Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2025

Japan’s growth momentum slows while price pressures intensify in October

Japan's private sector business activity expanded at the slowest pace in five months in October, according to the flash PMI. Manufacturing output further contracted and services activity grew at a more modest pace. Notably, the slowdown in output expansion was linked to a renewed contraction in new orders, driven by falling demand for Japanese manufactured goods.

Although Japanese companies across both the manufacturing and service sectors faced higher cost pressures, only the latter group seeing greater success in passing on cost increases to their clients, with goods prices again constrained by weak demand.

While the market expectation for the next Bank of Japan rate hike has reportedly been pushed back to later this year amid ongoing political updates, the latest flash PMI data also outline the need for greater caution as slowing growth and rising inflationary pressure again pull the interest rate path in different directions.

Japan's flash PMI slips to five-month low

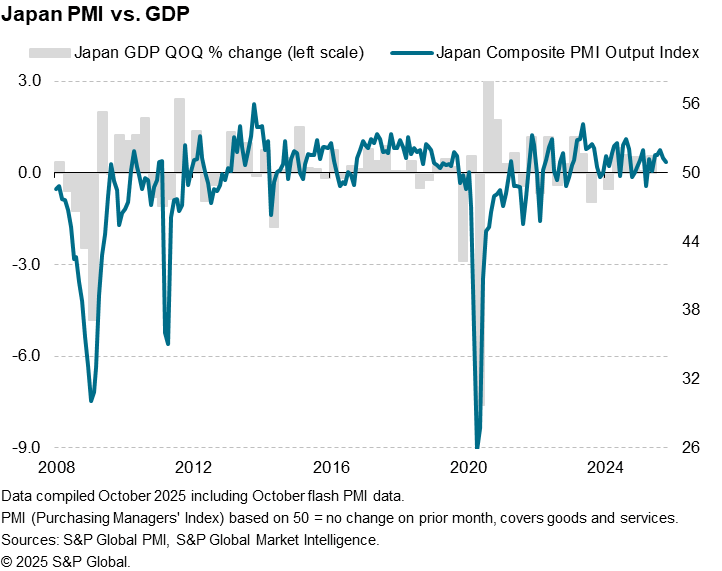

The S&P Global Flash Japan PMI Composite Output Index posted 50.9 in October, down from 51.3 in September. This marked the seventh consecutive month in which the headline reading remained above the 50.0 neutral mark to signal an expansion of business activity. However, the rate of growth decelerated for a second consecutive month to the slowest since May.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of just under 0.5% in October, which is close to the 0.2% average seen over the past decade.

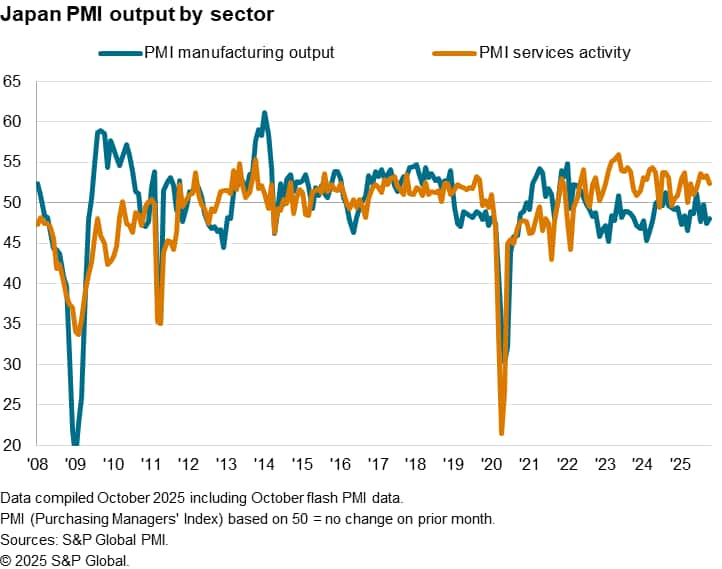

Services activity growth slows while manufacturing production remains in contraction

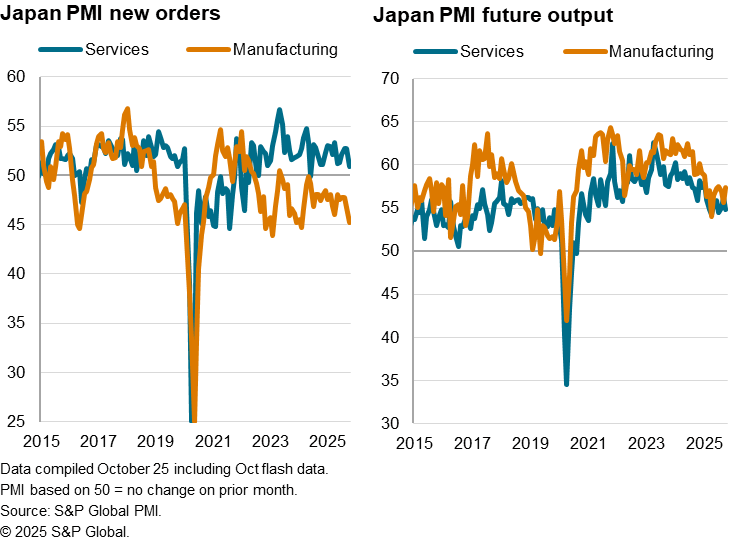

Business activity growth was limited to the service sector for a fourth straight month in October, despite the rate of services activity growth declining in the latest survey period to the softest so far in the second half of 2025. This was as services new business rose only marginally and the slowest rate in the ongoing 16-month sequence of expansion. Anecdotal evidence suggested that market conditions were less upbeat at the start of the fourth quarter, which led to the rate of demand growth moderating. Some firms also mentioned that rising prices dissuaded spending among clients. Notably, services new export business fell for a fourth consecutive month in October, marking the longest streak of contraction seen in approximately three years. This was further accompanied by the slowest rise in backlogs of work in the current eight-month spell of rising backlogs, which contributed to a slowdown in employment growth. Notably, the services Future Activity Index also showed services firms being the least optimistic in three months, with the level of confidence dropping below the long-run average. Altogether, the detailed PMI sub-indices are therefore pointing to the likelihood of a further slowdown of service sector growth in the near term.

On the other hand, manufacturing output remained in contraction, albeit with the rate of decline easing slightly since September. Goods producers continued to report falling demand for goods, affected by subdued economic conditions and reductions in client budgets. Although the pace of the production slump eased, the rate of contraction in manufacturing new orders hit the sharpest in 20 months, with export orders also declining in October.

The substantial deterioration in demand underscores the weakness of manufacturing sector conditions at the start of the final quarter of the year. Furthermore, while it was positive to see a slight recovery in business confidence among manufacturers in October, the level of confidence remained well below the series average to indicate muted optimism among goods producers.

Selling price inflation at three-month high

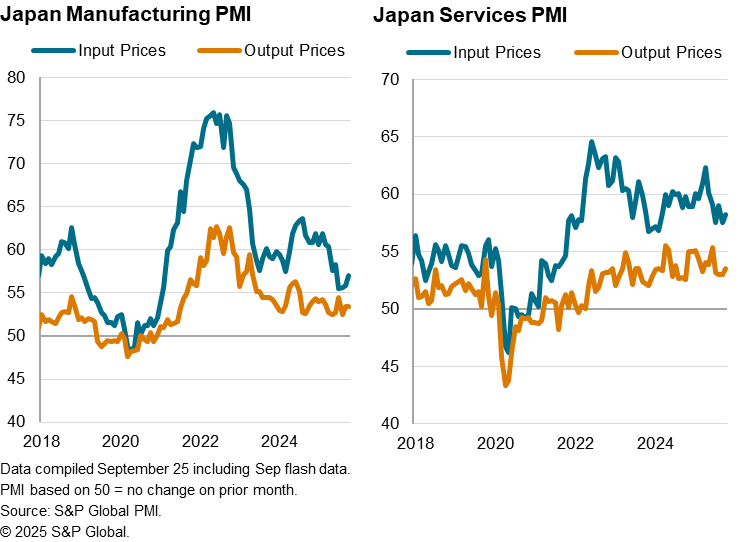

While slowing business activity growth adds reason for caution and hesitancy with raising interest rates, the latest PMI prices data present opposing signals with a further intensification of price pressure going into the final quarter of 2025.

Average input costs climbed at a faster pace in October, rising further above the series average. This was attributed to higher cost inflation in both the manufacturing and service sectors. Higher raw material, fuel and wage costs, aggravated by unfavourable exchange rates, were often listed as reasons for higher expenses by panellists.

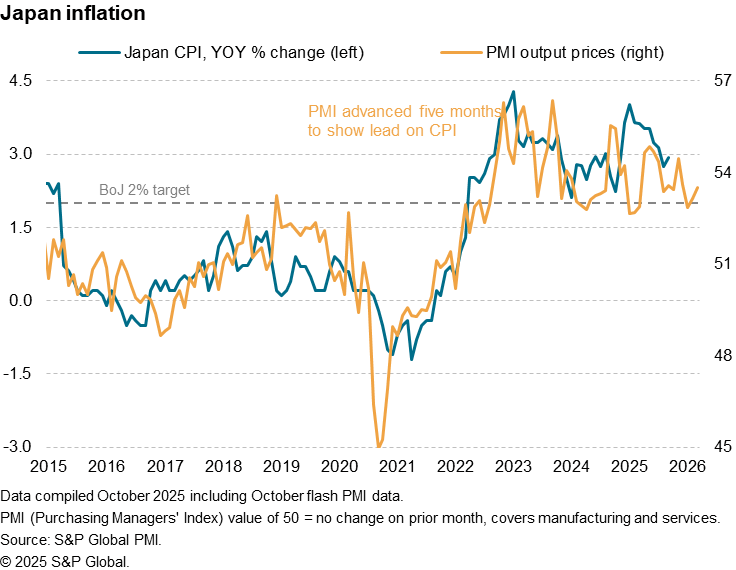

Consequent of the increase in overall cost inflation, selling price inflation lifted a three-month high. The passing on of higher input prices was mainly prevalent in the service sector, as manufacturers raised charges at a pace unchanged from September, limited by intense competition. Overall, the rate of output price inflation remained slightly below the year-to-date average, but October's reading had marked the second straight month in which the rate of inflation rose, representing a revival of inflationary pressures going into the final months of 2025.

The latest increase in selling price inflation is therefore indicative of consumer price inflation rising to just under 2.5% in the coming months, which indicates increased support for the Bank of Japan (BoJ) to conduct an imminent policy hike if not for the softening growth situation. Overall, our forecasts remain one of a December hike by the BoJ, though the slowing growth situation will need to be further monitored.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-slows-while-price-pressures-oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-slows-while-price-pressures-oct25.html&text=Japan%e2%80%99s+growth+momentum+slows+while+price+pressures+intensify+in+October+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-slows-while-price-pressures-oct25.html","enabled":true},{"name":"email","url":"?subject=Japan’s growth momentum slows while price pressures intensify in October | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-slows-while-price-pressures-oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%e2%80%99s+growth+momentum+slows+while+price+pressures+intensify+in+October+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-slows-while-price-pressures-oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}