Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 16, 2019

iTraxx Asia ex-Japan Rolls Strong

The iTraxx Asia ex-Japan Series 32 index was launched after significant changes to the index rules. While underlying constituent CDS liquidity continues to be the primary selection criteria, the motivation for the rule change is to align the iTraxx Asia ex-Japan index closer with the corresponding bond market. This enhances the use of the index as an effective instrument to gain access or manage exposure to the Asian investment grade credit markets.

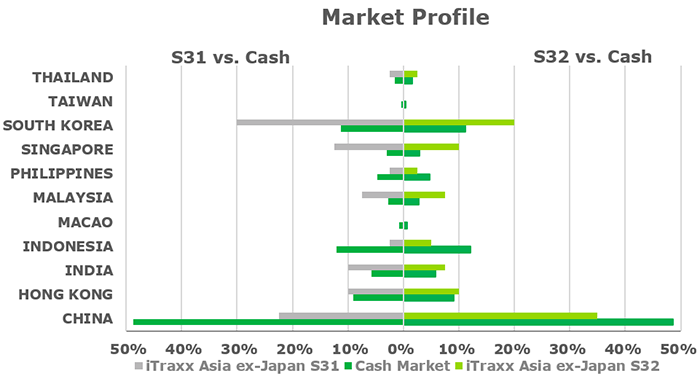

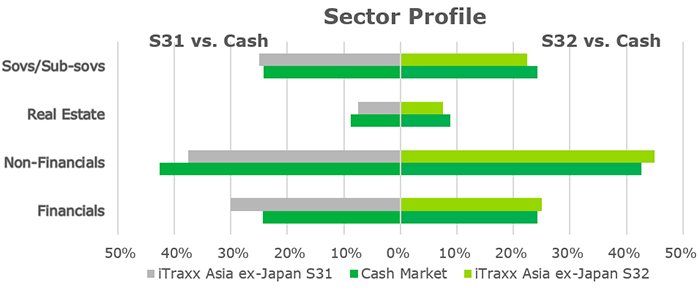

The alignment of the CDS index with the bond market is based on the Market and Sector profile of the corresponding bond benchmark. The benchmark used for the bond market is the iBoxx USD Asia ex-Japan Investment Grade Index. Broadly speaking, the index rule change will result in about 20 constituent changes over time until the bond market Market-Sector profile is achieved. The replacement entities will be chosen from the Liquidity List, which consists of entities that are actively traded in the Asia ex-Japan CDS market. When there are not enough new entities available in the Liquidity List from the required Market and Sector, new entities are selected from the Debt Issuer List. The Debt Issuer List consists of the largest bond issuers in the USD Asia ex-Japan Market, and only consists of entities that have at least USD one billion debt outstanding.

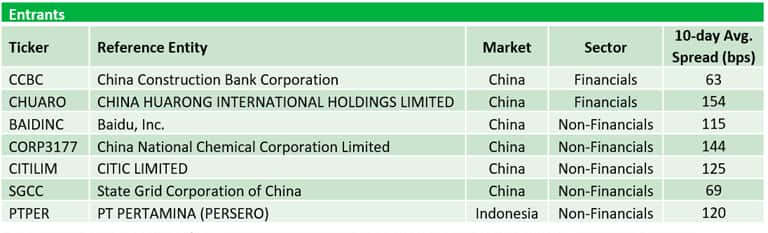

The rule change allows no more than seven constituent changes per roll. Based on this, we expect the iTraxx Asia ex-Japan index to fully align with the cash market over the next two or three rolls. Given the seven constituent changes in iTraxx Asia ex-Japan Series 32 based on Market-Sector profile, below is a depiction of the current Market and Sector composition. We expect the Market and Sector weighting differences in the iTraxx Asia ex-Japan index to reduce further in the upcoming index rolls.

Notional traded:

Following the announcement of the iTraxx Asia ex-Japan

Series 32 Final List in mid-September, IHS Markit CDS Pricing Service

received pricing contributions on all the new names that were

included in the index based on cash market issuance. The new names

included are some of the largest debt issuers in the Asia ex-Japan

USD bond market, and we believe they are a valuable addition to the

Asia ex-Japan CDS market. With robust composite prices/spreads for

all underlying index constituents, the iTraxx Asia ex-Japan Series

32 index is a highly liquid instrument to hedge / gain exposure to

Asian USD credit markets.

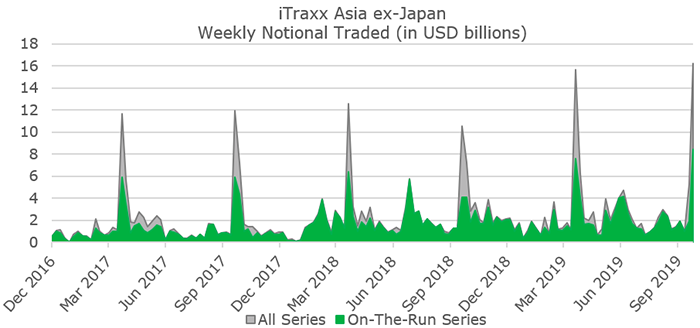

Notional traded in the roll months for the iTraxx Asia ex-Japan index has consistently been increasing over the past three years. The index notional traded spikes in the roll months due to investors moving their positions to the new on-the-run index series. In September 2019 roll, the weekly notional traded for iTraxx Asia ex-Japan was over USD 8 billion for the on-the-run series and exceeded USD 16 billion across all iTraxx Asia ex-Japan index series.

Source: DTCC

Access the

iTraxx Asia ex-Japan Rule book.

Access the

iTraxx Asia ex-Japan Rule book.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitraxx-asia-ex-japan-rolls-strong.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitraxx-asia-ex-japan-rolls-strong.html&text=iTraxx+Asia+ex-Japan+Rolls+Strong+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitraxx-asia-ex-japan-rolls-strong.html","enabled":true},{"name":"email","url":"?subject=iTraxx Asia ex-Japan Rolls Strong | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitraxx-asia-ex-japan-rolls-strong.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=iTraxx+Asia+ex-Japan+Rolls+Strong+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitraxx-asia-ex-japan-rolls-strong.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}