Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2025

July UK flash PMI signals further job cuts amid rising costs and slower output growth

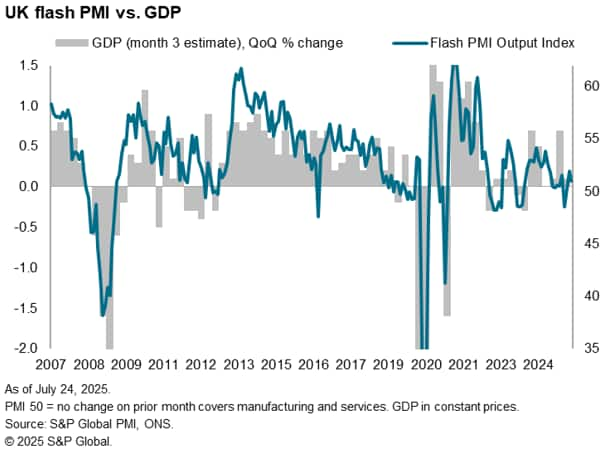

The flash UK PMI survey for July shows the economy struggling to expand as we move into the second half of the year. Output growth weakened to a pace indicative of the economy growing at a mere 0.1% quarterly rate, with risks tilted to the downside in the coming months.

The sluggish output growth reported in July reflected headwinds of deteriorating order books, subdued business confidence and rising costs, all of which were widely linked to the ongoing impact of the policy changes announced in last autumn's Budget and the broader destabilising effect of geopolitical uncertainty.

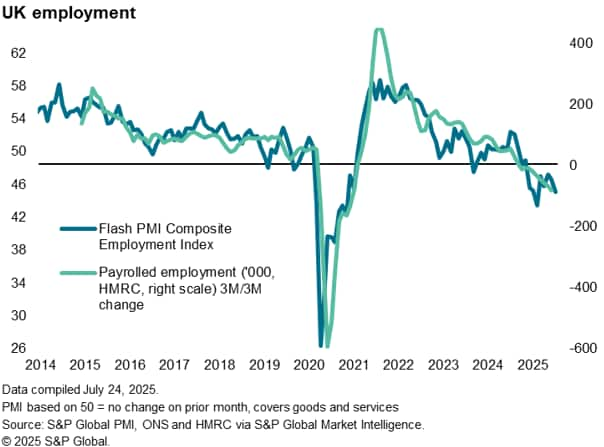

Particularly worrying is the sustained impact of the Budget measures on employment. Higher staffing costs have exacerbated firms' existing concerns over payroll numbers in the current environment of weak demand, resulting in another month of sharply reduced headcounts in July.

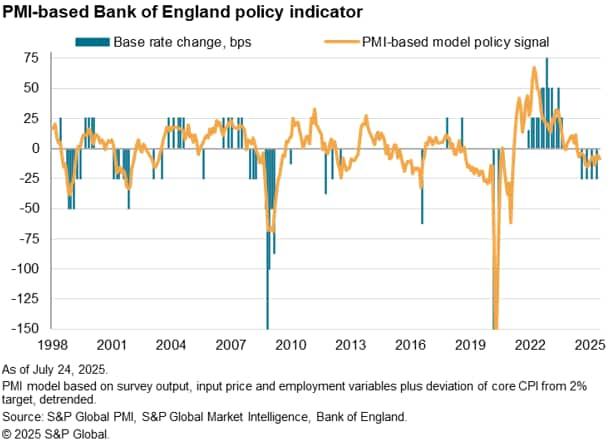

The weak growth trajectory and sustained culling of jobs will add to pressure on the Bank of England to cut rates again at its next policy meeting in August. It seems likely that the disappointing growth and labour market trends will increasingly dominate the inflation forecasting narrative, encouraging policymakers to 'look through' the recent rise in price pressures and instead focus on helping to revive growth.

Slow growth picture sustained into July

Only sluggish growth of UK business activity was recorded in July, marking a slow start to the third quarter after a disappointing second quarter.

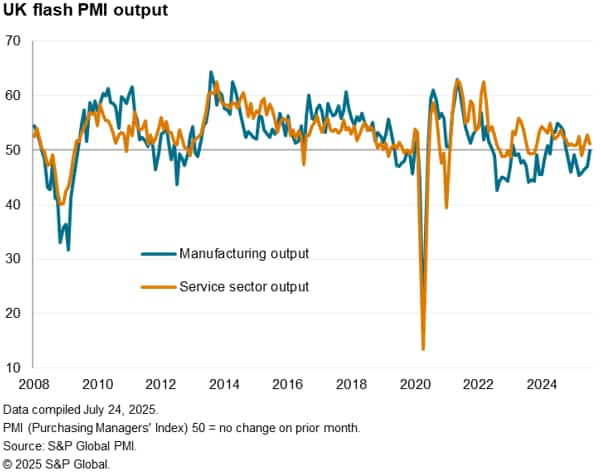

At 51.0, down from 52.0 in June, the flash PMI's headline composite output index was only modestly above the 50.0 no change mark. At this level, the PMI is broadly consistent with GDP growing at a mere 0.1% quarterly rate, which is broadly the same rate signalled by the PMI on average for the second quarter.

While July brought an encouraging sign of manufacturing output stabilising after eight months of continual decline, service sector growth lost some momentum.

Demand downturn

However, both sectors reported a further drop in new order inflows, indicating that demand conditions have? deteriorated again after having revived briefly for the first time in seven months during June. For the first time since the initial pandemic lockdowns of early 2020, all broad areas of the service sector reported falling levels of new orders.

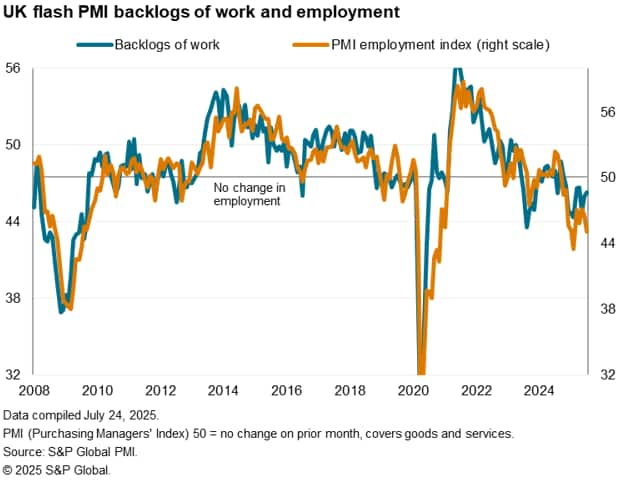

Backlogs of orders - a key indicator of whether companies are operating with a shortfall or excess of capacity relative to demand - consequently fell sharply again in July, prompting firms across both manufacturing and services to reduce headcounts. However, companies also reported that higher staffing costs, associated with increased National Insurance (NI) contributions and the raised Minimum Wage introduced in April, further encouraged the adjustment of employment lower.

Steepening job losses

July's flash PMI employment index represents a tenth successive month of job cutting and a continuation of the worst spell for employment since the global financial crisis of 2008-9 bar only the pandemic. July's PMI signals about 50,000 private sector jobs being cut during the month.

Low confidence

Concerns over staffing levels were also fueled by a lack of optimism about future prospects. A small uptick in firms' average future output expectations did little to change the overall level of business confidence, which remains far below its long-run average, where it has been continually since the autumn Budget.

Companies continued to report a discontent with recent UK government policies, exacerbated by broader geopolitical worries, notably in terms of the destabilizing impact of US trade policy on global demand.

Higher costs

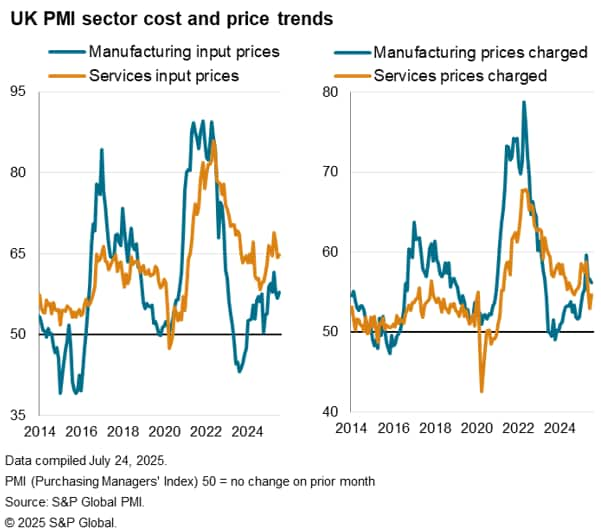

The raised staffing costs resulting from the Budget measures also played a key role in driving overall input costs higher in July. Having moderated to a six-month low in June, input cost inflation measured across both goods and services reaccelerated in July. Although remaining below recent highs seen earlier in the year, the rate of input cost inflation remains elevated by long-run standards.

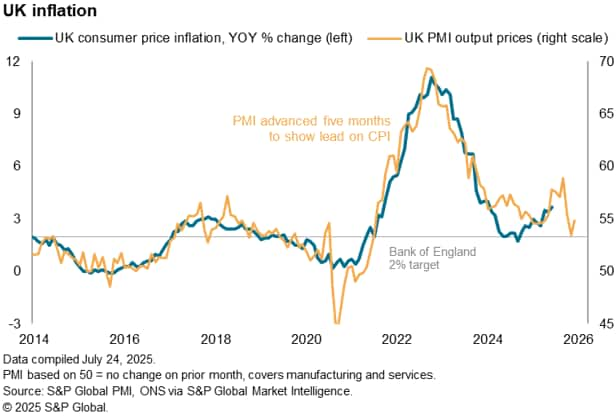

Higher costs fed through to higher selling prices, causing average prices charged for goods and services to rise at an increased rate in July. The pace of consumer price inflation signalled by the PMI is consequently above the Bank of England's 2% target, according to historical comparisons. However, the PMI survey data suggest that the main inflationary impact of the NI and other Budget measures has passed, and that strong competition amid weak demand is curbing firms' pricing power. This should help reduce headline inflation in the UK from the 3.7% rate recorded in June, albeit with a likely delay as the weaker price pressures take time to feed through to households.

Rate cutting bias

The July PMI survey has offerings for both the hawks and doves at the Bank of England. Sluggish output amid falling demand and the further marked fall in employment suggest there's a need for the economy to be injected with more stimulus in the form of lower interest rates. On the other hand, hawkish policymakers may want to see more evidence that the recent rise in price pressures, widely linked by companies to the Budget measures implemented in April, is transitory before feeling comfortable in cutting rates further.

Since August 2024, the Bank of England has reduced its Bank Rate four times, with the May meeting seeing the latest reduction to 4.25%. The June policy meeting saw a bias toward more easing after three committee members voted to cut rates against six voting for no change. We anticipate two more cuts in 2025 at the August and November policy meetings, as the softening growth picture increasingly causes price pressures to fade.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjuly-uk-flash-pmi-signals-further-job-cuts-amid-rising-costs-and-slower-output-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjuly-uk-flash-pmi-signals-further-job-cuts-amid-rising-costs-and-slower-output-growth.html&text=July+UK+flash+PMI+signals+further+job+cuts+amid+rising+costs+and+slower+output+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjuly-uk-flash-pmi-signals-further-job-cuts-amid-rising-costs-and-slower-output-growth.html","enabled":true},{"name":"email","url":"?subject=July UK flash PMI signals further job cuts amid rising costs and slower output growth | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjuly-uk-flash-pmi-signals-further-job-cuts-amid-rising-costs-and-slower-output-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=July+UK+flash+PMI+signals+further+job+cuts+amid+rising+costs+and+slower+output+growth+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjuly-uk-flash-pmi-signals-further-job-cuts-amid-rising-costs-and-slower-output-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}