Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2025

Manufacturing PMI at 14-month high in August amid broad improvement in worldwide production trends

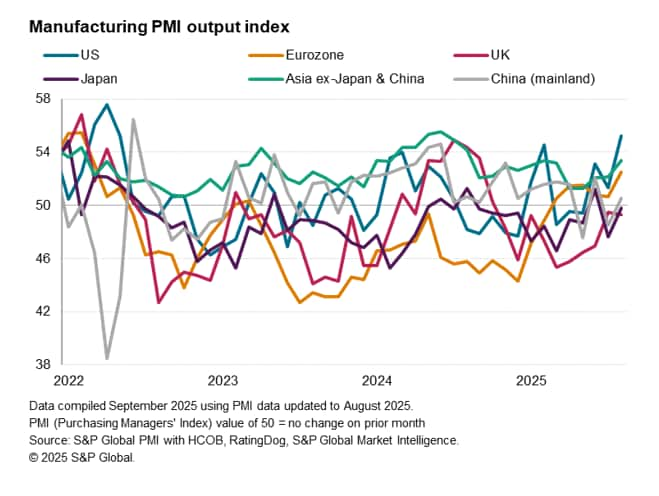

Worldwide manufacturing business conditions improved in August to the greatest extent recorded since June of last year. The upturn was led by a renewed increase in factory output, which in turn reflected a broad-based rise in PMI output sub-indices.

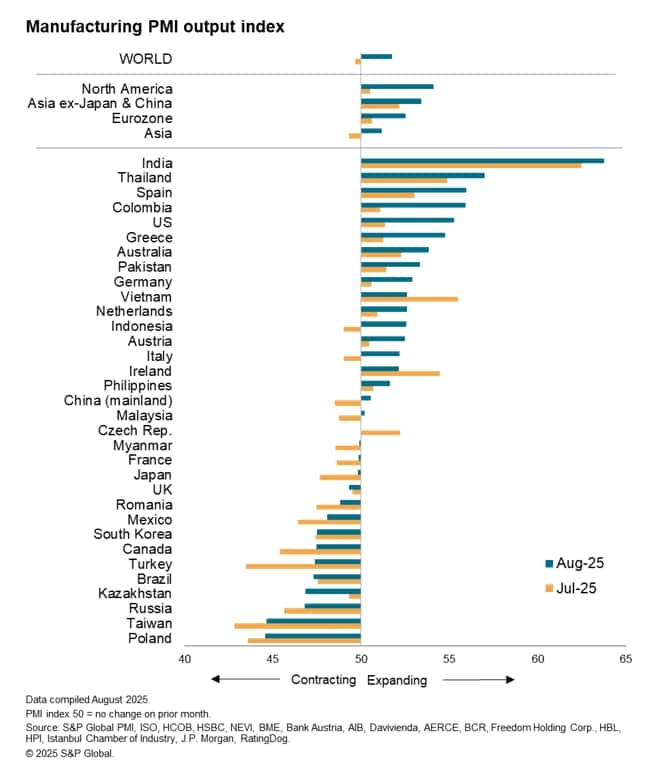

Although trends varied around the world, ranging from especially strong growth in India, Thailand, Spain, Colombia and the US to particularly steep downturns in Poland, Taiwan and Russia, only six of the 33 economies for which PMI data are available reported lower readings compared to July.

We look below at the latest production trends across all 33 economies tracked by S&P Global.

We note that the August data were collected at a time of increased US import tariffs on many economies and uncertainty about further tariff increases in coming months, and the improved production trends could in part be linked to some front-running of these potential tariff hikes. This poses some downside risks to production in the coming months.

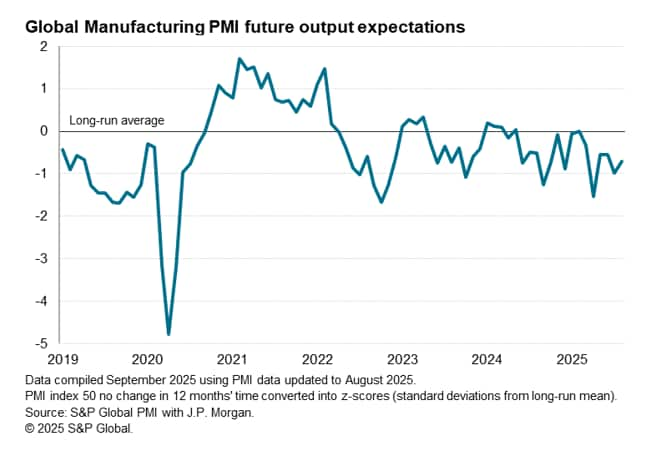

Similarly, while business expectations of production trends in the next 12 months picked up slightly compared to July, and remained well above April's recent low, sentiment remained at one of the lowest levels seen since the pandemic, reflecting global uncertainty over the geopolitical landscape, and in particular the tariff and trade picture going forward.

Nonetheless, the data signalled some resilience of business confidence in many economies, and a sense that peak uncertainty has passed while other factors have helped offset distortions caused by US tariffs.

The PMI data for coming months will therefore be important to assess for further guidance on the global economy's resilience.

Manufacturing conditions improve

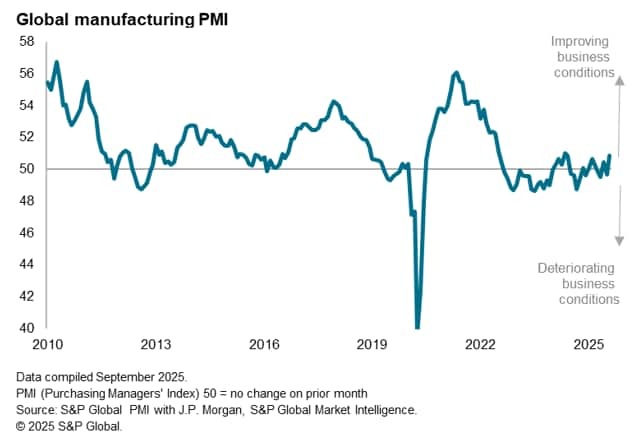

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, rose from 49.7 in July to 50.9 in August, moving back above the 50 'no change' level to indicate a small improvement in business conditions for the second time in the past three months. The latest reading was the highest since June 2024.

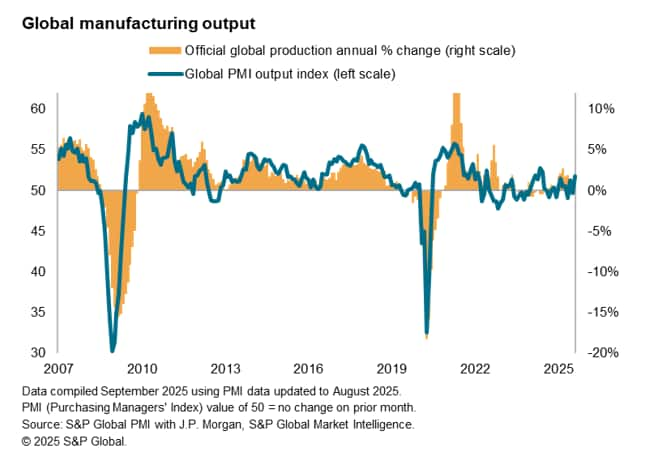

The PMI was lifted in particular by a rise in the sub-index measuring output, which tracks monthly changes in factory production volumes. Output rose in August, registering the strongest production gain since June of last year. Although still relatively modest, indicative of global production rising at an annual rate of about 1.5%, the latest output increase was among the largest seen over the past three years.

Measured globally, new order inflows into factories likewise revived slightly, having dipped in July, registering the best gain since February, though demand was subdued by a further fall in global export orders.

While production trends were very mixed around the world, the majority saw improved performances. Output rose in 18 of the 33 countries for which PMI data are available, and fell in the remaining 15. But it's worth noting that only six economies - the UK, Ireland. Brazil, Vietnam, Kazakhstan and Czechia - saw their performances deteriorate compared to July (i.e. their output indices fell).

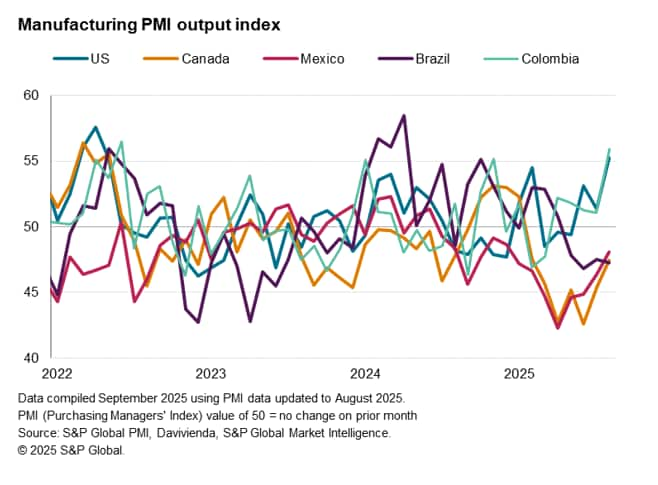

US production surge accompanied by easing downturns in Canada and Mexico

While India reported the strongest expansion of output in August, notching up its best performance since October 2020, the US reported a notable acceleration of growth to the fastest since May 2022 and a pace that outstripped all other major developed economies bar only Spain.

Other major American economies fared less well, with Canada reporting a seventh successive monthly fall in production and output dropping for a fourteenth successive month in Mexico. In both cases, however, rates of decline moderated, hinting in each case that production downturns peaked back in April.

Brazil meanwhile reported a fourth consecutive monthly decline, bucking the easing trend with a slightly steeper rate of contraction, but growth accelerated sharply in Colombia to its highest since June 2022.

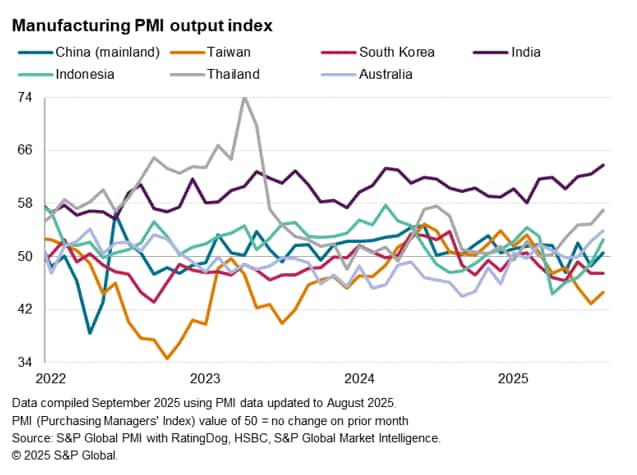

Output indices rise across the APAC region

Trends were mixed in Asia in terms of output expansions and declines, but in all cases performances improved on July in terms of either growth accelerating or downturns moderating in all cases bar Vietnam.

Besides the strong production increase in India, Thailand's manufacturers reported the largest output gain globally, expanding at the steepest rate since July of last year. Production also rebounded in Indonesia to register its first increase since March, and production rose at an increased rate in Pakistan, while mainland China's producers saw a marginal return to growth after output had fallen in July. Growth also ticked higher in the Philippines, to the strongest since April, and Myanmar saw the first increase for 15 months. While growth slowed in Vietnam, the past two months have seen the best performance for a year on average.

In contrast, production fell sharply in both Taiwan and South Korea, dropping for the fifth and sixth successive months respectively. Although the downturns cooled (albeit only very marginally in South Korea), Taiwan's decline was surpassed worldwide in August only by that seen in Poland.

In the wider APAC region, Australia notably reported the largest monthly increase in output since April 2022, building on a solid gain in July.

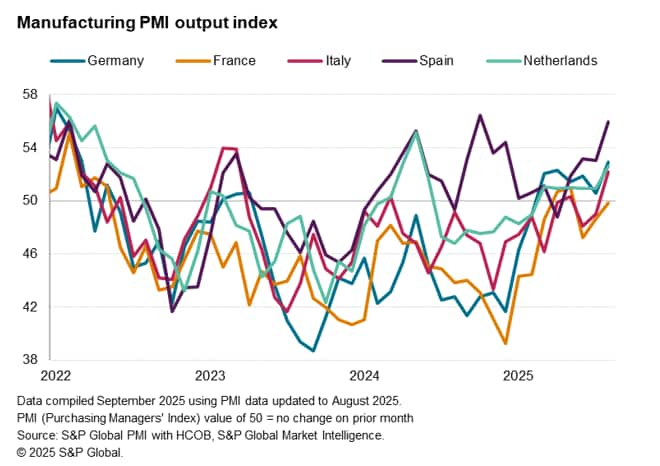

Eurozone output growth highest since March 2022

In Europe, a key development was an acceleration of manufacturing output growth in the eurozone to the fastest since March 2022, with output having now risen for six successive months. Spain recorded an especially steep upturn, with growth hitting the highest since October 2024 and outpaced globally only by that seen in India and Thailand.

Growth also accelerated in Germany, Austria, Italy, the Netherlands and Greece, reaching 41-, 39-, 29- ,15- and five-month highs respectively. While France reported a third successive monthly drop in output, the decline was only marginal, and the smallest seen over this period. Slower growth was meanwhile seen in Ireland, but output has expanded here now for eight successive months.

Although the UK reported the steepest decline of the western European economies in August, its downturn picking up a little pace compared to July, recent months have seen much reduced rates of contraction compared to earlier in the year.

Poland reports steepest downturn

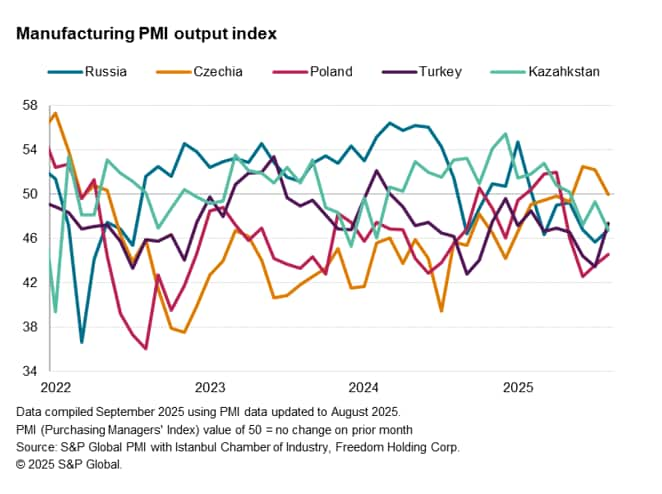

Moving east, downturns were seen in Russia, Poland and Turkey, but moderated in all three cases. Poland's downturn nevertheless was the steepest of all economies surveyed by S&P Global in August.

Kazakhstan's downturn meanwhile picked up pace and Czechia' s manufacturing economy contracted marginally after two months of solid growth.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-at-14month-high-in-august-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-at-14month-high-in-august-Aug25.html&text=Manufacturing+PMI+at+14-month+high+in+August+amid+broad+improvement+in+worldwide+production+trends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-at-14month-high-in-august-Aug25.html","enabled":true},{"name":"email","url":"?subject=Manufacturing PMI at 14-month high in August amid broad improvement in worldwide production trends | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-at-14month-high-in-august-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+PMI+at+14-month+high+in+August+amid+broad+improvement+in+worldwide+production+trends+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-at-14month-high-in-august-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}