Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2020

IHS Markit European GDP Nowcasts: Euro area growth to remain sluggish, but UK growth bounces back

Summary: 5th February 2020

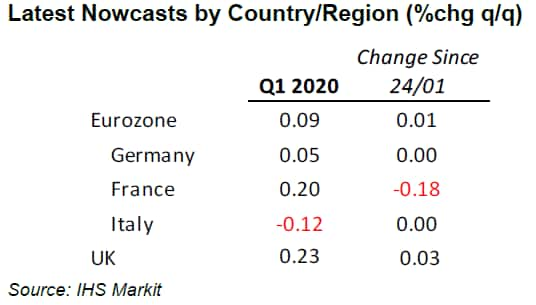

The euro area economy is set to record another weak quarter of growth, according to the latest nowcast estimate. Our dynamic factor model points to another marginal quarter-on-quarter rate of expansion, with growth trends at regional levels once again deviating markedly from one another. Meanwhile, based on available data and forecasts in our model, the UK is set to record a reasonable expansion relative to its European peers.

Our eurozone GDP nowcast for Q1 was broadly unchanged at +0.09%q/q. While positively there are signs that the deep manufacturing downturn isn't getting any worse, factory output is still expected to negatively contribute to economic output in the first three months of the year.

According to our dynamic factor model, underlying economic conditions in Germany have picked up ever-so-slightly, with first quarter GDP expected to rise by +0.05%q/q. The pickup from the previous quarter reflects improvements in PMI data for January, with survey data signalling solid service sector growth and a softer decline in manufacturing production.

Meanwhile, we see a sharp downward revision to the first quarter nowcast for France (by 0.18 percentage points) off the back of the surprisingly weak GDP data. Nevertheless, reading through the noise of official GDP figures - which is being driven by a sharp reduction in inventories - we believe that the underlying trend in the French economy was positive in the final quarter of 2019 and remains so at the start of the new decade. Our latest estimate points to growth of +0.2%q/q in Q1.

Our last nowcast for the euro area comes from Italy, where we retain our call of contraction for the first quarter (-0.12%q/q). If this comes to fruition, this would put the euro area's third largest economy into a technical recession.

A more positive picture can be seen for the UK, with our model boasting one of its best estimates of growth in the past 12 months (+0.23%q/q).

Receding levels of political uncertainty are set to boost economic activity in the current quarter, with robust labour market conditions expected to support consumption and the housing market in the near-term.

Next Nowcast Update: February 14th 2020

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-euro-area-growth-to-remain-sluggish-but-uk-growth-bounces-back-jan2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-euro-area-growth-to-remain-sluggish-but-uk-growth-bounces-back-jan2020.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Euro+area+growth+to+remain+sluggish%2c+but+UK+growth+bounces+back+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-euro-area-growth-to-remain-sluggish-but-uk-growth-bounces-back-jan2020.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Euro area growth to remain sluggish, but UK growth bounces back | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-euro-area-growth-to-remain-sluggish-but-uk-growth-bounces-back-jan2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Euro+area+growth+to+remain+sluggish%2c+but+UK+growth+bounces+back+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-euro-area-growth-to-remain-sluggish-but-uk-growth-bounces-back-jan2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}