Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2025

UK flash PMI edges higher in October as confidence improves and price pressures cool further

October's flash UK PMI survey brings hope that September was a low point for the economy from which business conditions are starting to improve. Output has picked up, with a particularly welcome return to growth for manufacturing for the first time in a year accompanied by an upturn in demand for services, notably among consumers. Business confidence has also brightened slightly, job losses have moderated, and inflationary pressures are coming back to levels consistent with the Bank of England's 2% target.

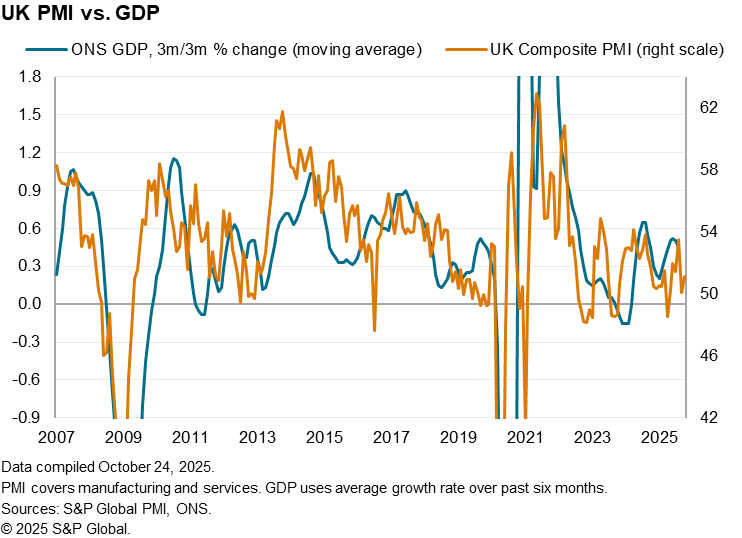

However, even with a helping hand from restarted production at JLR, the overall pace of growth signalled by the PMI remains consistent with only sluggish GDP growth of around 0.1%. And, while easing, jobs continue to be cut amid a backdrop of business confidence that remains subdued by historical standards. Goods exports also continue to fall at a worryingly steep rate, in part due to the global trade disruptions caused by US tariff policy.

Companies are clearly treading cautiously in terms of spending, investment and hiring ahead of the upcoming Budget, the outcome of which has the potential to once again sway the business mood in the months ahead.

Business growth shows sluggish revival

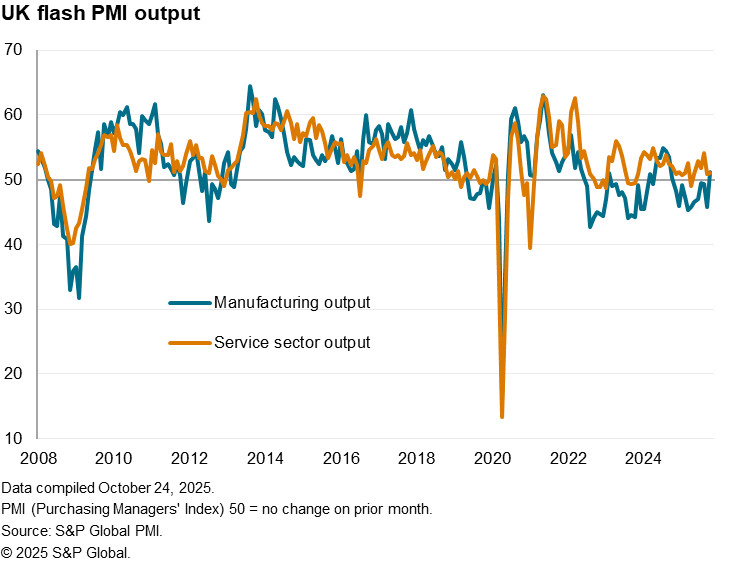

UK business activity growth picked up in October from the near-stalled picture seen in September but remained disappointingly sluggish. At 51.1, up from 50.1 in September, the flash PMI headline composite output index was the second-lowest seen over the past five months and hence signalled only a modest expansion of the economy at the start of the fourth quarter. The PMI is broadly consistent with GDP having stalled in September and growing at a 0.1% quarterly pace in October.

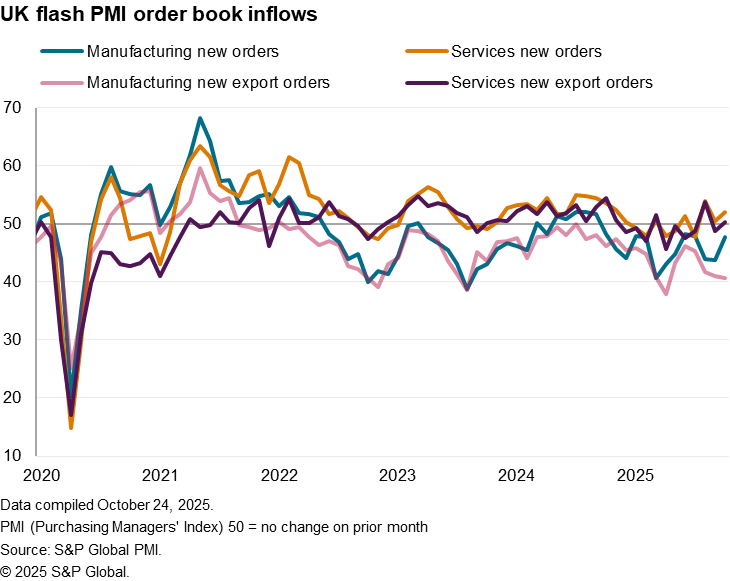

While service sector growth ticked higher in October, it was still the second-lowest growth rate seen over the past five months. More encouraging was a more pronounced uplift in service sector new business growth to the second-highest seen over the past 11 months, hinting at improving demand.

Within the service sector, recent growth has been led by IT and financial services, but the latter saw some fading of momentum in October. Consumer-oriented service providers meanwhile reported signs of improving activity and demand, and the downturn in the business services sector showed signs of moderating.

There was also better news from the manufacturing sector, where output rose for the first time in 12 months. However, some caution is warranted here, in that the upturn partly reflected the restart of manufacturing operations at JLR, with a knock-on effect to its suppliers, after operations were halted in September due to a cyber attack. Furthermore, a sustained drop in new orders placed at UK factories, extending the current period of decline to 13 months, suggests demand for goods remains a major drag on the sector, linked in part to a further steep fall in exports. October's fall in goods exports was the largest for six months, and among the largest recorded since the pandemic.

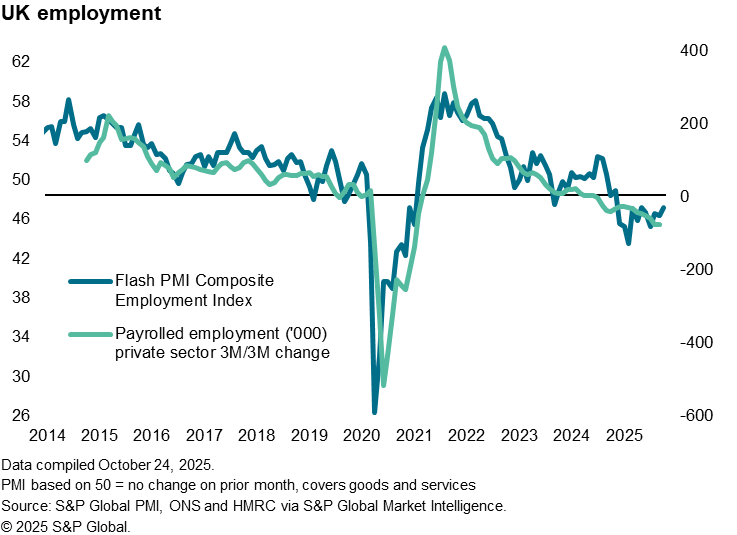

Jobs cut for 13th straight month, but rate of decline eases

The sluggish output growth signalled by the PMI was accompanied by a drop in employment for the thirteenth straight month - a labour market contraction which was triggered by last year's Autumn Budget, which raised staffing costs to businesses. However, October's drop in employment was the smallest signalled by the PMI since May, reflecting reports of reduced headcount-trimming by companies amid signs of improved demand and fewer cost concerns following prior employment cuts.

Although lower employment was again reported in both manufacturing and services in October, the drop in factory employment was the smallest for 11 months and the decline in the services economy was the smallest for five months. However, with both sectors also reporting a further reduction in backlogs of work, the survey data suggest employment could fall again in November, given these signs of excess capacity.

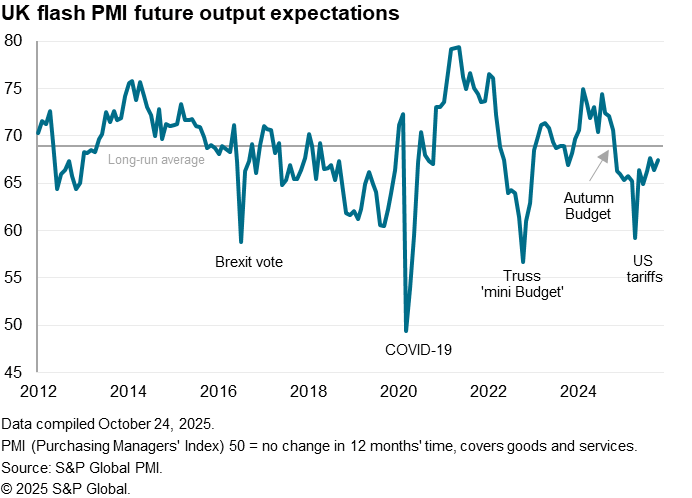

Confidence edges higher

Looking ahead, business optimism about the next 12 months remained below its long-run average to point to subdued sentiment by historical standards. Companies largely cited concerns over weak economic prospects for the year ahead, in part linked to government policies and broader global economic and policy uncertainty. Companies also raised concerns over the potential for further growth dampening policies in the upcoming November Budget. However, confidence lifted a little higher compared to September, to now run at the second highest recorded since last year's Autumn Budget, reflecting signs of pessimism moderating in both manufacturing and services economies compared to earlier in the year.

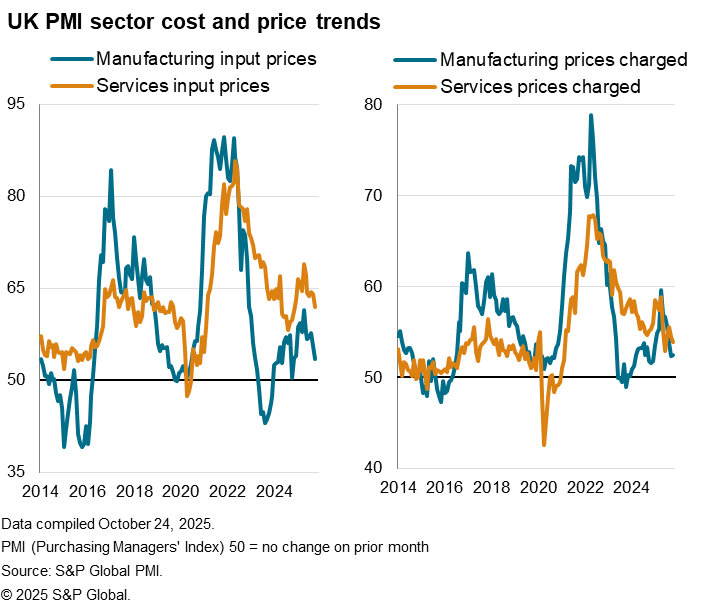

Inflationary pressures cool further

Inflationary pressures meanwhile cooled in October, dropping to a level broadly consistent with the Bank of England's 2% target. Average prices charged by companies for their goods and services rose at the slowest rate since February 2021 barring only the rise seen in June.

The flash PMI's selling price index therefore signals that consumer price inflation should soon cool from the current 3.8% rate.

Companies reported the fading impact of price hikes linked to the NIC and minimum wage increases announced in last year's Budget, with strong competitive forces and subdued demand conditions also limiting pricing power in many markets.

Encouraging news on the inflation front also came from input cost inflation. Average input costs in the manufacturing sector rose at the slowest rate for a year, while service sector input costs - a major element of which is wages and salaries - rose at the slowest rate for 11 months. A stronger pound and lower borrowing costs also appear to have helped reduced input costs.

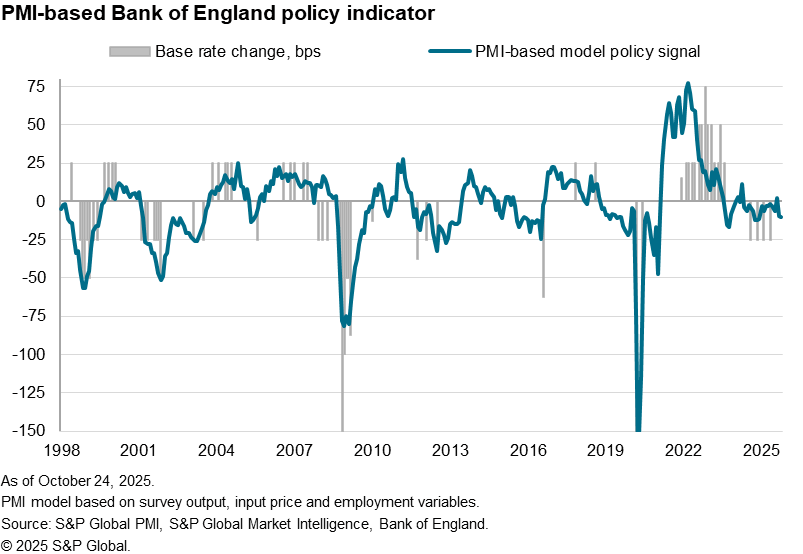

Dovish policy stance

The October flash PMI survey data are indicative of policymakers shifting further towards a dovish stance at upcoming meetings.

Since August 2024, the Bank of England has reduced its Bank Rate five times, which now stands at a two-year low of 4.00%. Recent policy meetings have seen split decisions, however, reflecting concerns over stubborn inflation on one hand and signs of weak economic growth and falling employment on the other. In signaling sluggish economic growth, falling employment and moderating price pressures, the flash PMI data for October will therefore play into the hands of the doves and could shift policymakers increasingly toward cutting interest rates again before the end of the year.

After inflation came in lower than expected in September, holding steady at 3.8%, future markets have already priced in a 70% chance of a rate cut at the MPC's December meeting with a 40% chance of a cut in November.

Read the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-edges-higher-in-october-as-confidence-improves-and-price-pressures-cool-Oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-edges-higher-in-october-as-confidence-improves-and-price-pressures-cool-Oct25.html&text=UK+flash+PMI+edges+higher+in+October+as+confidence+improves+and+price+pressures+cool+further+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-edges-higher-in-october-as-confidence-improves-and-price-pressures-cool-Oct25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI edges higher in October as confidence improves and price pressures cool further | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-edges-higher-in-october-as-confidence-improves-and-price-pressures-cool-Oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+edges+higher+in+October+as+confidence+improves+and+price+pressures+cool+further+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-edges-higher-in-october-as-confidence-improves-and-price-pressures-cool-Oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}