Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 20, 2020

Japanese private sector economy struggles to gain recovery momentum

- Flash Japan PMI signals a faster pace of decline in output during November

- New business weakens at quicker rate

- Job shedding continues…

- … and business confidence slips

The Japanese private sector economy continued its struggle to gain recovery momentum midway through the fourth quarter, with flash PMI survey data indicating a further decline in business activity during November. The deterioration sets the scene for a subdued economic performance in the final quarter of 2020.

Demand conditions continued to weaken, with inflows of new busines shrinking further, weighed down by a renewed fall in exports. Other survey indicators also showed worrying signs. Operating capacity remained in surplus amid weak sales, leading to further job shedding. Business sentiment meanwhile slipped to the lowest for three months.

Stalling recovery

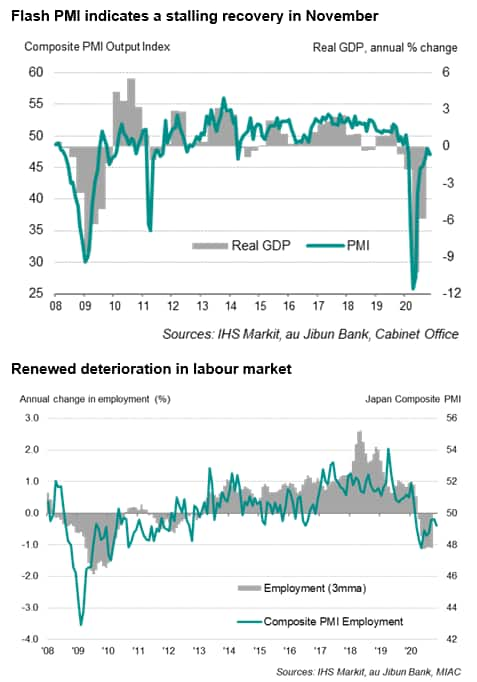

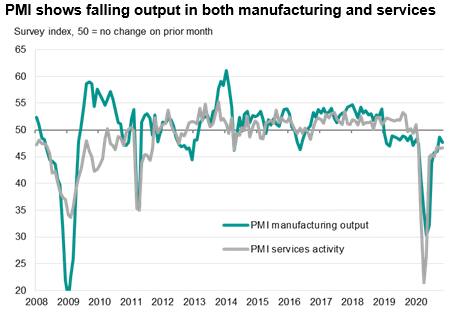

The au Jibun Bank flash Composite PMI, compiled by IHS Markit and based on 85-90% of responses received from the monthly surveys, dropped from 48.0 in October to 47.0 in November. The latest reading signalled a further and faster decline in private sector output across both manufacturing and services.

The data suggest that the pace of recovery is stalling, putting the economy on track for a subdued fourth quarter. At 47.5, the average PMI so far for the fourth quarter is just a mere 1.9 points higher than the 45.6 in the third quarter, far underwhelming the gain of 14.1 points recorded in the three months ending September.

Although recent GDP data showed the economy expanding 5.0% in the third quarter, that followed an 8.2% decline in the second quarter and left GDP still 5.9% below levels of a year ago, underscoring the sluggish recovery to regain pre-pandemic output levels.

Stubbornly weak demand may also limit the extent to which activity rebounds in December. Inflows of new business fell further and at a marked rate in November, reflecting subdued domestic and foreign demand as rising COVID-19 infections in many countries, including Japan, dampened activity.

The survey also indicated a persistent surplus in operating capacity, as reflected by a further drop in backlogs of work, with the rate of decrease accelerating.

Labour market deteriorates

The labour market meanwhile also deteriorated in November amid weakening sales and rising spare capacity, representing a setback to the recent move towards stabilisation signalled by the PMI's employment index. The decline in overall employment accelerated from October, with the service sector seeing a renewed fall in workforce numbers.

Factory employment continued to shrink, albeit marginally. Anecdotal evidence indicated that factories commonly reduced their headcounts or opted not to replace voluntary leavers in response to falling output.

Deflationary pressures

The PMI data also highlighted how prices continued to fall mid-way through the fourth quarter. Input costs fell for the first time in six months during November, with a stronger yen, lower wage bills and falling fuel prices cited by respondents as reasons for reduced expenses. That said, lower input prices were limited to services firms as manufacturers reported further input cost inflation linked to increased transportation fees.

Amid efforts to fight for sales, firms across both manufacturing and service sectors increasingly offered price discounts. Overall output charges fell for a ninth straight month as a result, with the rate of decrease hitting the fastest since August.

Outlook

Looking ahead, the path to recovery remains fraught with challenges, notably as a recent rise in local infections could re-ignite cautious consumer behaviour alongside a subdued labour market and a weak outlook for wages. Reintroduced lockdown measures in many countries due to second waves of new COVID-19 cases could also weigh on foreign demand for Japanese goods and services.

Although Japanese private sector firms have become more optimistic about earnings projections, uncertainty of the pandemic trajectory, even with improved progress on the vaccine front, alongside balance sheet adjustments and the appreciation of yen could continue to weigh on capital investment.

We expect Japan's real GDP to shrink by 5.4% in 2020 before expanding by a relatively modest 2.2% in 2021.

Final PMI survey data for Japan will be released on 1st and 3rd December for manufacturing and services respectively.

Bernard Aw, Principal Economist, IHS Markit

Email: bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-private-sector-economy-struggles-to-gain-recovery-momentum-Nov20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-private-sector-economy-struggles-to-gain-recovery-momentum-Nov20.html&text=Japanese+private+sector+economy+struggles+to+gain+recovery+momentum+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-private-sector-economy-struggles-to-gain-recovery-momentum-Nov20.html","enabled":true},{"name":"email","url":"?subject=Japanese private sector economy struggles to gain recovery momentum | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-private-sector-economy-struggles-to-gain-recovery-momentum-Nov20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+private+sector+economy+struggles+to+gain+recovery+momentum+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-private-sector-economy-struggles-to-gain-recovery-momentum-Nov20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}