Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2025

Japan's flash PMI points to manufacturing acting as drag on economy in July as business confidence wanes

Japan's private sector continued to expand at the start of the third quarter, according to the flash PMI. That said, a steady rate of growth masked a divergence in sector performance, as improvements in the service sector helped to offset a notable renewal of manufacturing contraction.

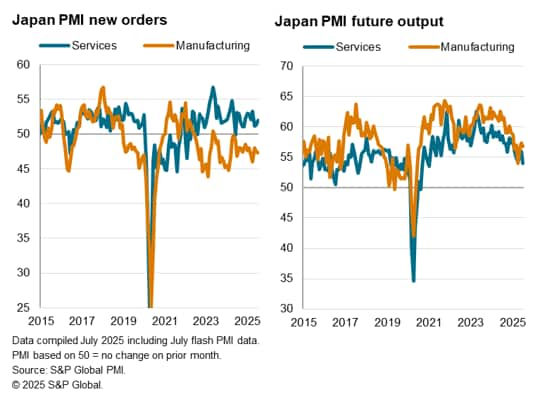

Meanwhile, overall new orders growth showed signs of picking up after near stalling in the prior two months, but this was amidst a sustained and broad-based downturn in new export orders while optimism levels fell from June. Altogether, this indicated an uncertain outlook for growth, though this was based on data collected prior to news regarding an US-Japan trade deal.

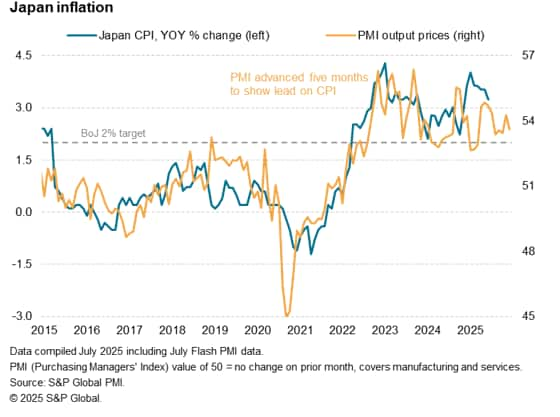

Selling price inflation eased in July, hinting at softer inflationary pressures in Japan in the coming months. The projected rates of inflation nevertheless remain above the Bank of Japan's target for now to support the bias for another interest rate hike by the end of year.

Japan's flash PMI unchanged in July

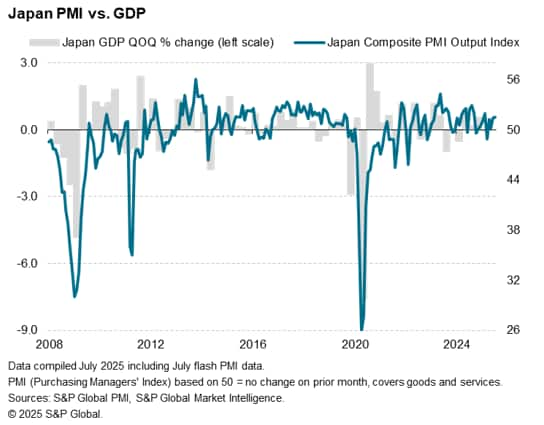

The S&P Global Flash Japan PMI Composite Output Index posted above the 50.0 neutral mark for a fourth successive month in July to signal expansion in activity. At 51.5, the latest reading was unchanged from the four-month high in June and among the highest seen in the past ten months. Compared with the broad-based rise in output in June, growth in activity was limited to the service sector, however, at the start of the second half of 2025.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of about 0.5% in July, which is slightly higher than the 0.2% average seen over the past decade.

Accelerating service sector growth offsets factory slowdown

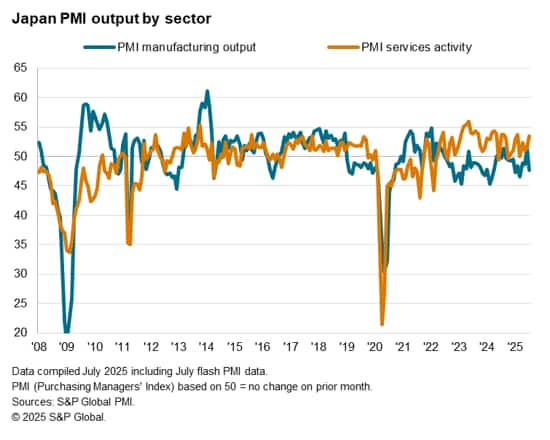

A renewed downturn in manufacturing production featured strongly in the latest survey. The Flash Japan Manufacturing PMI Output Index fell to 47.6 in July, down from 51.2 in June. This was the lowest reading seen since March.

When observing the flash survey results, we noted that the first rise in manufacturing output in ten months in June had been driven mainly by a clearance of existing orders, including for the Expo 2025 event. As anticipated, this expansion of goods output proved short-lived as the latest July flash PMI showed a slowdown in production linked to a fall in new orders, according to comments from panellists. Anecdotal evidence further pointed to US trade policy negatively affecting demand, with new export orders falling for the forty-first month in a row in July, and at a rate that was more pronounced than the series average.

Meanwhile an improvement in service sector performance helped to fully offset the slowdown for goods. Services activity expanded at a rate that was solid and the fastest in five months. Better demand conditions for services coupled with a widening of customer bases supported sales at service providers. The improvement in demand was limited to the domestic market, however, as export sales of services fell for the first time in 2025.

Despite rising new business, service providers added headcounts at a rate that was marginal and slower compared to their manufacturing counterparts in July. That said, it should be highlighted that, rather than being read as hesitancy among services firms, the easing of job creation was attributed mainly to a shortage of suitable candidates, as Japanese businesses broadly face labour constraints with issues such as an aging population.

Fading optimism

Forward-looking indicators provided mixed signals for growth in the coming months. Specifically, while new orders growth accelerated slightly from near-neutral levels in May and June, business optimism moderated. The level of confidence was the second lowest seen since the pandemic, ranked just behind April when higher US tariffs were first announced.

Comments relating to pessimism regarding the outlook in manufacturing chiefly highlighted uncertainty regarding global growth on the back of US tariffs, which also dented optimism in the services economy to its lowest since 2020, though this was taken from survey results collected up the flash close date on July 22nd and did not take into account the announcement of a trade deal between the US and Japan on July 23rd. As such, we will be looking closely to the final PMI data due August 1 for manufacturing and August 5 for services for any changes in the Future Output Index.

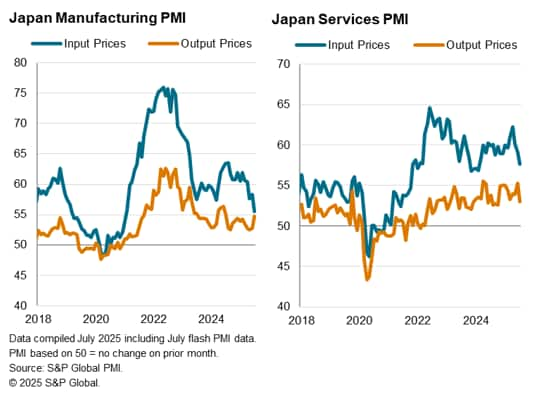

Input price inflation at lowest for over four years

Finally, on prices, Japanese businesses saw cost pressures further ease at the start of the third quarter. Average input prices increased at the slowest pace since June 2021. This was attributed to easing cost inflation at both manufacturers and service providers. The rates of inflation were the lowest in 53 and 17 months respectively. Specifically for manufacturers, the latest reading fell below the series average for the first time since February 2021, with falling energy costs and discounting at suppliers listed as key reasons for lower average input prices.

On the back of softening cost pressures, service sector selling price inflation fell to the lowest in nine months. On the other hand, manufacturers raised selling prices at the fastest pace in a year, citing the need to pass on past increases in costs.

Overall, the latest PMI price gauges are indicative of inflation staying elevated above the 2.0% mark in the coming months. This remains supportive of the Bank of Japan's (BoJ) bias to lift interest rates. That said, the risks appear tilted to the downside with the easing of cost inflation as observed from the latest flash survey.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-flash-pmi-manufacturing-drag-on-economy-in-july-business-confidence-wanes-jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-flash-pmi-manufacturing-drag-on-economy-in-july-business-confidence-wanes-jul25.html&text=Japan%27s+flash+PMI+points+to+manufacturing+acting+as+drag+on+economy+in+July+as+business+confidence+wanes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-flash-pmi-manufacturing-drag-on-economy-in-july-business-confidence-wanes-jul25.html","enabled":true},{"name":"email","url":"?subject=Japan's flash PMI points to manufacturing acting as drag on economy in July as business confidence wanes | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-flash-pmi-manufacturing-drag-on-economy-in-july-business-confidence-wanes-jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+flash+PMI+points+to+manufacturing+acting+as+drag+on+economy+in+July+as+business+confidence+wanes+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-flash-pmi-manufacturing-drag-on-economy-in-july-business-confidence-wanes-jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}