITs.

- Model developments include incorporation of a new data source and reassessment of all factors, supporting deeper scrutiny of the industry given the recent separation of REITs from financials as its own sector classification

- The REIT Model II buy-rated portfolio outperformed the sell-rated portfolio by 0.81% per month, or 9.77% annualized, over our recently expanded REIT universe and we further demonstrate its successful use as a weighting scheme in long-only active and passive portfolio construction

- All sub-composites recorded positive average monthly return spreads with the most notable results associated with Price Momentum (1.14%) followed by Value (0.49%), which incorporates a key enhancement to the capitalization rate

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-construction-opportunities-for-the-reit-model.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-construction-opportunities-for-the-reit-model.html&text=New+construction+opportunities+for+the+REIT+model+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-construction-opportunities-for-the-reit-model.html","enabled":true},{"name":"email","url":"?subject=New construction opportunities for the REIT model | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-construction-opportunities-for-the-reit-model.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+construction+opportunities+for+the+REIT+model+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-construction-opportunities-for-the-reit-model.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}