Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 06, 2020

Momentum factors shut down value strategies

Research Signals - September 2020

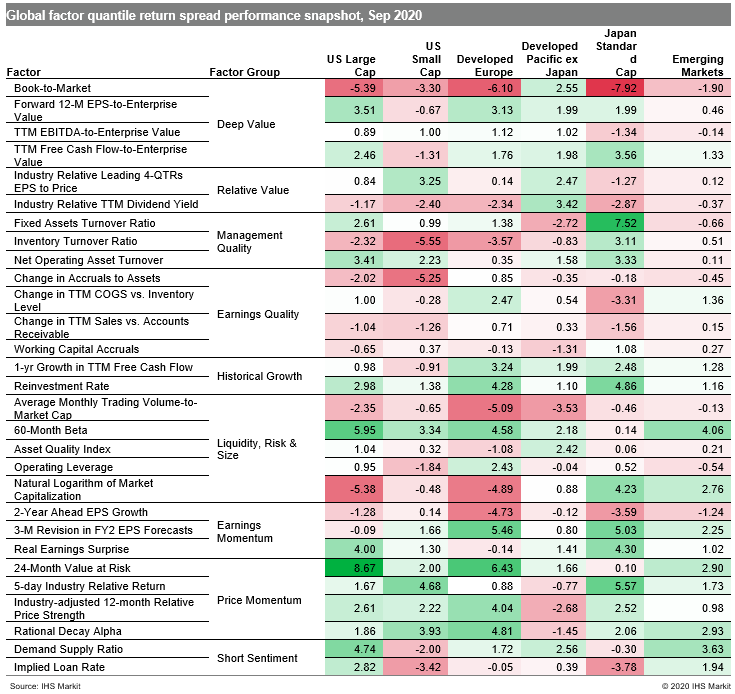

Many regional stock markets struggled in September, trimming their advance over the quarter, with concerns that the rising number of coronavirus cases may result in further restrictions to contain its spread. However, investors sought high momentum stocks, while avoiding undervalued names across most of our coverage universes (Table 1). Business sentiment also hit its highest level since May 2018, according to the J.P.Morgan Global Manufacturing PMI survey, with the headline figure rising to a 25-month high.

- US: Price Momentum measures returned to their leading role, replacing Deep Value which traversed to the bottom of the factor performance spectrum, as confirmed directionally by Industry-adjusted 12-month Relative Price Strength and Book-to-Market, respectively

- Developed Europe: Investors' style preferences mirrored that of US large caps, as captured by outperformance to measures such as Rational Decay Alpha and underperformance to Book-to-Market

- Developed Pacific: Demand Supply Ratio, a Short Sentiment indicator measuring the amount of stock borrowed relative to its lendable inventory, was a highly rewarded indicator in markets outside Japan

- Emerging markets: Investors showed a preference for high momentum stocks (e.g., Rational Decay Alpha), while avoiding high risk names (e.g., 60-Month Beta)

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-factors-shut-down-value-strategies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-factors-shut-down-value-strategies.html&text=Momentum+factors+shut+down+value+strategies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-factors-shut-down-value-strategies.html","enabled":true},{"name":"email","url":"?subject=Momentum factors shut down value strategies | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-factors-shut-down-value-strategies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Momentum+factors+shut+down+value+strategies+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmomentum-factors-shut-down-value-strategies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}