Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 10, 2025

Mixed export performance seen across goods producers in Asia

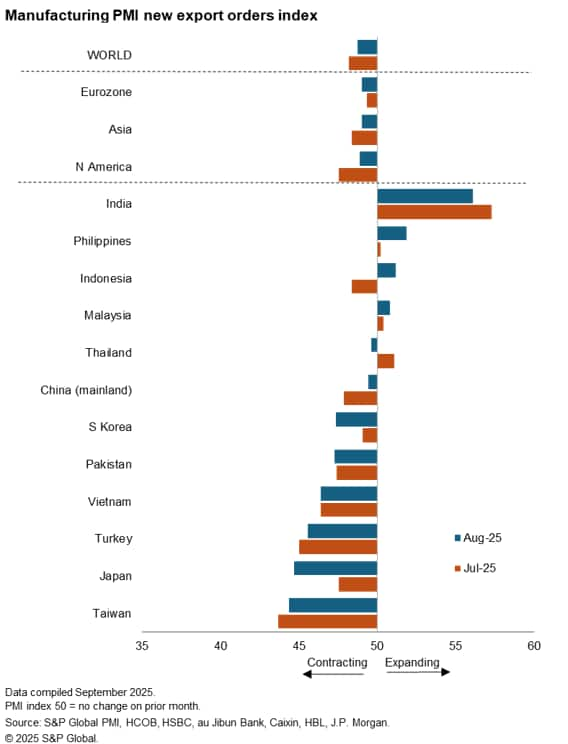

Global goods producers reported a fifth consecutive monthly decrease in export orders in August, the decline dating back to the initial bout of tariff announcements in April. However, while the rate of decline remained only modest, and broadly similar across North America, the Eurozone and Asia, the latter saw divergent trends across the region, ranging from steep export declines in Taiwan and Japan to rising exports in India and the Philippines.

India continues to outperform

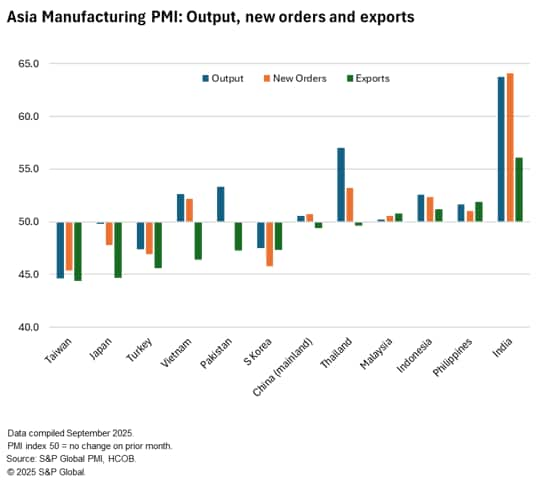

August PMI data saw just four of the 12 monitored PMI surveys in Asia register an expansion in foreign demand for manufactured goods. By a considerable margin, India led growth of new export orders, while there were also sustained rises in Malaysia and the Philippines. Indonesia was the only other economy to record an uplift in international sales, registering growth for the first time in five months.

The Philippines notably saw the rate of growth in export orders reach the highest since the start of 2025, while Indonesian manufacturers signalled the steepest rise in just under two years. Both economies are among those which agreed a lower tariff with the US ahead of 1 August. The other winner in the region was Malaysia, where foreign sales improved to the greatest extent since July 2024, benefitting from its own trade agreement with the US.

Of the eight Asian economies which saw a reduction in international sales, Mainland China and Thailand recorded a rise in total new orders, but a sustained decline in exports, suggesting growth here was largely due to domestic demand improvements. Taiwan, Japan, Vietnam, Turkey and Pakistan meanwhile all saw the rate of moderation in foreign demand exceed the fall in aggregate new orders, an indication that overall demand was weighed down by poorer export conditions.

South Korea, a key market and bellwether for global trade due to its manufacturing sector being so deeply integrated in global supply chains, continued to see weakness across the goods-producing sector in August. While some firms mentioned that domestic economic conditions were subdued, foreign sales were down for the fifth consecutive month, dropping at the fastest pace since the initial tariff announcements in April.

Some tariff relief but barriers remain

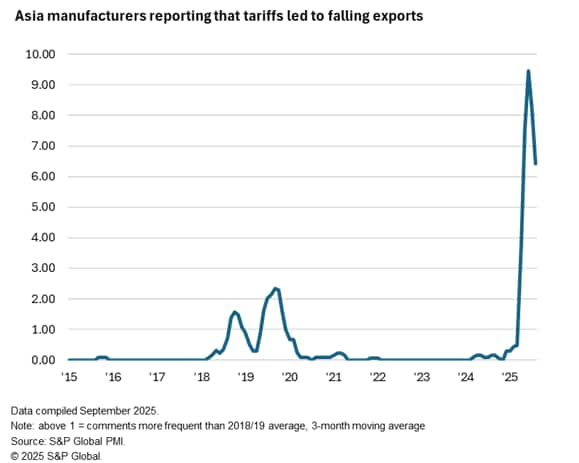

As the global trade environment has continued to adjust to frequent changes in US tariff policy, anecdotal evidence provided by manufacturing firms responding to PMI surveys across Asia often indicated that tariffs continued to be cited as a key factor hindering export demand.

Where export sales were reportedly lower, comments from the PMI survey panel suggested that the number reasons given by goods producers which mentioned "tariffs" were around six times higher than the average seen during the initial round of tariffs introduced during President Trump's first term. Moreover, this is almost double the number seen in our initial analysis back in May, and only slightly lower than the series record seen in June.

While a swathe of trade agreements were announced ahead of the Trump administration's self-imposed deadline of 1 August, the PMI data indicate that a strong degree of uncertainty remains prevalent among goods producers in Asia.

Two of the largest economies in the region, Japan and South Korea, have seen their reciprocal tariffs reduce from 25% to 15%, while Indonesia, Malaysia, Vietnam and the Philippines have seen a reduction to 19%. That said, the condition has been placed on Vietnam that the 19% tariff will only apply on goods that are not shipped via Mainland China - where the tariff is 40%.

On the other hand, India (as mentioned above) and Mainland China remain without trade agreements with the US, with the latter engaged in continued negotiations. At the time of writing, there has not been a framework agreed, with a further pause on higher tariffs until 10 November being announced.

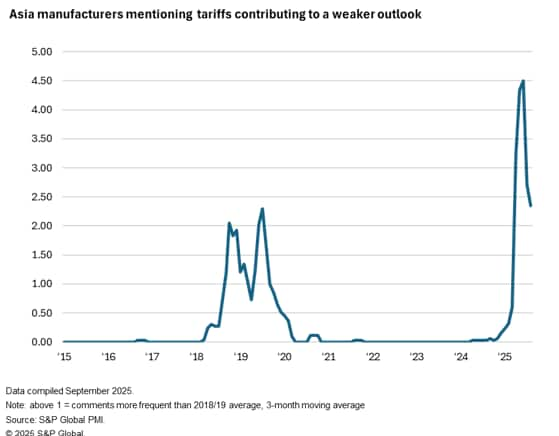

Expectations remain historically subdued across Asia

Looking at Asian manufacturers' expectations regarding the outlook for output over the coming year, the overall degree of positive sentiment was subdued in August compared to the historical average. Although the degree of optimism has improved from April's recent low to reach a five-month high, it remained below the average seen since 2012.

Of those monitored economies in Asia, manufacturers continued to mention tariffs as a key source of uncertainty and a headwind to the outlook for production. That said, comment analysis suggested that mentions of tariffs have eased from a survey high in April, albeit remaining twice as widespread than seen during President Trump's first term.

Usamah Bhatti, Economist, S&P Global Market Intelligence

Tel: +44 1344 328 370

usamah.bhatti@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-export-performance-seen-across-goods-producers-in-asia-sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-export-performance-seen-across-goods-producers-in-asia-sep25.html&text=Mixed+export+performance+seen+across+goods+producers+in+Asia+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-export-performance-seen-across-goods-producers-in-asia-sep25.html","enabled":true},{"name":"email","url":"?subject=Mixed export performance seen across goods producers in Asia | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-export-performance-seen-across-goods-producers-in-asia-sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+export+performance+seen+across+goods+producers+in+Asia+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-export-performance-seen-across-goods-producers-in-asia-sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}