Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 06, 2018

Growing pressure on Casino’s dividend

Casino posted good operational performance at half stage and confirmed its 2018 outlook at 3Q18. But the focus is on Casino and its parent company's Rallye leverage

- Casino forward dividend yield is at a ten-year high, and more than twice peers' level

- The negative sentiment persists and Casino is the most shorted stock in France

- But operational performance and ownership structure encourages Casino's dividend prospects, despite payout ratio above 100% of net income estimates

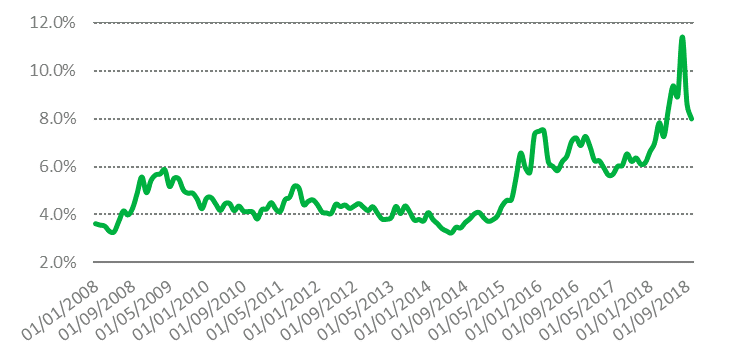

Casino's share price has been under pressure in 2018, reflecting concerns about high levels of debt at Casino and its parent company's Rallye, its complex structure, a fierce competitive retail market in France and exposure to Latam markets. Casino reported stronger profitability than Carrefour at the half-year stage but failed to convince on its debt causing its share price to plummet (-9%) and reached a ten-year low in early September after intense news flow. And despite the share price recovery (+45% since lowest level), the forward dividend yield remains at a ten-year high and is more than twice Carrefour and peers' level.

Casino's month-end dividend yield at ten-year

high

Source: IHS Markit, FactSet

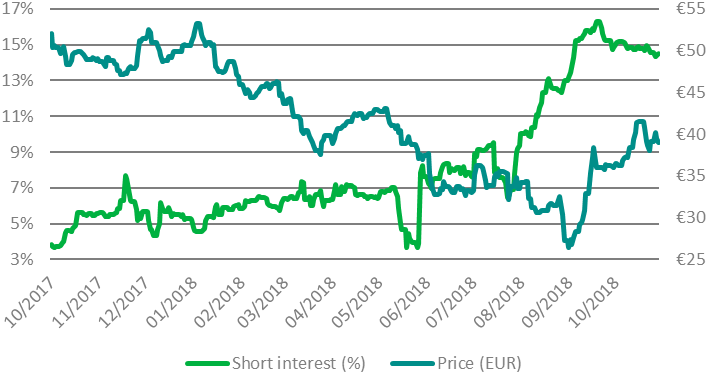

And the negative sentiment persists. Casino's short interest is currently around 15%, well above Carrefour's level of 3%. And it remains the most shorted stock in the France SBF120.

Source: IHS Markit, FactSet

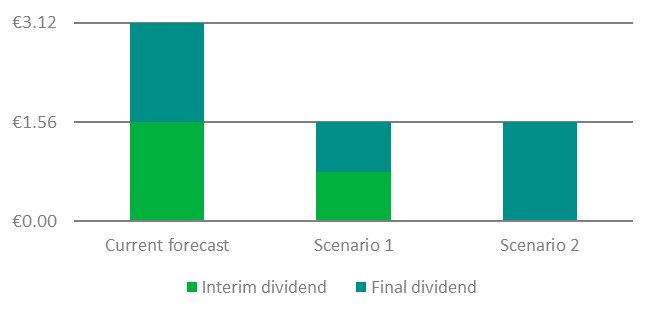

But despite red flags that can forewarn a dividend cut, we forecast Casino to distribute a flat dividend of €3.12 per share, to be paid in two instalments of €1.56 per share. We think that the ownership structure and the operating performance support the current dividend level from Casino, despite a payout ratio above 100% of net income estimates and a dividend cash outflow just covered by free cash flow estimates.

Downside risks: two possible cut scenarios. 1) A dividend cut of 50% for Casino FY18 dividend would result in a payout ratio around 60% of earnings estimates, in line with level prior to FY14 when net profit started declining. 2) Casino could opt to keep its annual dividend in line with the FY17 final dividend, i.e. €1.56 per share, and thus cancelling the interim payment.

Source: IHS Markit

We think that the scenario 1 (50% dividend cut, two equal instalments) is more likely if Casino decides to cut its dividend. Casino has not yet announced its FY18 interim dividend but the management reaffirmed at 3Q18 that they still plan to pay an interim dividend this year.

To access the report, please contact dividendsupport@ihsmarkit.com.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowing-pressure-on-casinos-dividend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowing-pressure-on-casinos-dividend.html&text=Growing+pressure+on+Casino%e2%80%99s+dividend++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowing-pressure-on-casinos-dividend.html","enabled":true},{"name":"email","url":"?subject=Growing pressure on Casino’s dividend | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowing-pressure-on-casinos-dividend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Growing+pressure+on+Casino%e2%80%99s+dividend++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowing-pressure-on-casinos-dividend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}