Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 07, 2025

Global trade contraction eases in September

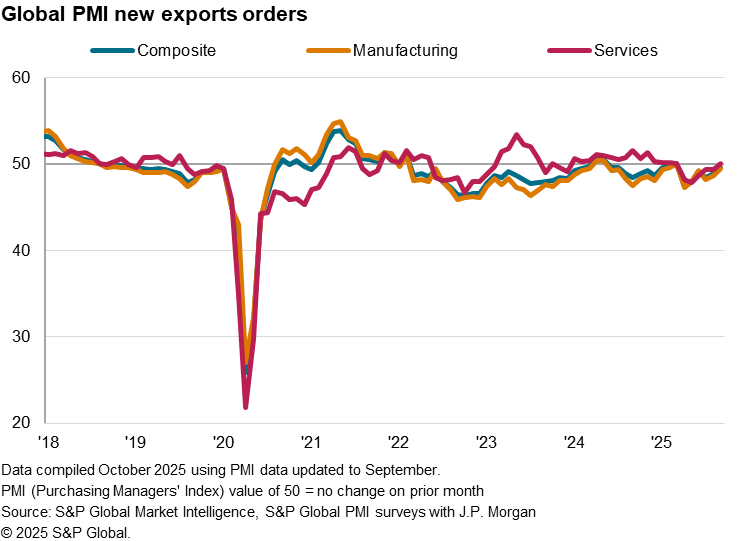

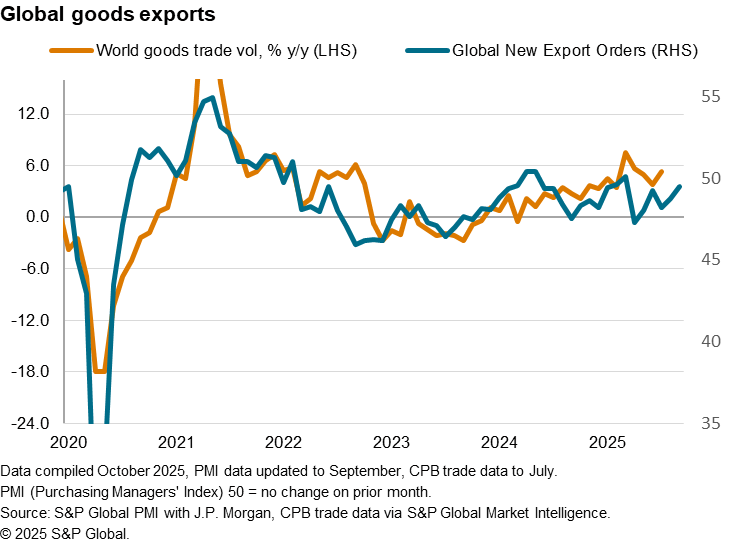

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade remained in contraction at the end of the third quarter of 2025. That said, the degree of decline eased with the seasonally adjusted Global PMI New Export Orders Index, sponsored by J.P.Morgan and compiled by S&P Global, rising to 49.6 in September, up from 48.9 in August. This marked the sixth straight month in which the reading posted below the 50.0 neutral mark to signal an ongoing contraction of trade activity, though at the least pronounced pace in the current sequence.

Manufacturing trade contraction eases while the exchange of services stabilises

The downturn in export orders was centred on the manufacturing sector in September, with the sector posting a sixth consecutive monthly reduction in new export orders. That said, the pace at which goods new export orders fell was marginal and slowest in the current six-month sequence.

Details from the latest manufacturing PMI data revealed varied performance across countries and regions at the end of the third quarter. Notably, ASEAN as a whole saw goods exports rising for the first time since May 2022, albeit only marginally. This coincided with continued growth in purchasing activity in the US, thereby hinting at further front-loading driven activity especially ahead of additional US sector tariffs. Notably, September's Global Electronics PMI data pointed to resilient growth in the computing and communications equipment sub-sectors, as the US reportedly mulls tariffs on foreign electronics. Mainland China and South Korea also saw improvements in goods trade performance, with comments from manufacturers attributing better demand to new product launches and reduced trade uncertainty. In contrast, Taiwan, Japan and Australia reported lower new export orders as US tariffs negatively affected overseas demand. Over in the UK and eurozone, subdued trade performance also prevailed, with the former posting the steepest drop in goods exports of all countries tracked by the PMI in September.

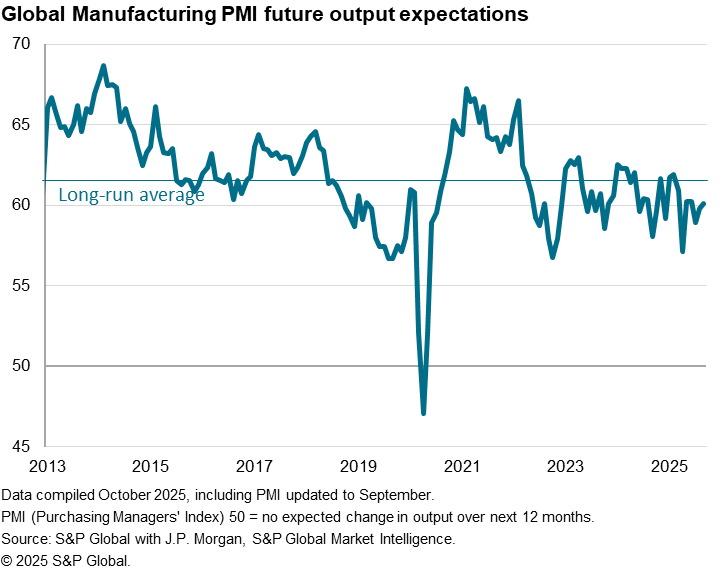

Overall, the latest manufacturing data showed that US trade policy continued to be a key dampener for trade conditions, though there are some pockets of reprieve. Business sentiment among goods producers improved to the highest in three months, but remained subdued by historical standards. This was while mentions of rising uncertainty dampened the outlook for growth among panellists to the greatest degree since June, therefore suggesting that manufacturers continue to see the risk of US trade policy on production in the coming months.

On the other hand, services exports stabilised in September, rising fractionally following five successive months of contraction. That said, the latest improvement marked merely a return to conditions at the start of the year, when the services New Export Business Index had hovered just above the 50.0 neutral mark to indicate modest improvements.

Detailed sector PMI revealed that export growth continued to be dominated by service-related sectors with Software & Services, Transportation and Banks in the lead. The weakest performers were companies in the Real Estate, Forestry & Paper Products and Resources sectors.

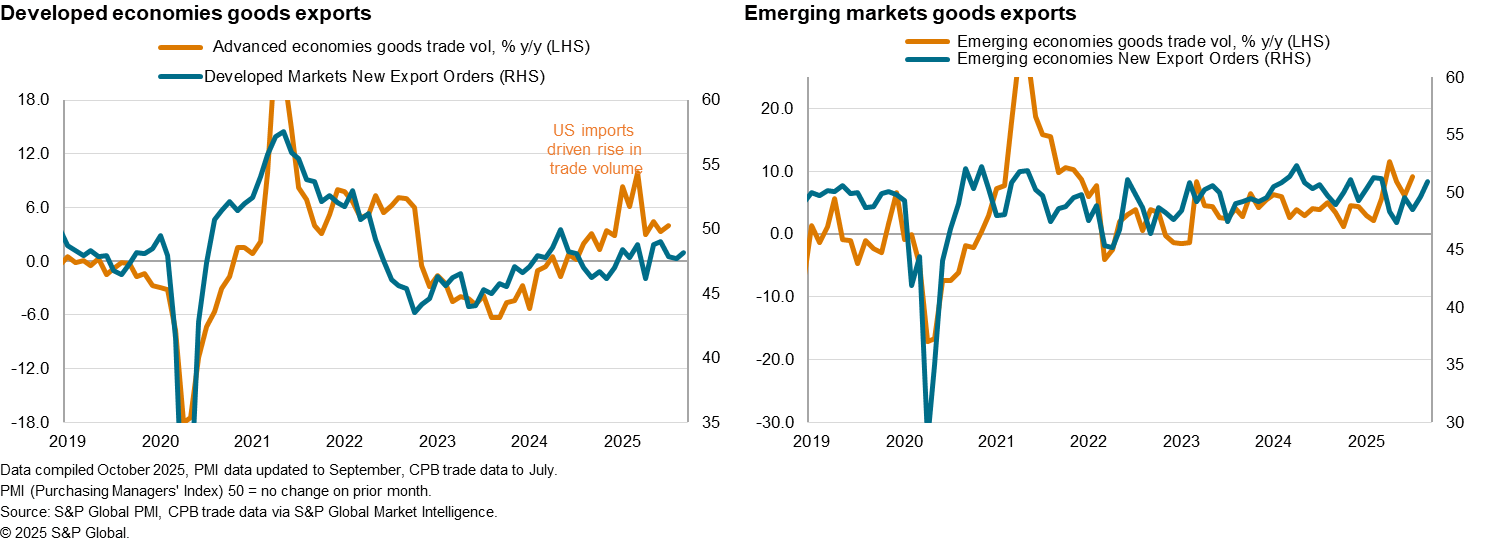

Renewed export growth in emerging markets contrasts with further downturn for developed economies

Regionally, the contraction in new export business narrowed and was concentrated within developed markets in September, as new export orders from emerging markets returned to growth, albeit only marginally.

Faster services export growth, the strongest in seven months, coupled with a renewed rise in manufacturing new export orders supported the first expansion in emerging markets exports in six months. Although modest, the latest expansion in new export orders marked the end to the longest spell of export contraction for emerging markets since late 2022.

Developed markets as a whole continued to post lower new export business in September, extending the sequence of contraction that commenced in mid-2022. The rate of reduction was the softest in three months, however, attributed to easing declines across both the manufacturing and service sectors.

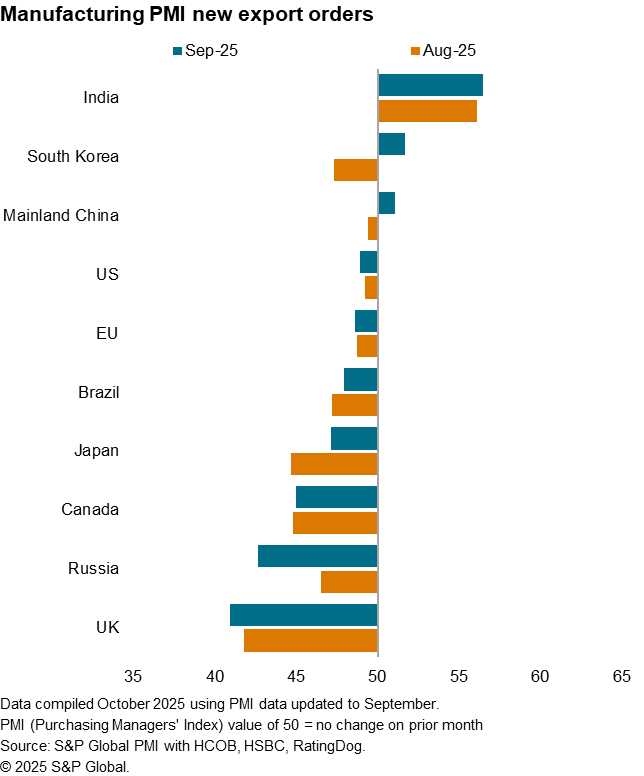

South Korea and Mainland China join India in goods trade expansion

The number of top ten trading economies recording higher goods exports tripled in September from just India in August. India nevertheless retained the lead with the rate of manufacturing new export orders growth accelerating since August, albeit with the overall pace of manufacturing expansion having softened.

Joining India in expansion in September were South Korea and Mainland China, both recording their first rises in goods new export orders in six months. New product launches played a key role in supporting the improvements in manufacturing performances across these two North-Asian economies.

At the other end of the scale, the UK recorded the sharpest downturn in goods trade, though attributed partly to auto production and related supply chains being disrupted by a cyber-attack in September. Overall manufacturing PMI in the UK had also declined to a five-month low. Steep declines were also seen across Russia and Canada, while more modest reductions were recorded in the remaining four economies of the top 10 trading economies - namely Japan, Brazil, the EU and US.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-in-september-Oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-in-september-Oct25.html&text=Global+trade+contraction+eases+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-in-september-Oct25.html","enabled":true},{"name":"email","url":"?subject=Global trade contraction eases in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-in-september-Oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+contraction+eases+in+September+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-in-september-Oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}