Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 04, 2019

Muni Monthly Summary - October 2019

In this month's blog we review a couple of instances wherein uncertainty in the outcome of litigation has led to a bumpy ride for some bondholders.

We focus on the following bonds

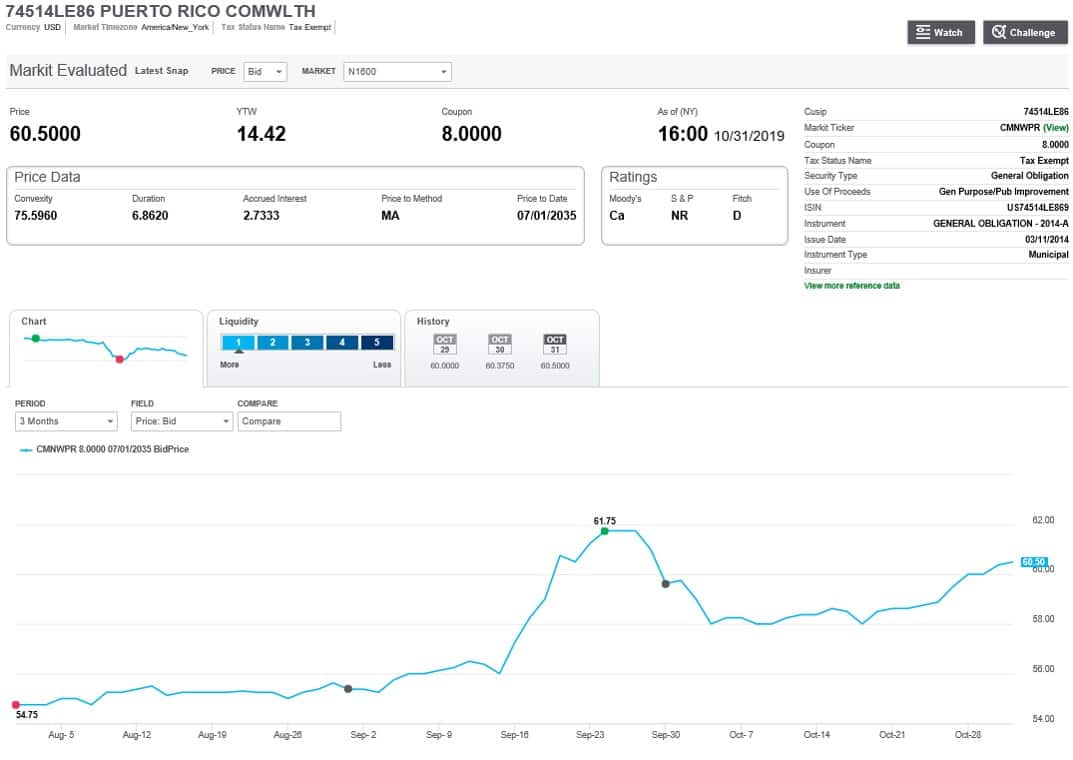

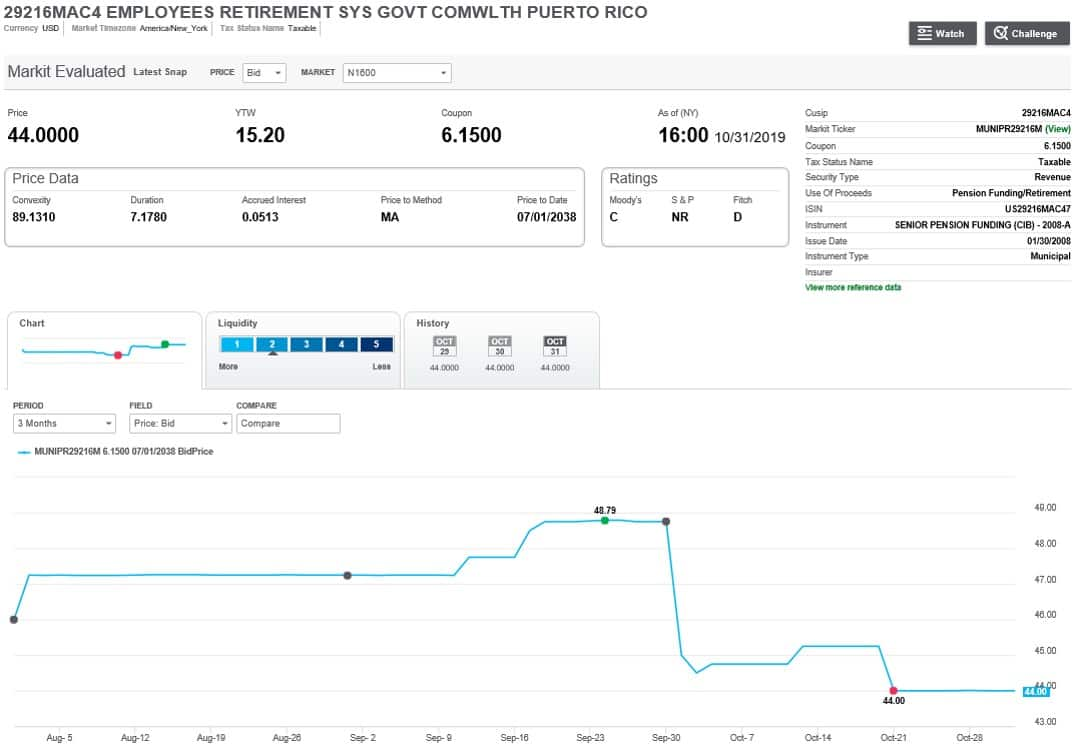

- Puerto Rico General Obligation bonds and PR Pension Bonds

- Witnessed volatility as Puerto Rico's Plan of Adjustment is being discussed

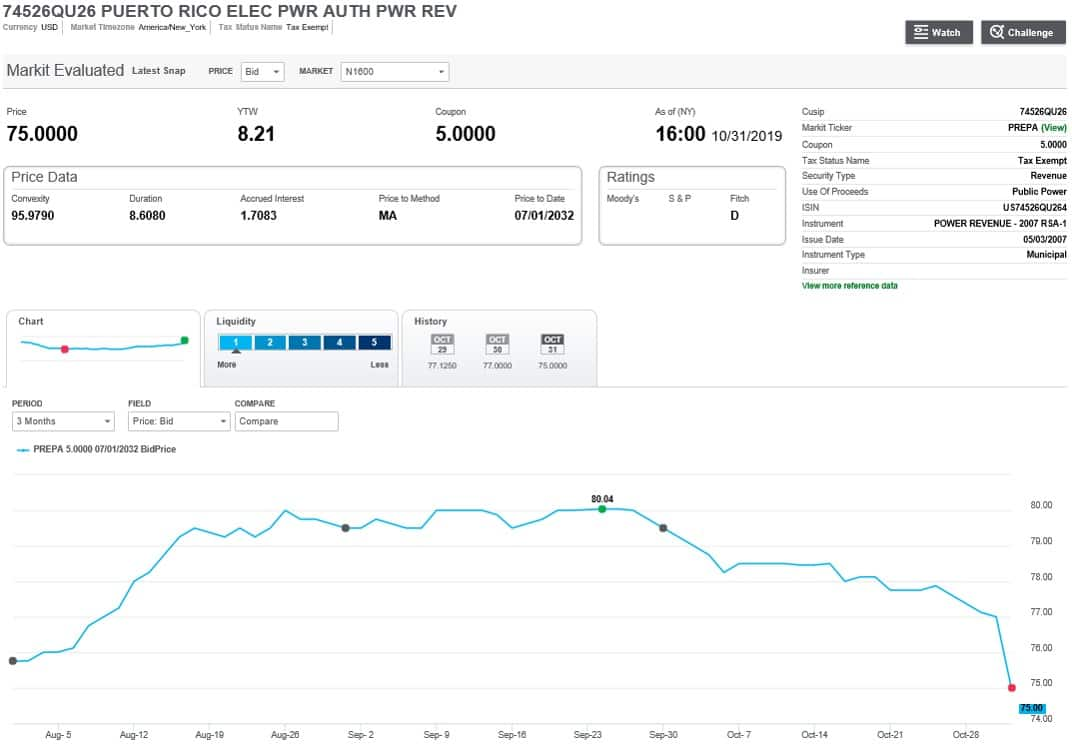

- Puerto Rico Electric Power Authority bonds

- Traded weaker on the last day of October 2019 as there was a request to reject a proposal of restructuring

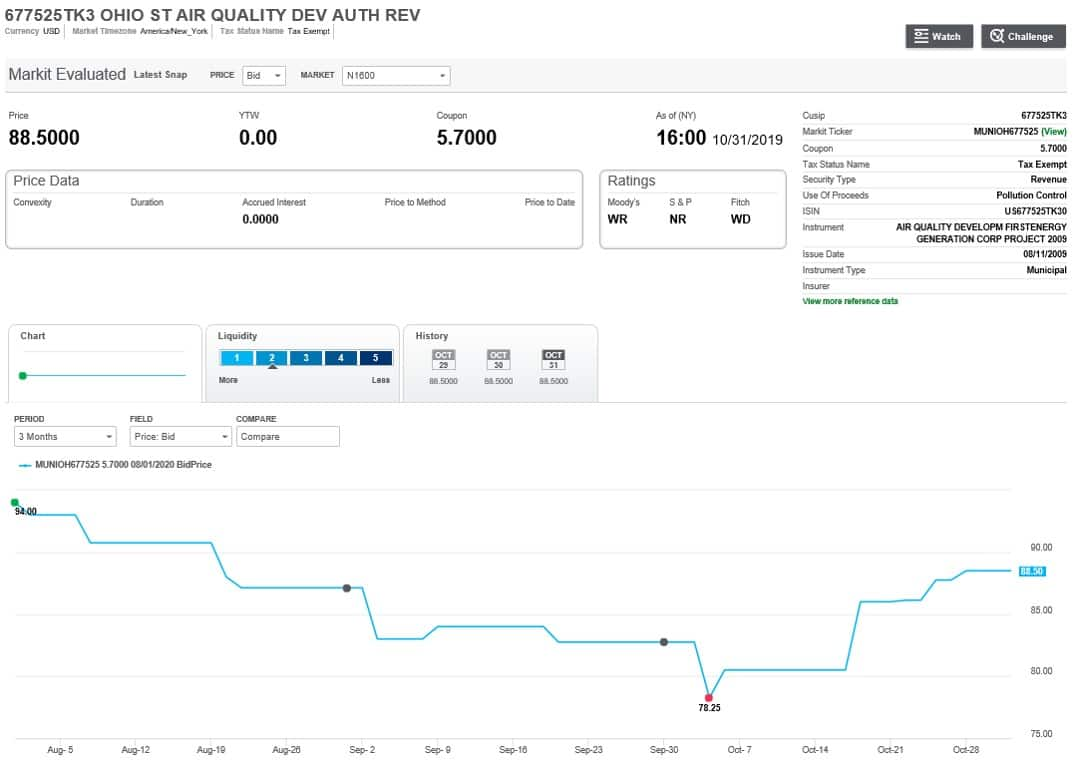

- 5.7% Ohio State First Energy Bonds maturing in 2020

- Unsecured bonds issued by First Energy Solutions traded stronger in the middle of October 2019 as news of its bankruptcy plan being approved came out

Puerto Rico 8% GO bonds due in 2035 had a volatile October. Bonds moved from close to 62.5 cents to a dollar in the last week of September to a low of 58 cents in the second week of October 2019 and back to over 60 cents at the end of October 2019. Source: Price Viewer

Puerto Rico Pension bonds with 6.15% due in 2038 moved from close to 49 cents to a dollar in the last week of September to 44 cents in the third week of October 2019.

PREPA 5% revenue bonds had a volatile October. Bonds moved from close to 80 cents to a dollar in the last week of September to 75 cents on the last day of October 2019 as news on its restructuring possibly being impacted came out.

Similarly, Ohio First Energy bond prices were volatile in September and October 2019. Ohio First Energy 5.7% bonds due in 2020 moved from close to 83 cents to a dollar in the last week of September to a low of 78.5 cents in the first week of October 2019 and back to over 88 cents at the end of October 2019.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuni-monthly-summary--october-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuni-monthly-summary--october-2019.html&text=Muni+Monthly+Summary+-+October+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuni-monthly-summary--october-2019.html","enabled":true},{"name":"email","url":"?subject=Muni Monthly Summary - October 2019 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuni-monthly-summary--october-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Muni+Monthly+Summary+-+October+2019+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuni-monthly-summary--october-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}