Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 03, 2020

Investors go to the securities lending polls

Research Signals - October 2020

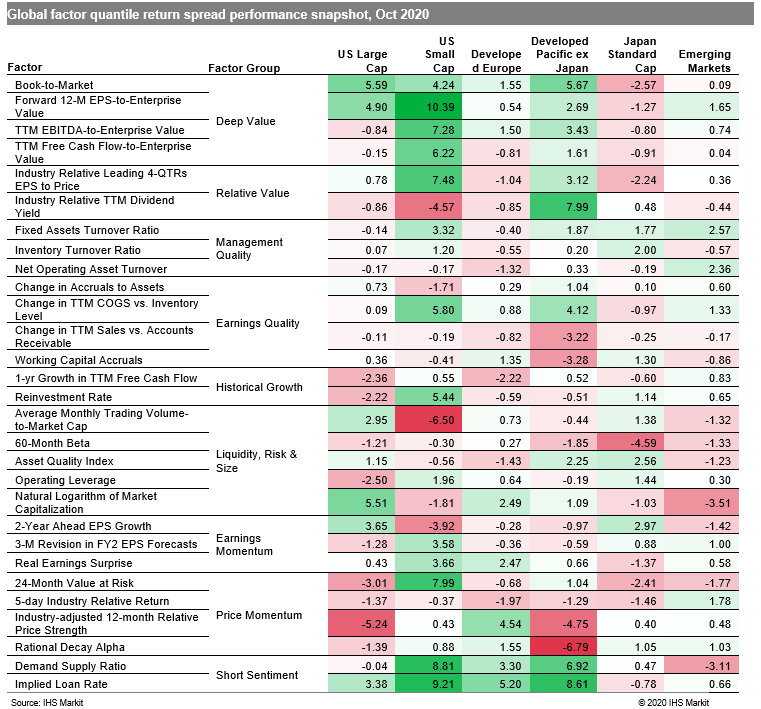

Several regional stock markets saw a reversal in factor performance and Short Sentiment signals, such as Implied Loan Rate, were voted for in many developed markets (Table 1), as equities struggled particularly in the last week of October ahead of the US election amid rising numbers of coronavirus cases and new restrictions to curb its spread. Signs of a global economic rebound, including that seen in the J.P.Morgan Global Manufacturing PMI and the accompanying business sentiment both rising to a 29-month high, leave investors and businesses alike looking for clues as to whether the fragile recovery can be sustained.

- US: Investors flip flopped once again on their preference for value stocks, with positive performance recorded by Book-to-Market and Forward 12-M EPS-to-Enterprise Valsue

- Developed Europe: Industry-adjusted 12-month Relative Price Strength extended its positive trend for the year, with investors favoring high momentum stocks in all but one month

- Developed Pacific: Rational Decay Alpha and 24-Month Value at Risk captured investors' preference for high momentum and high risk names in Japan and the reverse in markets outside Japan

- Emerging markets: 3-M Revision in FY2 EPS Forecasts continued a generally positive trend for earnings momentum measures for the year, while Natural Logarithm of Market Capitalization saw a trend reversal, as small caps underperformed

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestors-go-to-the-securities-lending-polls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestors-go-to-the-securities-lending-polls.html&text=Investors+go+to+the+securities+lending+polls+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestors-go-to-the-securities-lending-polls.html","enabled":true},{"name":"email","url":"?subject=Investors go to the securities lending polls | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestors-go-to-the-securities-lending-polls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+go+to+the+securities+lending+polls+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestors-go-to-the-securities-lending-polls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}