Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2025

Growth in the US accelerates in July as rising demand for services offsets manufacturing dip

US business activity grew at a sharply increased rate in July, according to early 'flash' PMI data, marking a strong start to the third quarter. Employment growth also accelerated. However, growth of output and employment became increasingly unbalanced, as manufacturing business conditions deteriorated in contrast to a strengthening services economy, the latter fueled by rising domestic demand.

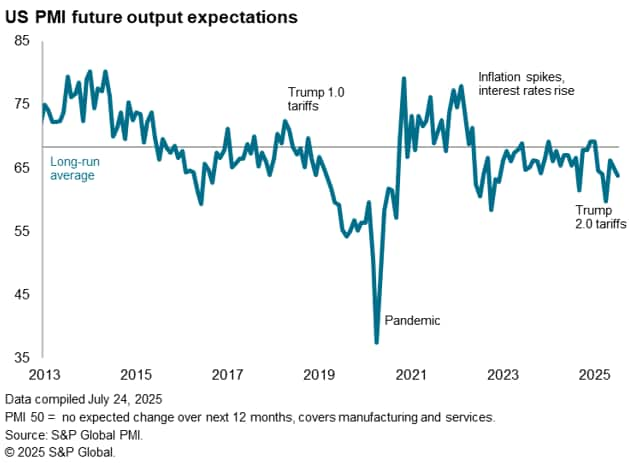

Business confidence in the outlook meanwhile deteriorated in both sectors as companies reported ongoing concerns over the impact of government policies, especially in relation to federal spending cuts and tariffs.

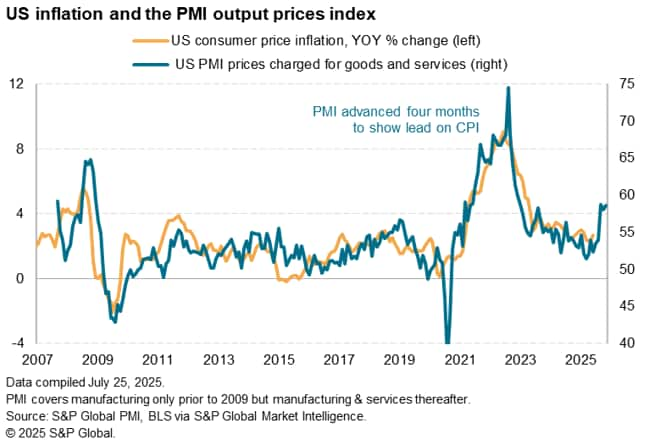

Alongside upward wage pressures, tariffs were also again widely linked to steeper cost growth, which was increasingly passed through to customers. The resulting rise in selling prices for goods and services was one of the largest seen over the past three years, suggesting that inflation will rise further above the Federal Reserve's 2% target in the coming months as these price hikes feed through to households.

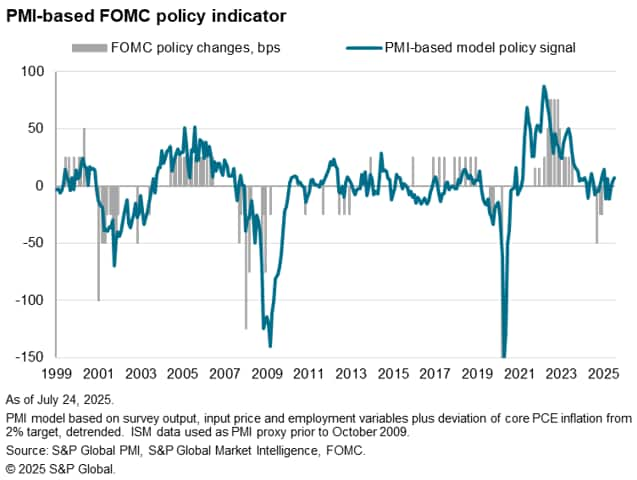

The survey data therefore collectively support our expectations that the FOMC will keep rates steady in the coming months, likely until December.

Stronger growth

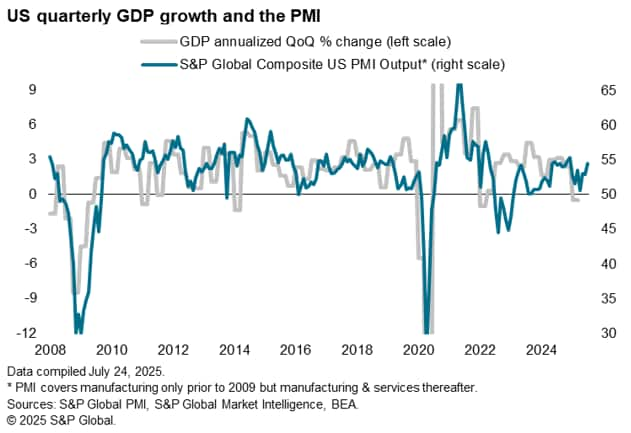

The headline S&P Global US PMI Composite Output Index rose sharply from 52.9 in June to 54.6 in July, according to the 'flash' reading (based on about 85% of usual survey responses). The latest reading signalled the fastest rate of growth recorded so far this year, with output having now grown continually for 30 months.

Comparisons with official GDP data suggest that the PMI is broadly consistent with the economy growing at a 2.3% annualized rate. That represents a marked improvement on the 1.3% rate signalled by the survey for the second quarter.

Dependence on services

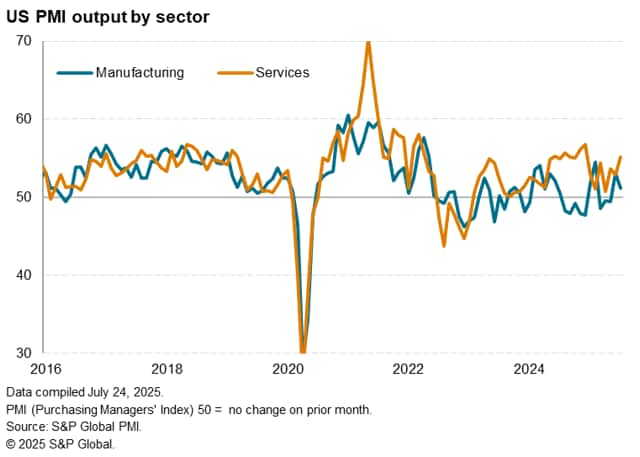

Whether this growth can be sustained is by no means assured. In the first instance, growth was worryingly uneven and overly reliant on the services economy. Business activity in the services economy rose at a rate not seen since last December. Although manufacturing output also rose, up for a second successive month, the rate of production growth moderated to signal only a modest expansion.

Although new orders growth also accelerated to match the pace seen back in May, a sector lopsidedness was also evident here. An improvement in new business inflows in the service sector was offset by the first (albeit marginal) drop in factory orders recorded so far this year.

In both cases, order book growth was impacted by a fall in export orders, which collectively fell for the third time in the past four months and at the sharpest rate since April. However, while service providers saw improved domestic demand from both households and businesses, the renewed drop in demand in the manufacturing sector was often attributed to tariffs, higher prices and heightened economic uncertainty.

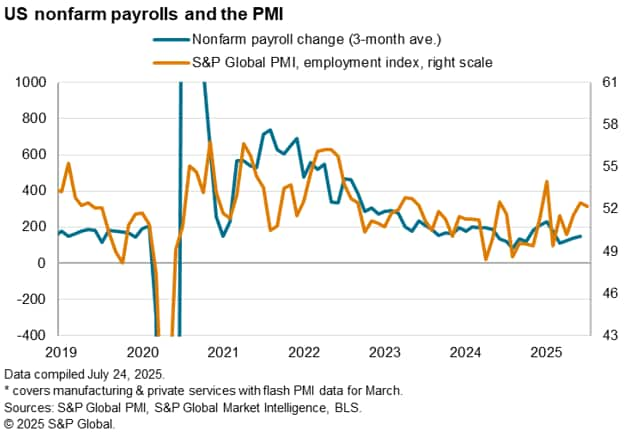

Employment growing strongly led by services

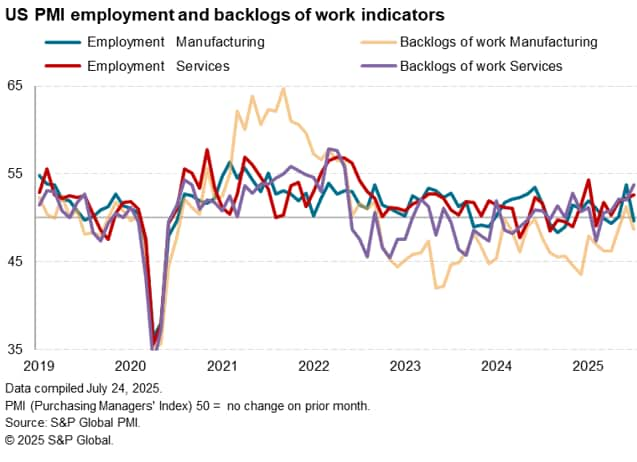

Employment rose for a fifth straight month as companies took on additional staff in response to rising backlogs of work. Uncompleted orders rose at a pace not witnessed since May 2022.

However, these trends again varied markedly by sector, further underscoring the unevenness of growth. Backlogs rose at the steepest rate for over three years in the services economy as firms struggled to meet demand, despite reporting the largest gain in payroll numbers since January. In contrast, manufacturing backlogs fell, causing a drop in factory payrolls for the first time in three months.

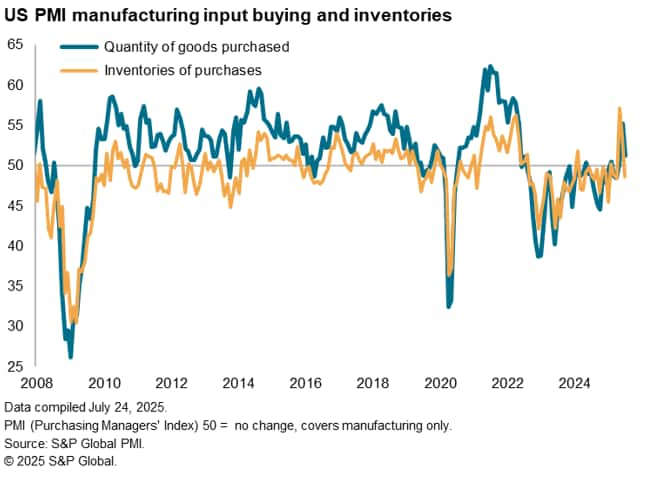

Tariff front-running fades

An additional factor of concern is the fading of the inventory build seen earlier in the year. Having built up their inventories of both raw materials and finished goods in May and June, often attributed to factories and their customers seeking to front-run tariffs, manufacturers reported lower stock holdings in both cases at the start of the third quarter. Purchasing of inputs likewise rose at a sharply reduced rate amid reduced reports of the need to front-run potential tariff hikes on imported goods.

Prices spike higher again in manufacturing

Price pressures meanwhile intensified across both manufacturing and service sectors during July, widely blamed on higher goods prices due to tariffs but also in some cases to rising labor costs. Average prices charged for goods and services rose at a rate just shy of May's recent high to register the second-strongest monthly increase since September 2022.

The PMI Prices Charged index readings in recent months have been substantially above levels that are historically consistent with inflation running at 2%, hinting strongly that official measures of inflation such as CPI and PCE prices will show higher annual rates of increase in coming months as price rises feed through to end consumers.

Services price inflation accelerated to register the second-steepest increase since April 2023 and, although factory gate selling price inflation eased, the rise in charges for manufactured goods was the second-largest since November 2022.

Input cost inflation also picked up again having eased slightly in June, registering the second-steepest rise since January 2023. The rate of input cost inflation remained especially sharp in manufacturing, despite cooling compared to June's post-pandemic peak, and accelerated in services.

Close to two-thirds of all manufacturers reporting higher input costs attributed these to tariffs, whilst just under half of respondents explicitly linked their increased selling prices to tariffs. However, the tariff impact was by no means limited to factories, as some 40% of service providers reporting higher selling prices explicitly mentioned tariffs.

Future sentiment dips lower

A final area of concern was a drop in companies' expectations about output in the year fell for a second successive month in July. The decline took sentiment further below the survey's long-run average amid declines in both manufacturing and service sector confidence. Although optimists continued to outnumber pessimists, sentiment in July was the lowest recorded for just over two-and-a-half years bar only the recent nadir seen in April.

Reduced optimism again primarily reflected broad-based concerns over tariffs and cuts to state funding following recent US policy changes. Even in manufacturing, any protectionist benefits of import tariffs were often outweighed by concerns over higher prices and rising costs.

Outlook

The upturn signalled by the July flash PMI therefore points to a potential acceleration of economic growth in the third quarter, but growth looks uneven, with manufacturing in particular on course for weaker growth as businesses pull back on their inventory buying. Businesses across both sectors remain worried about the outlook linked to disruptive government policies and the inflationary impact of tariffs. The latter in particular looks likely to deter the FOMC from cutting interest rates until policymakers have greater clarity on the inflation outlook.

The data therefore corroborate speculation that the Fed will remain on hold for some time. Our forecast team expects the Federal Reserve to keep interest rates unchanged at 4.25% to 4.50% throughout the rest of 2025 up to December, when a further cut is anticipated. This follows 100 basis points of rate cuts in late 2024, since when the FOMC has decided on a "wait and see" approach to policy in the light of changing economic conditions generated by US policy announcements from the new Trump administration, notably including tariffs.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowth-in-the-us-accelerates-in-july-as-rising-demand-for-services-offsets-manufacturing-dip-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowth-in-the-us-accelerates-in-july-as-rising-demand-for-services-offsets-manufacturing-dip-Jul25.html&text=Growth+in+the+US+accelerates+in+July+as+rising+demand+for+services+offsets+manufacturing+dip+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowth-in-the-us-accelerates-in-july-as-rising-demand-for-services-offsets-manufacturing-dip-Jul25.html","enabled":true},{"name":"email","url":"?subject=Growth in the US accelerates in July as rising demand for services offsets manufacturing dip | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowth-in-the-us-accelerates-in-july-as-rising-demand-for-services-offsets-manufacturing-dip-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Growth+in+the+US+accelerates+in+July+as+rising+demand+for+services+offsets+manufacturing+dip+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowth-in-the-us-accelerates-in-july-as-rising-demand-for-services-offsets-manufacturing-dip-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}